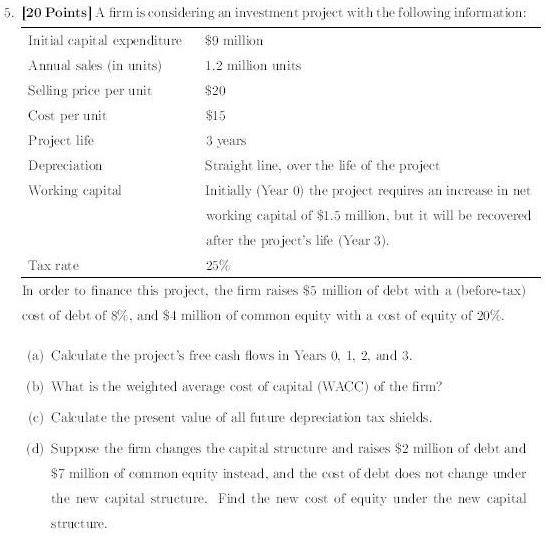

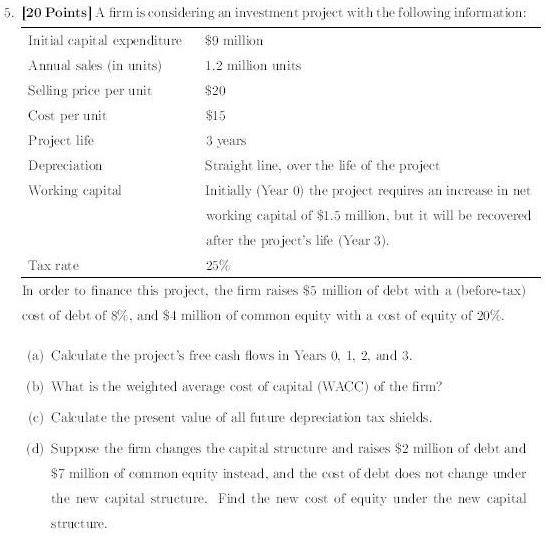

5. [20 Points) A firm is considering an investment project with the following information: Initial capital expenditure $9 million Annual sales (in units) 1.2 million units Selling price per unit $20 Cost per unit $15 Project life 3 years Depreciation Straight line, over the life of the project Working capital Initially (Year 0) the project requires an increase in net working capital of $1.5 million, but it will be recovered after the projext's life (Year 3). Tax rate 25% In order to finance this project, the firm raises $5 million of debt with a (before-tax) est of debt of 8%. and $1 million of common equity with a vost of equity of 20%. (a) Calculate the project's free cash flows in Years 0. 1. 2. and 3. (b) What is the weighted average cost of capital (WACC) of the firm? (c) Cakulate the present value of all fiture depreciation tax shields (d) Suppose the firm changes the capital structure and raise's $2 million of debt and $7 million of common equity instead, and the cast of debt does not changer under the new capital structure. Find the new cost of equity under the new capital structure 5. [20 Points) A firm is considering an investment project with the following information: Initial capital expenditure $9 million Annual sales (in units) 1.2 million units Selling price per unit $20 Cost per unit $15 Project life 3 years Depreciation Straight line, over the life of the project Working capital Initially (Year 0) the project requires an increase in net working capital of $1.5 million, but it will be recovered after the projext's life (Year 3). Tax rate 25% In order to finance this project, the firm raises $5 million of debt with a (before-tax) est of debt of 8%. and $1 million of common equity with a vost of equity of 20%. (a) Calculate the project's free cash flows in Years 0. 1. 2. and 3. (b) What is the weighted average cost of capital (WACC) of the firm? (c) Cakulate the present value of all fiture depreciation tax shields (d) Suppose the firm changes the capital structure and raise's $2 million of debt and $7 million of common equity instead, and the cast of debt does not changer under the new capital structure. Find the new cost of equity under the new capital structure