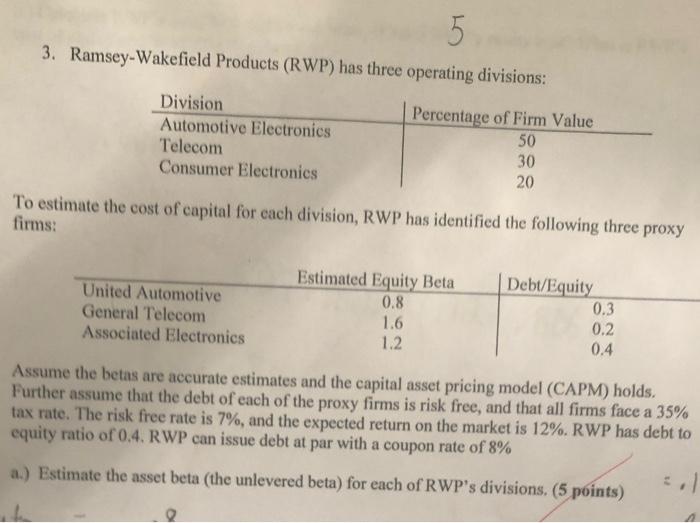

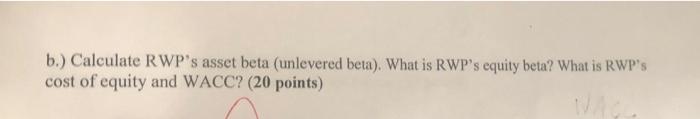

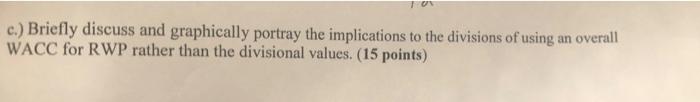

5 3. Ramsey-Wakefield Products (RWP) has three operating divisions: Percentage of Firm Value Division Automotive Electronics Telecom Consumer Electronics 50 30 20 To estimate the cost of capital for each division, RWP has identified the following three proxy firms: United Automotive General Telecom Associated Electronics Estimated Equity Beta 0.8 1.6 1.2 Debt/Equity 0.3 0.2 0.4 a Assume the betas are accurate estimates and the capital asset pricing model (CAPM) holds. Further assume that the debt of each of the proxy firms is risk free, and that all firms face a 35% tax rate. The risk free rate is 7%, and the expected return on the market is 12%. RWP has debt to equity ratio of 0.4. RWP can issue debt at par with a coupon rate of 8% a.) Estimate the asset beta (the unlevered beta) for each of RWP's divisions. (5 points) b.) Calculate RWP's asset beta (unlevered beta). What is RWP's equity beta? What is RWP's cost of equity and WACC? (20 points) c.) Briefly discuss and graphically portray the implications to the divisions of using an overall WACC for RWP rather than the divisional values. (15 points) 5 3. Ramsey-Wakefield Products (RWP) has three operating divisions: Percentage of Firm Value Division Automotive Electronics Telecom Consumer Electronics 50 30 20 To estimate the cost of capital for each division, RWP has identified the following three proxy firms: United Automotive General Telecom Associated Electronics Estimated Equity Beta 0.8 1.6 1.2 Debt/Equity 0.3 0.2 0.4 a Assume the betas are accurate estimates and the capital asset pricing model (CAPM) holds. Further assume that the debt of each of the proxy firms is risk free, and that all firms face a 35% tax rate. The risk free rate is 7%, and the expected return on the market is 12%. RWP has debt to equity ratio of 0.4. RWP can issue debt at par with a coupon rate of 8% a.) Estimate the asset beta (the unlevered beta) for each of RWP's divisions. (5 points) b.) Calculate RWP's asset beta (unlevered beta). What is RWP's equity beta? What is RWP's cost of equity and WACC? (20 points) c.) Briefly discuss and graphically portray the implications to the divisions of using an overall WACC for RWP rather than the divisional values. (15 points)