Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. (25 points) Company ASDF has 10 million of common shares outstanding, traded at $70 per share. Market beta of those shares is 0.8 .

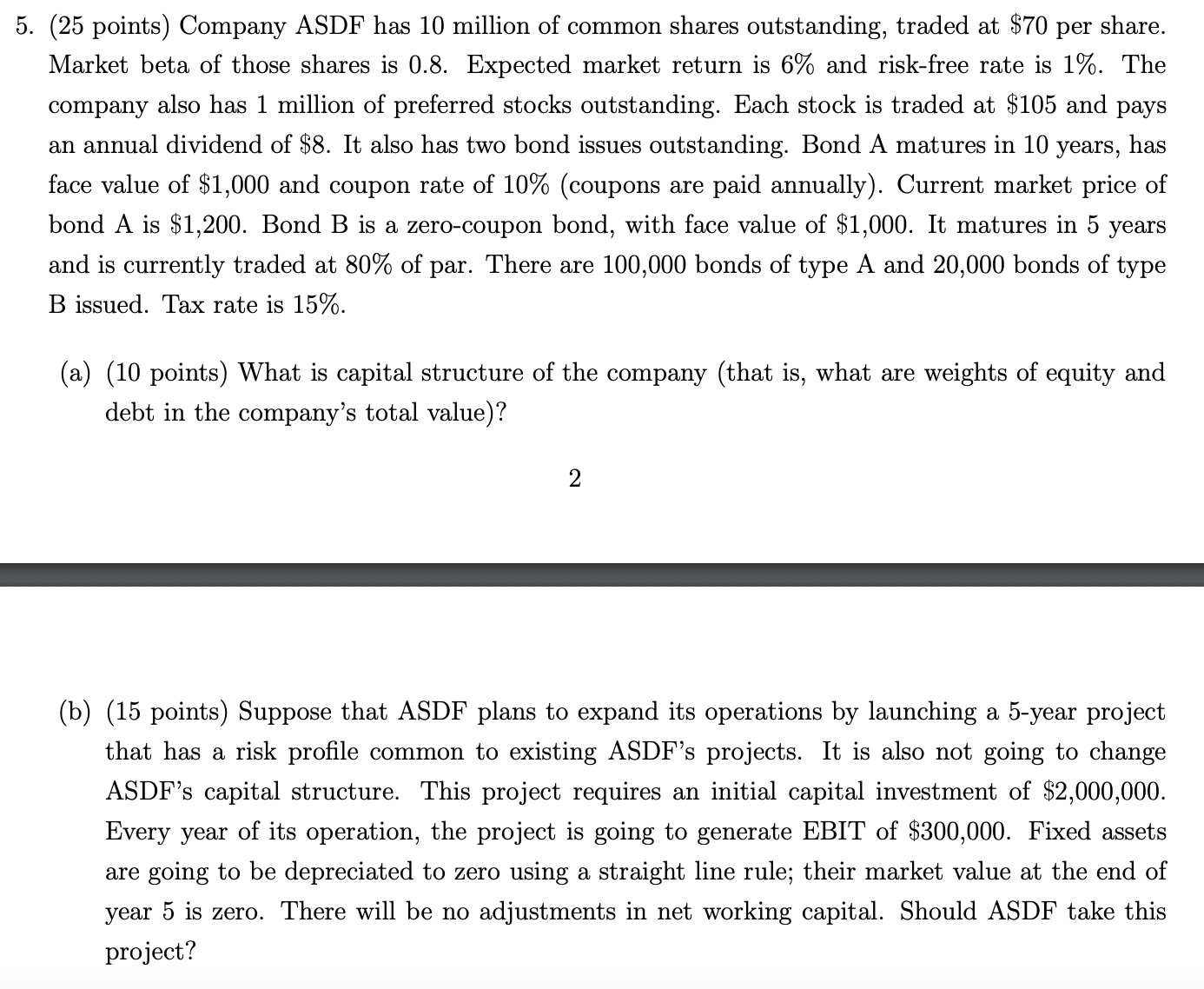

5. (25 points) Company ASDF has 10 million of common shares outstanding, traded at $70 per share. Market beta of those shares is 0.8 . Expected market return is 6% and risk-free rate is 1%. The company also has 1 million of preferred stocks outstanding. Each stock is traded at $105 and pays an annual dividend of $8. It also has two bond issues outstanding. Bond A matures in 10 years, has face value of $1,000 and coupon rate of 10% (coupons are paid annually). Current market price of bond A is $1,200. Bond B is a zero-coupon bond, with face value of $1,000. It matures in 5 years and is currently traded at 80% of par. There are 100,000 bonds of type A and 20,000 bonds of type B issued. Tax rate is 15%. (a) (10 points) What is capital structure of the company (that is, what are weights of equity and debt in the company's total value)? (b) (15 points) Suppose that ASDF plans to expand its operations by launching a 5-year project that has a risk profile common to existing ASDF's projects. It is also not going to change ASDF's capital structure. This project requires an initial capital investment of $2,000,000. Every year of its operation, the project is going to generate EBIT of $300,000. Fixed assets are going to be depreciated to zero using a straight line rule; their market value at the end of year 5 is zero. There will be no adjustments in net working capital. Should ASDF take this project? 5. (25 points) Company ASDF has 10 million of common shares outstanding, traded at $70 per share. Market beta of those shares is 0.8 . Expected market return is 6% and risk-free rate is 1%. The company also has 1 million of preferred stocks outstanding. Each stock is traded at $105 and pays an annual dividend of $8. It also has two bond issues outstanding. Bond A matures in 10 years, has face value of $1,000 and coupon rate of 10% (coupons are paid annually). Current market price of bond A is $1,200. Bond B is a zero-coupon bond, with face value of $1,000. It matures in 5 years and is currently traded at 80% of par. There are 100,000 bonds of type A and 20,000 bonds of type B issued. Tax rate is 15%. (a) (10 points) What is capital structure of the company (that is, what are weights of equity and debt in the company's total value)? (b) (15 points) Suppose that ASDF plans to expand its operations by launching a 5-year project that has a risk profile common to existing ASDF's projects. It is also not going to change ASDF's capital structure. This project requires an initial capital investment of $2,000,000. Every year of its operation, the project is going to generate EBIT of $300,000. Fixed assets are going to be depreciated to zero using a straight line rule; their market value at the end of year 5 is zero. There will be no adjustments in net working capital. Should ASDF take this project

