Answered step by step

Verified Expert Solution

Question

1 Approved Answer

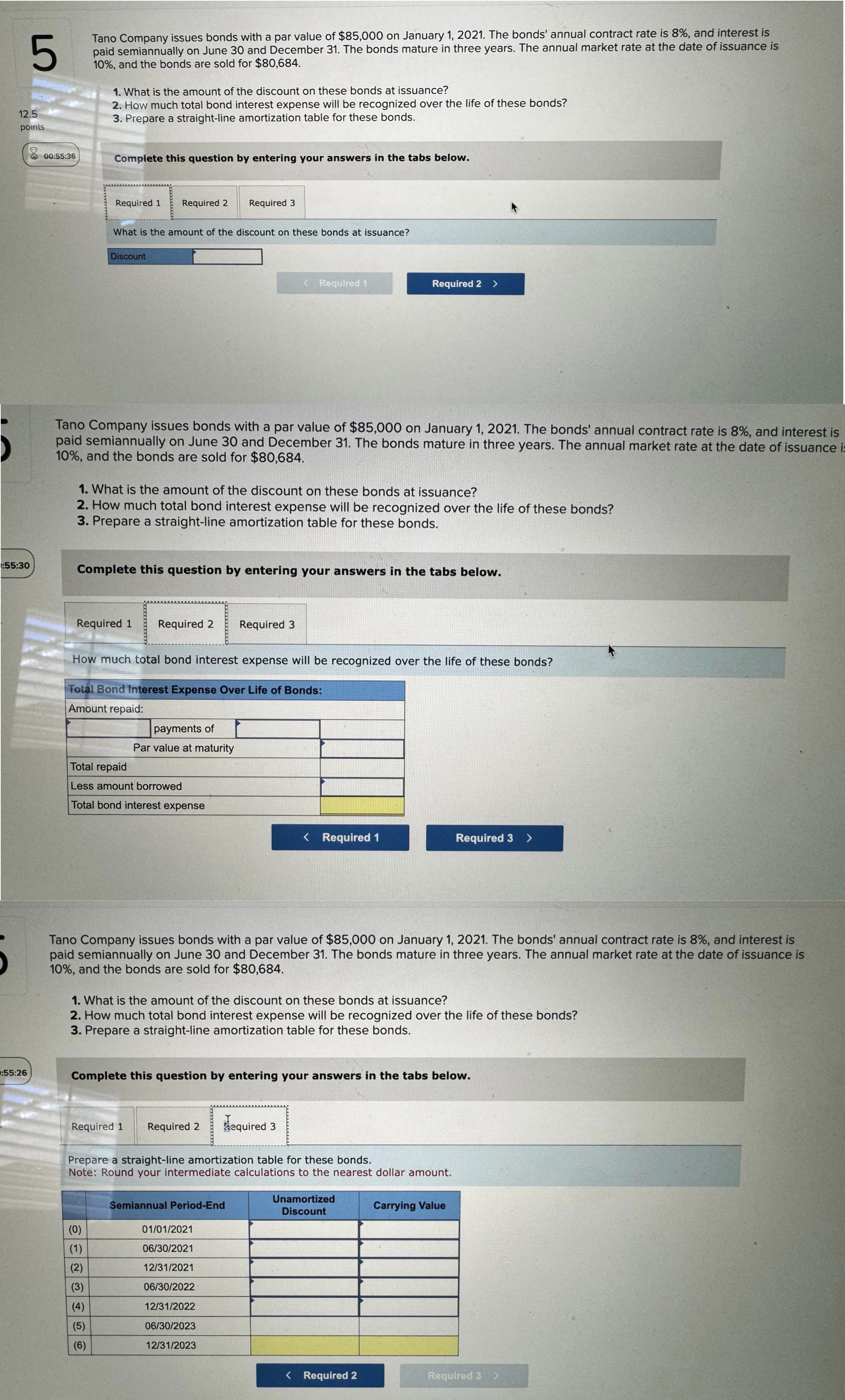

5 12.5 points Tano Company issues bonds with a par value of $85,000 on January 1, 2021. The bonds' annual contract rate is 8%,

5 12.5 points Tano Company issues bonds with a par value of $85,000 on January 1, 2021. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $80,684. 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds. 00:55:36 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the amount of the discount on these bonds at issuance? Discount < Required 1 Required 2 > Tano Company issues bonds with a par value of $85,000 on January 1, 2021. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $80,684. 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds. :55:30 Complete this question by entering your answers in the tabs below. 0:55:26 Required 1 Required 2 Required 3 How much total bond interest expense will be recognized over the life of these bonds? Total Bond Interest Expense Over Life of Bonds: Amount repaid: Total repaid payments of Par value at maturity Less amount borrowed Total bond interest expense < Required 1 Required 3> Tano Company issues bonds with a par value of $85,000 on January 1, 2021. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $80,684. 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a straight-line amortization table for these bonds. Note: Round your intermediate calculations to the nearest dollar amount. Semiannual Period-End (0) 01/01/2021 (1) 06/30/2021 (2) 12/31/2021 (3) 06/30/2022 (4) 12/31/2022 (5) 06/30/2023 (6) 12/31/2023 Unamortized Discount Carrying Value < Required 2 Required 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started