Answered step by step

Verified Expert Solution

Question

1 Approved Answer

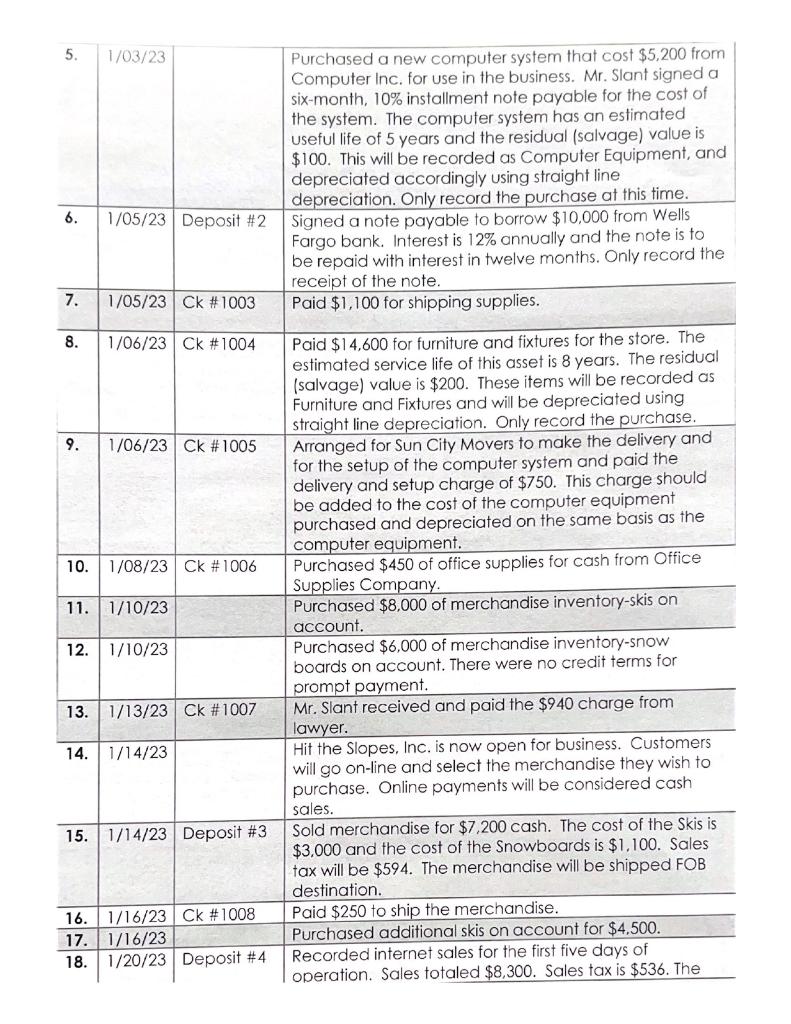

5. 1/03/23 6. 1/05/23 Deposit #2 1/05/23 Ck #1003 7. 8. 1/06/23 Ck #1004 9. 1/06/23 Ck #1005 10. 1/08/23 Ck #1006 11. 1/10/23