5. (25 points) Company ASDF has 10 million of common shares outstanding, traded at $70 per share. Market beta of those shares is 0.8 . Expected market return is 6% and risk-free rate is 1%. The company also has 1 million of preferred stocks outstanding. Each stock is traded at $105 and pays an annual dividend of $8. It also has two bond issues outstanding. Bond A matures in 10 years, has face value of $1,000 and coupon rate of 10% (coupons are paid annually). Current market price of bond A is $1,200. Bond B is a zero-coupon bond, with face value of $1,000. It matures in 5 years and is currently traded at 80% of par. There are 100,000 bonds of type A and 20,000 bonds of type B issued. Tax rate is 15%. (a) (10 points) What is capital structure of the company (that is, what are weights of equity and debt in the company's total value)? (b) (15 points) Suppose that ASDF plans to expand its operations by launching a 5-year project that has a risk profile common to existing ASDF's projects. It is also not going to change ASDF's capital structure. This project requires an initial capital investment of $2,000,000. Every year of its operation, the project is going to generate EBIT of $300,000. Fixed assets are going to be depreciated to zero using a straight line rule; their market value at the end of year 5 is zero. There will be no adjustments in net working capital. Should ASDF take this project? 5. (25 points) Company ASDF has 10 million of common shares outstanding, traded at $70 per share. Market beta of those shares is 0.8 . Expected market return is 6% and risk-free rate is 1%. The company also has 1 million of preferred stocks outstanding. Each stock is traded at $105 and pays an annual dividend of $8. It also has two bond issues outstanding. Bond A matures in 10 years, has face value of $1,000 and coupon rate of 10% (coupons are paid annually). Current market price of bond A is $1,200. Bond B is a zero-coupon bond, with face value of $1,000. It matures in 5 years and is currently traded at 80% of par. There are 100,000 bonds of type A and 20,000 bonds of type B issued. Tax rate is 15%. (a) (10 points) What is capital structure of the company (that is, what are weights of equity and debt in the company's total value)? (b) (15 points) Suppose that ASDF plans to expand its operations by launching a 5-year project that has a risk profile common to existing ASDF's projects. It is also not going to change ASDF's capital structure. This project requires an initial capital investment of $2,000,000. Every year of its operation, the project is going to generate EBIT of $300,000. Fixed assets are going to be depreciated to zero using a straight line rule; their market value at the end of year 5 is zero. There will be no adjustments in net working capital. Should ASDF take this project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started