Answered step by step

Verified Expert Solution

Question

1 Approved Answer

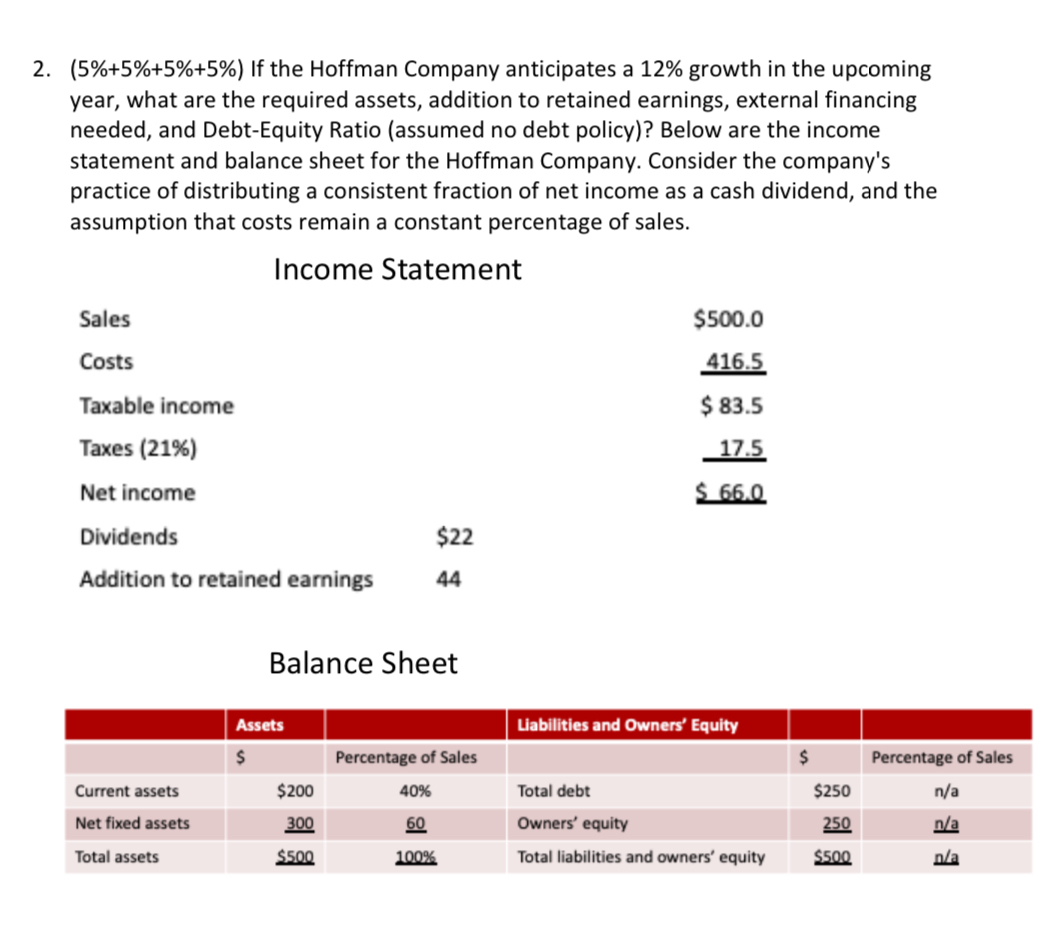

( 5 % + 5 % + 5 % + 5 % ) If the Hoffman Company anticipates a 1 2 % growth in the

If the Hoffman Company anticipates a growth in the upcoming year, what are the required assets, addition to retained earnings, external financing needed, and DebtEquity Ratio assumed no debt policy Below are the income statement and balance sheet for the Hoffman Company. Consider the company's practice of distributing a consistent fraction of net income as a cash dividend, and the assumption that costs remain a constant percentage of sales.

Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started