Answered step by step

Verified Expert Solution

Question

1 Approved Answer

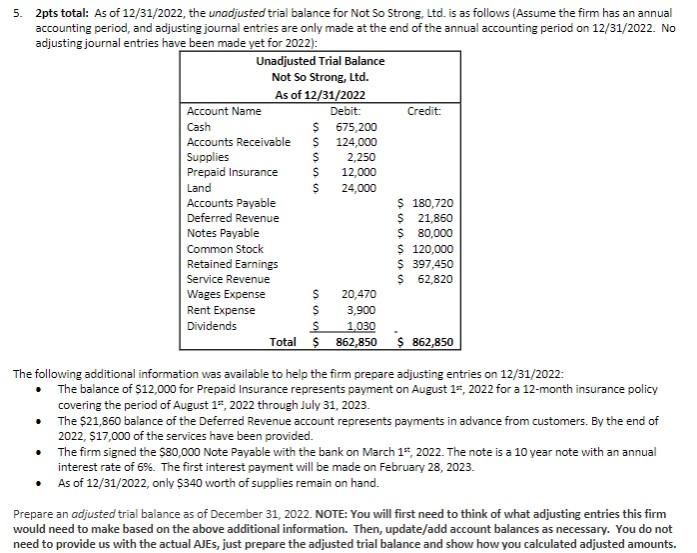

5. 2pts total: As of 12/31/2022, the unadjusted trial balance for Not So Strong, Ltd. is as follows (Assume the firm has an annual

5. 2pts total: As of 12/31/2022, the unadjusted trial balance for Not So Strong, Ltd. is as follows (Assume the firm has an annual accounting period, and adjusting journal entries are only made at the end of the annual accounting period on 12/31/2022. No adjusting journal entries have been made yet for 2022): Unadjusted Trial Balance Not So Strong, Ltd. As of 12/31/2022 Debit: Account Name Cash S Accounts Receivable $ Supplies Prepaid Insurance Land Accounts Payable Deferred Revenue Notes Payable Common Stock Retained Earnings Service Revenue Wages Expense Rent Expense Dividends SSSS $ 12,000 $ 24,000 S is 675,200 124,000 2,250 S 20,470 3,900 1,030 Credit: $ 180,720 $ 21,860 $ 80,000 $ 120,000 $ 397,450 $ 62,820 S Total $ 862,850 $ 862,850 The following additional information was available to help the firm prepare adjusting entries on 12/31/2022: The balance of $12,000 for Prepaid Insurance represents payment on August 15, 2022 for a 12-month insurance policy covering the period of August 15, 2022 through July 31, 2023. The $21,860 balance of the Deferred Revenue account represents payments in advance from customers. By the end of 2022, $17,000 of the services have been provided. The firm signed the $80,000 Note Payable with the bank on March 1, 2022. The note is a 10 year note with an annual interest rate of 6%. The first interest payment will be made on February 28, 2023. As of 12/31/2022, only $340 worth of supplies remain on hand. Prepare an adjusted trial balance as of December 31, 2022. NOTE: You will first need to think of what adjusting entries this firm would need to make based on the above additional information. Then, update/add account balances as necessary. You do not need to provide us with the actual AJES, just prepare the adjusted trial balance and show how you calculated adjusted amounts.

Step by Step Solution

★★★★★

3.55 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started