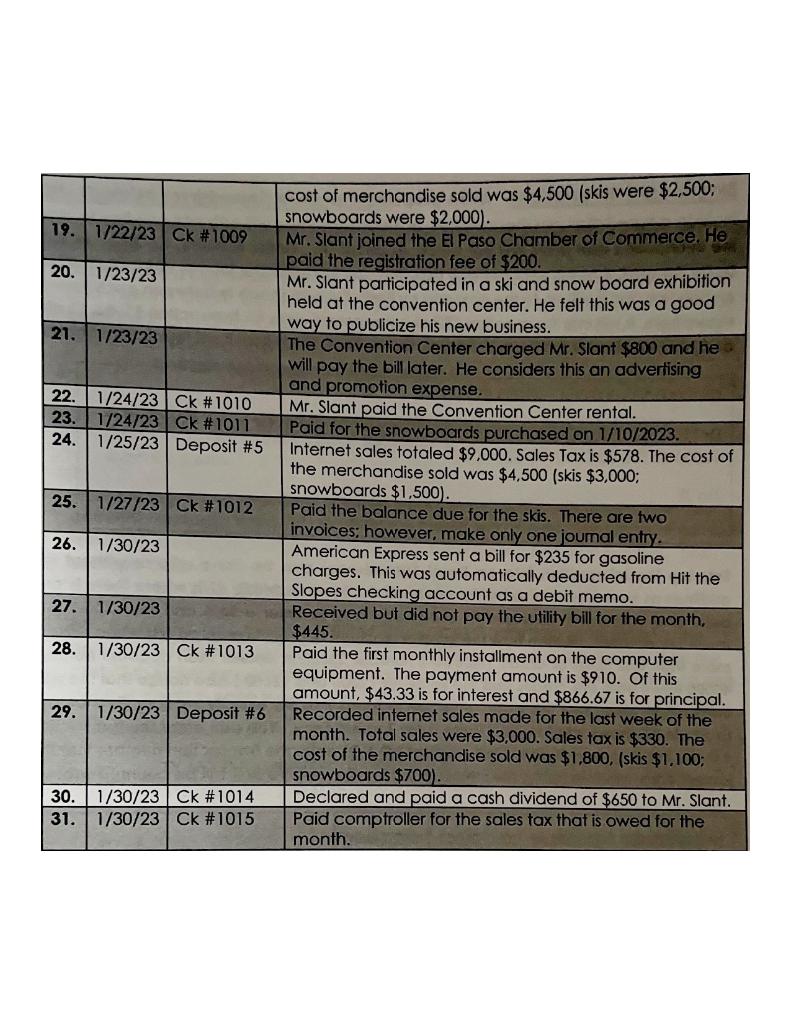

5. 1/03/23 6. 1/05/23 Deposit #2 1/05/23 Ck #1003 7. 8. 1/06/23 Ck #1004 9. 1/06/23 Ck #1005 10. 1/08/23 Ck #1006 11. 1/10/23 12. 1/10/23 13. 1/13/23 Ck #1007 14. 1/14/23 15. 1/14/23 Deposit #3 16. 1/16/23 Ck #1008 17 17. 1/16/23 18. 1/20/23 Deposit #4. Purchased a new computer system that cost $5,200 from Computer Inc. for use in the business. Mr. Slant signed a six-month, 10% installment note payable for the cost of the system. The computer system has an estimated useful life of 5 years and the residual (salvage) value is $100. This will be recorded as Computer Equipment, and depreciated accordingly using straight line depreciation. Only record the purchase at this time. Signed a note payable to borrow $10,000 from Wells Fargo bank. Interest is 12% annually and the note is to be repaid with interest in twelve months. Only record the receipt of the note. Paid $1,100 for shipping supplies. Paid $14,600 for furniture and fixtures for the store. The estimated service life of this asset is 8 years. The residual (salvage) value is $200. These items will be recorded as Furniture and Fixtures and will be depreciated using straight line depreciation. Only record the purchase. Arranged for Sun City Movers to make the delivery and for the setup of the computer system and paid the delivery and setup charge of $750. This charge should be added to the cost of the computer equipment purchased and depreciated on the same basis as the computer equipment. Purchased $450 of office supplies for cash from Office Supplies Company. Purchased $8,000 of merchandise inventory-skis on account. Purchased $6,000 of merchandise inventory-snow boards on account. There were no credit terms for prompt payment. Mr. Slant received and paid the $940 charge from lawyer. Hit the Slopes, Inc. is now open for business. Customers will go on-line and select the merchandise they wish to purchase. Online payments will be considered cash sales. Sold merchandise for $7,200 cash. The cost of the Skis is $3,000 and the cost of the Snowboards is $1,100. Sales tax will be $594. The merchandise will be shipped FOB destination. Paid $250 to ship the merchandise. Purchased additional skis on account for $4.500. Recorded internet sales for the first five days of operation. Sales totaled $8,300. Sales tax is $536. The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started