Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4.On May 1, 2020,0 and P formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. O contributed a

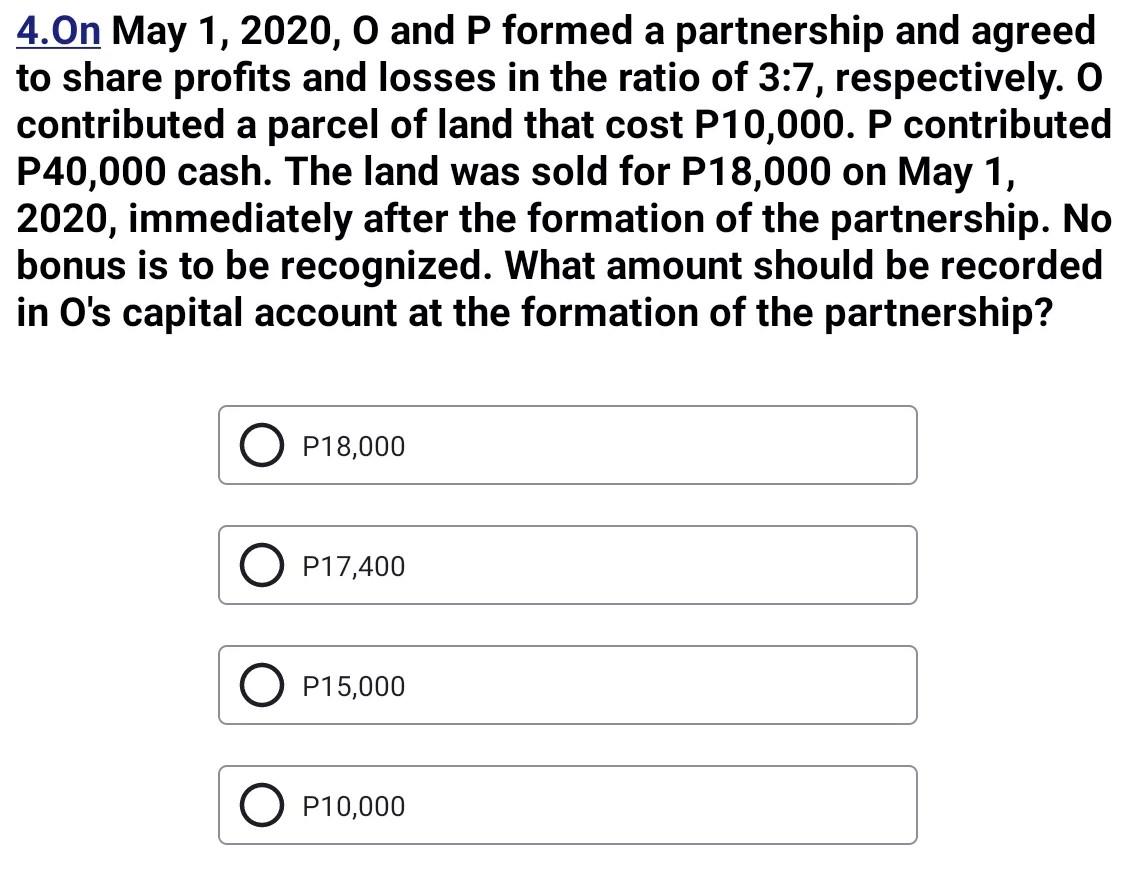

4.On May 1, 2020,0 and P formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. O contributed a parcel of land that cost P10,000. P contributed P40,000 cash. The land was sold for P18,000 on May 1, 2020, immediately after the formation of the partnership. No bonus is to be recognized. What amount should be recorded in O's capital account at the formation of the partnership? O P18,000 P17,400 O P15,000 P10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started