Answered step by step

Verified Expert Solution

Question

1 Approved Answer

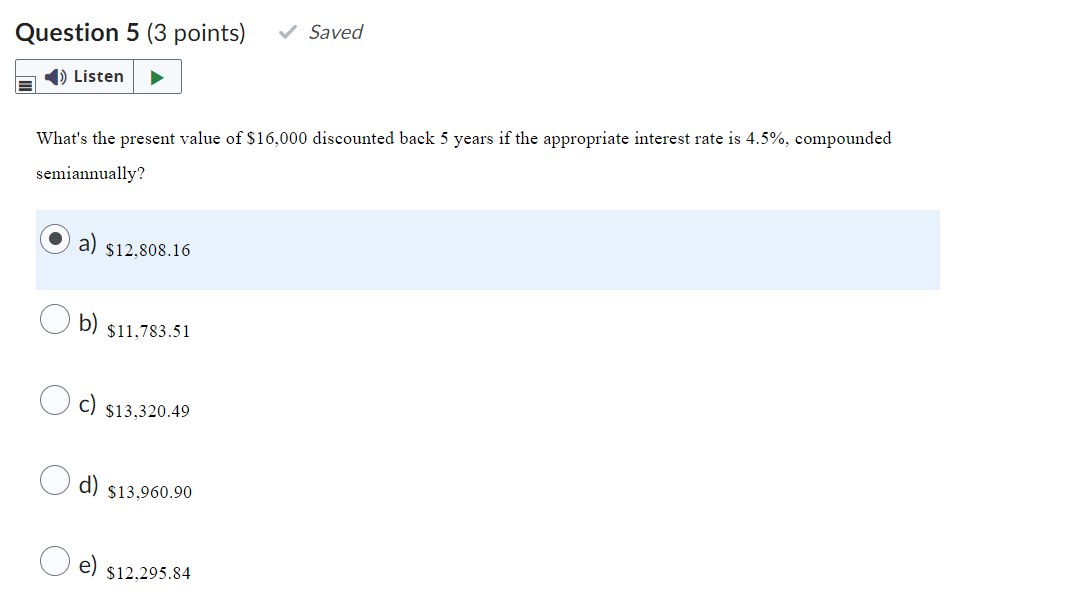

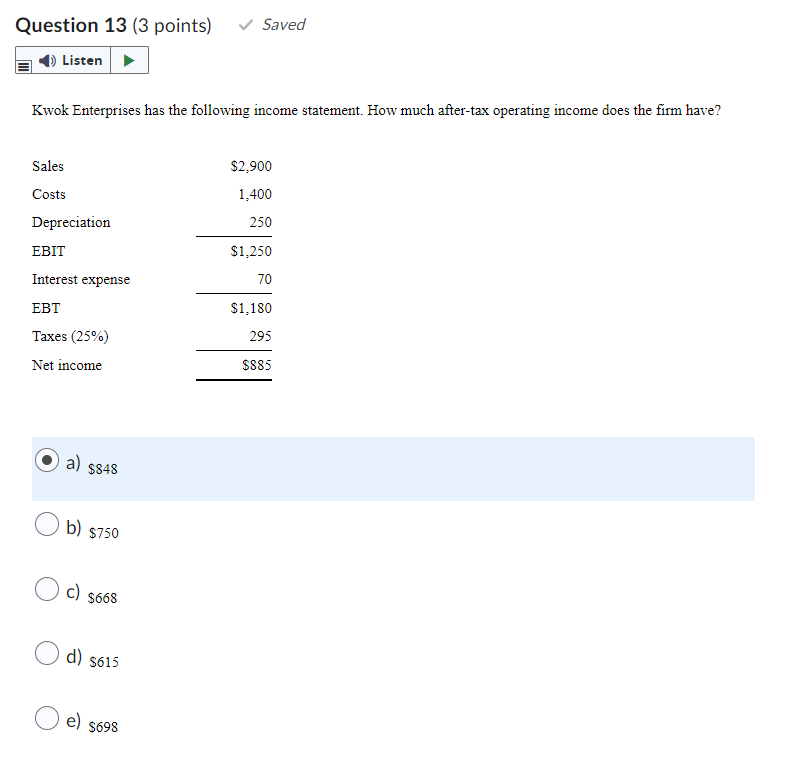

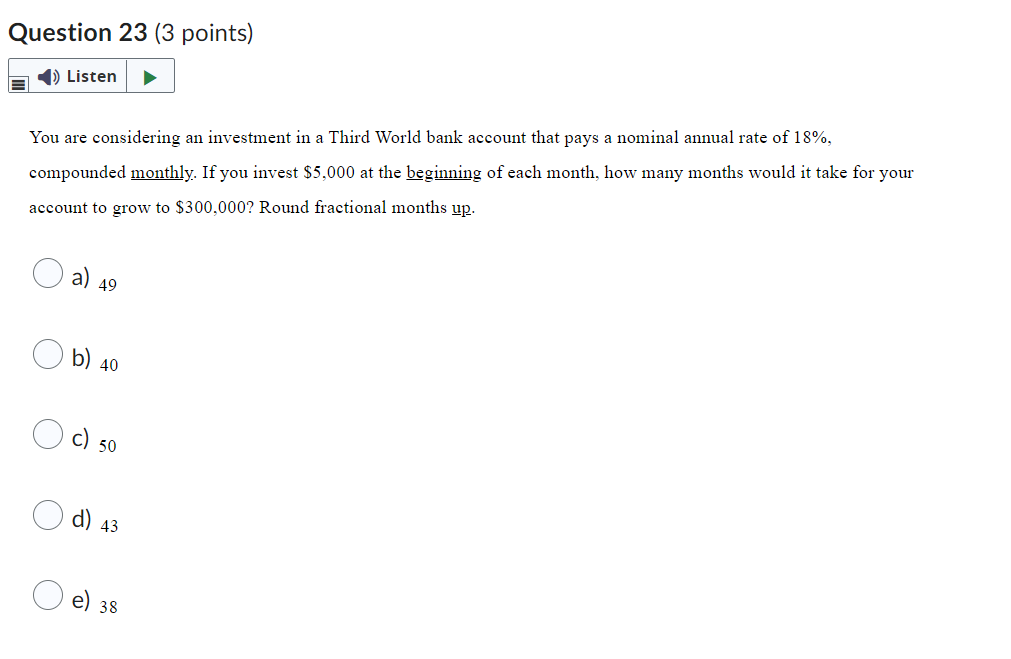

5. 13. 23 Question 5 (3 points) Saved Listen What's the present value of $16,000 discounted back 5 years if the appropriate interest rate is

5.

13.

23

Question 5 (3 points) Saved Listen What's the present value of $16,000 discounted back 5 years if the appropriate interest rate is 4.5%, compounded semiannually? a) $12.808.16 $11,783.51 $13,320.49 $13,960.90 e) $12.295.84 Question 13 (3 points) Saved Listen Kwok Enterprises has the following income statement. How much after-tax operating income does the firm have? Sales $2,900 Costs 1,400 Depreciation 250 EBIT $1,250 Interest expense 70 EBT $1,180 Taxes (25%) 295 Net income $885 a) $848 b) $750 c) $668 d) $615 e) $698 Question 23 (3 points) Listen You are considering an investment in a Third World bank account that pays a nominal annual rate of 18%, compounded monthly. If you invest $5,000 at the beginning of each month, how many months would it take for your account to grow to $300,000? Round fractional months up. a) 49 b) 40 c) 50 d) 43 e) 38

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started