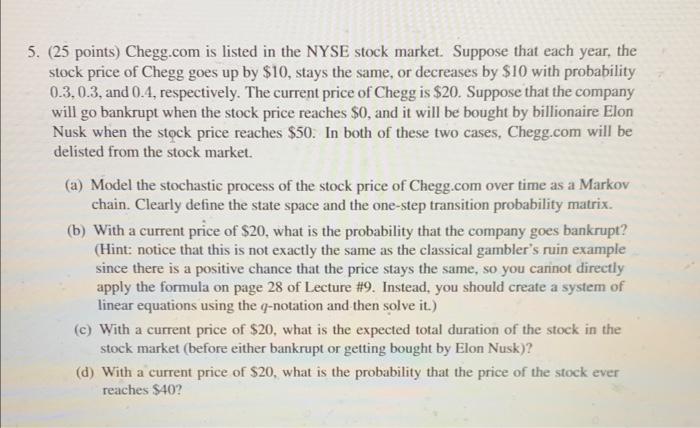

5. (25 points) Chegg.com is listed in the NYSE stock market. Suppose that each year, the stock price of Chegg goes up by $10, stays the same, or decreases by $10 with probability 0.3,0.3, and 0.4, respectively. The current price of Chegg is $20. Suppose that the company will go bankrupt when the stock price reaches $0, and it will be bought by billionaire Elon Nusk when the stock price reaches $50. In both of these two cases, Chegg.com will be delisted from the stock market. (a) Model the stochastic process of the stock price of Chegg.com over time as a Markov chain. Clearly define the state space and the one-step transition probability matrix. (b) With a current price of $20, what is the probability that the company goes bankrupt? (Hint: notice that this is not exactly the same as the classical gambler's ruin example since there is a positive chance that the price stays the same, so you carinot directly apply the formula on page 28 of Lecture \#9. Instead, you should create a system of linear equations using the q-notation and then solve it.) (c) With a current price of $20, what is the expected total duration of the stock in the stock market (before either bankrupt or getting bought by Elon Nusk)? (d) With a current price of $20, what is the probability that the price of the stock ever reaches $40 ? 5. (25 points) Chegg.com is listed in the NYSE stock market. Suppose that each year, the stock price of Chegg goes up by $10, stays the same, or decreases by $10 with probability 0.3,0.3, and 0.4, respectively. The current price of Chegg is $20. Suppose that the company will go bankrupt when the stock price reaches $0, and it will be bought by billionaire Elon Nusk when the stock price reaches $50. In both of these two cases, Chegg.com will be delisted from the stock market. (a) Model the stochastic process of the stock price of Chegg.com over time as a Markov chain. Clearly define the state space and the one-step transition probability matrix. (b) With a current price of $20, what is the probability that the company goes bankrupt? (Hint: notice that this is not exactly the same as the classical gambler's ruin example since there is a positive chance that the price stays the same, so you carinot directly apply the formula on page 28 of Lecture \#9. Instead, you should create a system of linear equations using the q-notation and then solve it.) (c) With a current price of $20, what is the expected total duration of the stock in the stock market (before either bankrupt or getting bought by Elon Nusk)? (d) With a current price of $20, what is the probability that the price of the stock ever reaches $40