Answered step by step

Verified Expert Solution

Question

1 Approved Answer

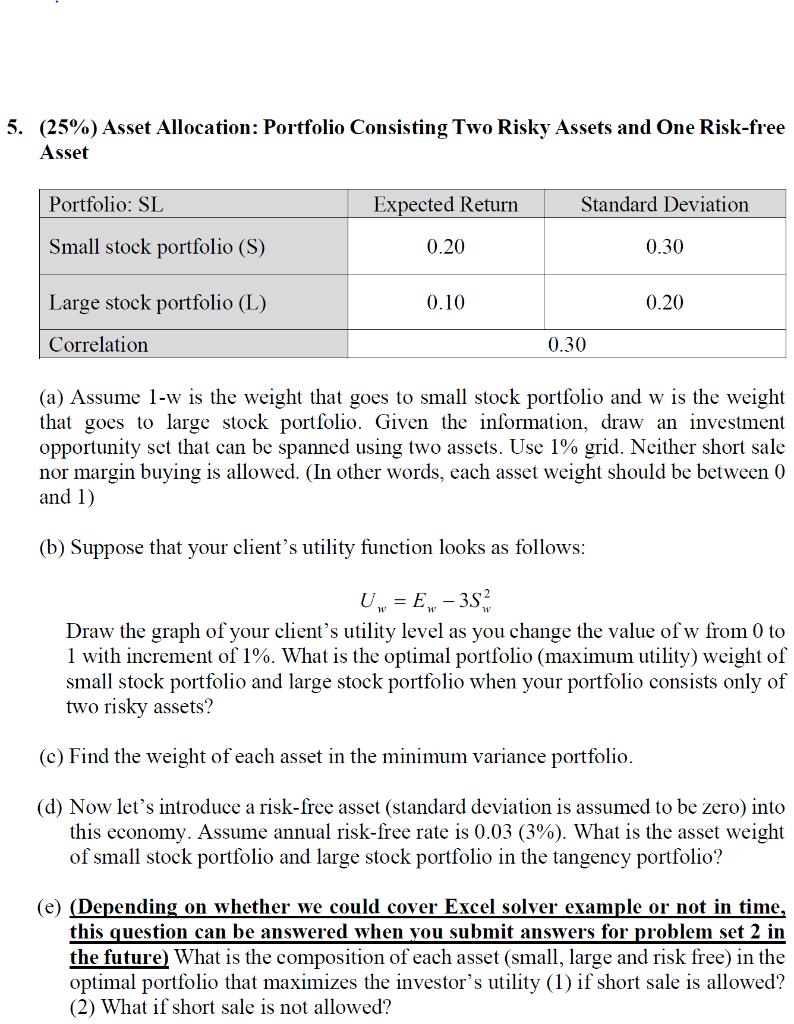

5. (25%) Asset Allocation: Portfolio Consisting Two Risky Assets and One Risk-free Asset Portfolio: SL Expected Return Standard Deviation Small stock portfolio (S) 0.20

5. (25%) Asset Allocation: Portfolio Consisting Two Risky Assets and One Risk-free Asset Portfolio: SL Expected Return Standard Deviation Small stock portfolio (S) 0.20 0.30 Large stock portfolio (L) Correlation 0.10 0.20 0.30 (a) Assume 1-w is the weight that goes to small stock portfolio and w is the weight that goes to large stock portfolio. Given the information, draw an investment opportunity set that can be spanned using two assets. Use 1% grid. Neither short sale nor margin buying is allowed. (In other words, each asset weight should be between 0 and 1) (b) Suppose that your client's utility function looks as follows: U = E-35%2 Draw the graph of your client's utility level as you change the value of w from 0 to 1 with increment of 1%. What is the optimal portfolio (maximum utility) weight of small stock portfolio and large stock portfolio when your portfolio consists only of two risky assets? (c) Find the weight of each asset in the minimum variance portfolio. (d) Now let's introduce a risk-free asset (standard deviation is assumed to be zero) into this economy. Assume annual risk-free rate is 0.03 (3%). What is the asset weight of small stock portfolio and large stock portfolio in the tangency portfolio? (e) (Depending on whether we could cover Excel solver example or not in time, this question can be answered when you submit answers for problem set 2 in the future) What is the composition of each asset (small, large and risk free) in the optimal portfolio that maximizes the investor's utility (1) if short sale is allowed? (2) What if short sale is not allowed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started