Answered step by step

Verified Expert Solution

Question

1 Approved Answer

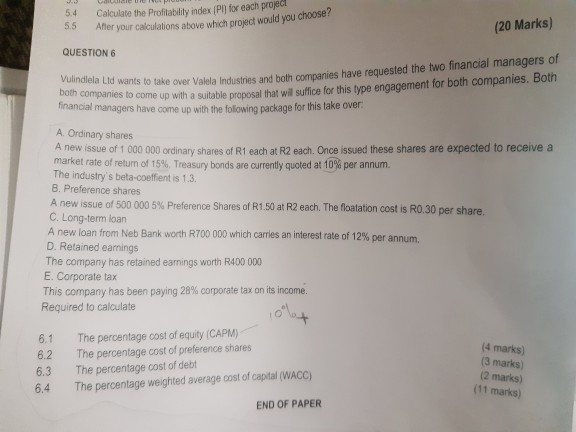

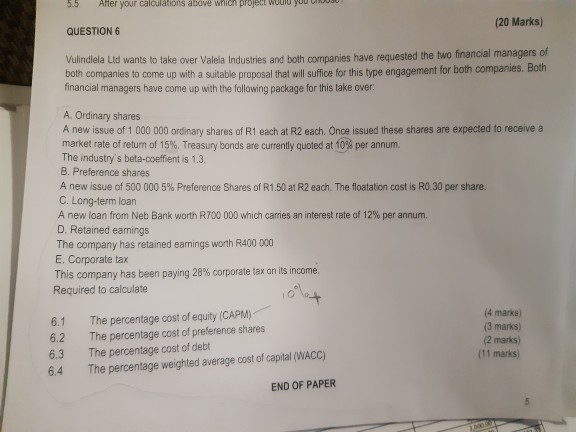

5 54 55 QUESTION G A Ordinary shares A new issue of 1 000 000 ordinary shares de la market rate of return of 15%.

5 54 55 QUESTION G A Ordinary shares A new issue of 1 000 000 ordinary shares de la market rate of return of 15%. Treasury bons are curry The industry's bela-coellient is 13. B. Preference shares A new issue of 500 000 5%. Preference Shures of R150 Rear The C. Long-term loan A new loan from Neb Bank worth 700 000 which comes an interest D. Retained earrings The company has retained earnings worth 400 000 E. Corporate tax This company has been paying 28%.corporate as ons income Required to calculate 6.1 6.2 6.3 6.4 The percentage cost of equity (CAPM The percentage cost of preference shares The percentage cost of debt The percentage weighted average cost of capital (WACC) END OF PAPER Cat the Paya the Calculate the prepare your Intesanoma Calame Prolitas Vulindlela Lid wants to take over de both companies to come up with a Aher your calculation och financial managers have come up with the 55 QUESTION both companies to come up with a pro financial managers have come up with the following page for A Ordinary shares A new issue of 1 000 000 ordinary shares of Reach Reach Once market rate of retum of 15 Treasury bonds are currently udledate The industry's beta-coeffient is 1.3 B. Preference shares A new issue of 500 000 5% Preference Shares of R1 50 at R2 each. The festations C. Long-term loan A new loan from Neb Bank worth R700 000 which carries an interest rate of 12% per annum D. Retained earings The company has retained earnings worth R400 000 E. Corporate tax This company has been paying 28% corporate tax on its income. Required to calculate 6.1 6.2 6.3 6.4 The percentage cost of equity (CAPM) The percentage cost of preference shares The percentage cost of debt The percentage weighted average cost of capital (WACC) Vulindlela Lid wants to take over and be After your calculations above which project would you choose? 5.4 Calculate the Profitability index (Ph for each projed 5.5 (20 Marks) QUESTION 6 Malindlela Lid wants to take over Valela Industries and both companies have requested the two financial managers of both companies to come up with a suitable proposal that will suffice for this type engagement for both companies. Both financial managers have come up with the following package for this take over A Ordinary shares A new issue of 1 000 000 ordinary shares of Rt each at R2 each. Once issued these shares are expected to receive a market rate of return of 15%. Treasury bonds are currently quoted at 10% per annum The industry's beta-coeffient is 1.3. B. Preference shares A new issue of 500 000 5% Preference Shares of R1.50 at R2 each. The floatation cost is R0.30 per share. C. Long-term loan A new loan from Neb Bank worth R700 000 which carries an interest rate of 12% per annum. D. Retained earnings The company has retained earnings worth R400 000 E. Corporate tax This company has been paying 28% corporate tax on its income. Required to calculate 6.1 6.2 6.3 6.4 The percentage cost of equity (CAPM) The percentage cost of preference shares The percentage cost of debt The percentage weighted average cost of capital (WACC) (4 marks) (3 marks) (2 marks) (11 marks) END OF PAPER 5.5 After your calculations above which project would you (20 Marks) QUESTION 6 Vulindlela Lid wants to take over Valela Industries and both companies have requested the two financial managers of both companies to come up with a suitable proposal that will suffice for this type engagement for both companies. Both financial managers have come up with the following package for this take over: A. Ordinary shares A new issue of 1 000 000 ordinary shares of R1 each at R2 each. Once issued these shares are expected to receive a market rate of retum of 15%. Treasury bands are currently quoted at 10% per annum The industry's beta-coeffient is 1.3. B. Preference shares A new issue of 500 000 5% Preference Shares of R1.50 at R2 each. The floatation cost is R0.30 per share. C. Long-term loan A new loan from Neb Bank worth R700 000 which carries an interest rate of 12% per annum D. Retained earnings The company has retained earnings worth R400 000 E. Corporate tax This company has been paying 28% corporate tax on its income. Required to calculate 6.1 The percentage cost of equity (CAPM) (4 marks) 6.2 The percentage cost of preference shares (3 marks) (2 marks) 6.3 The percentage cost of debt (11 marks) 6.4 The percentage weighted average cost of capital (WACC) END OF PAPER After your calculations above which project would you choose? 5.4 Calculate the Profitability index (Ph for each projed 5.5 (20 Marks) QUESTION 6 Malindlela Lid wants to take over Valela Industries and both companies have requested the two financial managers of both companies to come up with a suitable proposal that will suffice for this type engagement for both companies. Both financial managers have come up with the following package for this take over A Ordinary shares A new issue of 1 000 000 ordinary shares of Rt each at R2 each. Once issued these shares are expected to receive a market rate of return of 15%. Treasury bonds are currently quoted at 10% per annum The industry's beta-coeffient is 1.3. B. Preference shares A new issue of 500 000 5% Preference Shares of R1.50 at R2 each. The floatation cost is R0.30 per share. C. Long-term loan A new loan from Neb Bank worth R700 000 which carries an interest rate of 12% per annum. D. Retained earnings The company has retained earnings worth R400 000 E. Corporate tax This company has been paying 28% corporate tax on its income. Required to calculate 6.1 6.2 6.3 6.4 The percentage cost of equity (CAPM) The percentage cost of preference shares The percentage cost of debt The percentage weighted average cost of capital (WACC) (4 marks) (3 marks) (2 marks) (11 marks) END OF PAPER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started