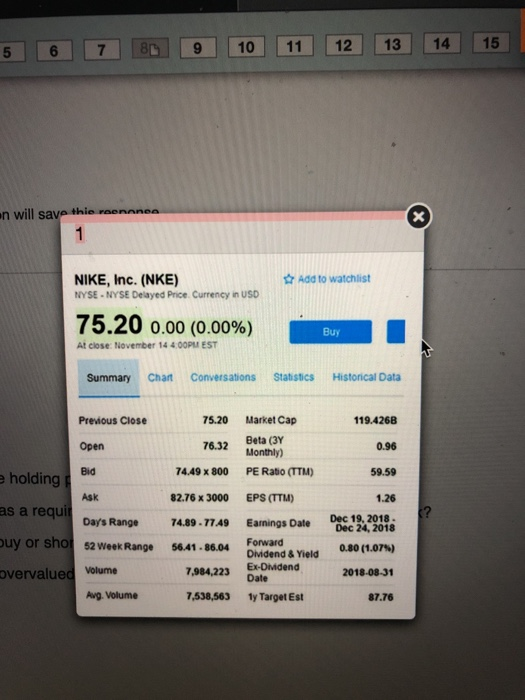

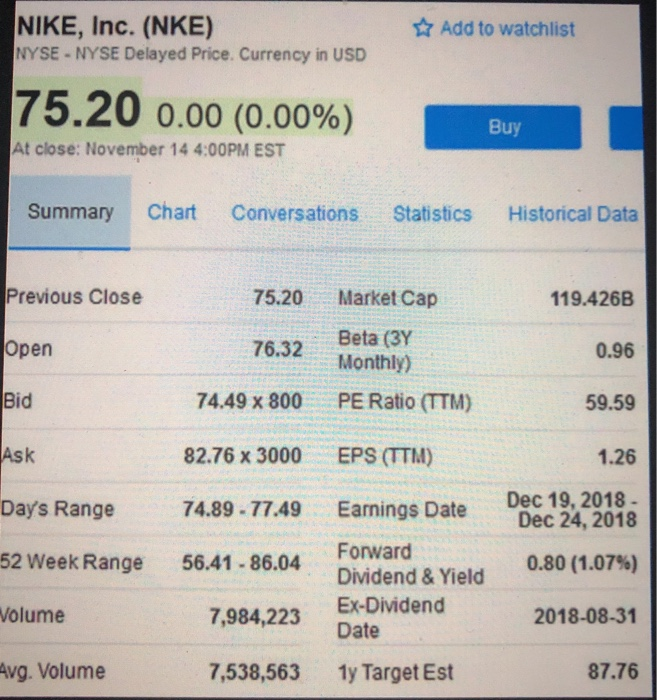

5 6 7 8 9 10 11 12 13 14 15 en will save this reen NIKE, Inc. (NKE) NYSE - NYSE Delayed Price Currency in USD Add to watchlist 75.20 0.00 (0.00%) At close: November 14 4:00PM EST Buy Summary Chart Conversations Statistics Historical Data Previous Close 75.20 119.426B Open 76.32 Market Cap Beta (3Y Monthly) PE Ratio (TTM) 0.96 74.49 x 800 59.59 82.76 x 3000 EPS (TTM) 1.26 Bid e holding Ask as a requir Day's Range buy or shot 52 Week Range 74.89.77.49 56.41. 86.04 Earnings Date Forward Dividend & Yield Ex-Dividend Date 1y Target Est Dec 19, 2018. Dec 12 Dec 24, 2018 0.80 (1.07%) 2018-08-31 overvalued volume 7,984,223 Avg. Volume 7,538,563 87.76 1. 8 points. Compute the holding period return for the stock 2. 8 points. The stock has a required return of 5.1%. What is the value of the stock? 3. 2 points. Should you buy or short the stock? 4.2 points. Is the stock overvalued or undervalued? 1. 8 points. Compute the holding period return for the stock 2. 8 points. The stock has a required return of 5.1%. What is the value of the stock? 3.2 points. Should you buy or short the stock? 4.2 points. Is the stock overvalued or undervalued? NIKE, Inc. (NKE) NYSE - NYSE Delayed Price. Currency in USD Add to watchlist 75.20 0.00 (0.00%) Buy At close: November 14 4:00PM EST Summary chart Conversations Statistics Historical Data Previous Close 75.20 119.426B Open 76.32 Market Cap Beta (3Y Monthly) PE Ratio (TTM) 0.96 Bid 74.49 x 800 59.59 Ask 82.76 x 3000 EPS (TTM) 1.26 Day's Range 74.89 - 77.49 Earnings Date Dec 19, 2018 - Dec 24, 2018 52 Week Range 56.41 - 86.04 0.80 (1.07%) Volume 7,984,223 Forward Dividend & Yield Ex-Dividend Date 1y Target Est 2018-08-31 Avg. Volume 7,538,563 87.76 5 6 7 8 9 10 11 12 13 14 15 en will save this reen NIKE, Inc. (NKE) NYSE - NYSE Delayed Price Currency in USD Add to watchlist 75.20 0.00 (0.00%) At close: November 14 4:00PM EST Buy Summary Chart Conversations Statistics Historical Data Previous Close 75.20 119.426B Open 76.32 Market Cap Beta (3Y Monthly) PE Ratio (TTM) 0.96 74.49 x 800 59.59 82.76 x 3000 EPS (TTM) 1.26 Bid e holding Ask as a requir Day's Range buy or shot 52 Week Range 74.89.77.49 56.41. 86.04 Earnings Date Forward Dividend & Yield Ex-Dividend Date 1y Target Est Dec 19, 2018. Dec 12 Dec 24, 2018 0.80 (1.07%) 2018-08-31 overvalued volume 7,984,223 Avg. Volume 7,538,563 87.76 1. 8 points. Compute the holding period return for the stock 2. 8 points. The stock has a required return of 5.1%. What is the value of the stock? 3. 2 points. Should you buy or short the stock? 4.2 points. Is the stock overvalued or undervalued? 1. 8 points. Compute the holding period return for the stock 2. 8 points. The stock has a required return of 5.1%. What is the value of the stock? 3.2 points. Should you buy or short the stock? 4.2 points. Is the stock overvalued or undervalued? NIKE, Inc. (NKE) NYSE - NYSE Delayed Price. Currency in USD Add to watchlist 75.20 0.00 (0.00%) Buy At close: November 14 4:00PM EST Summary chart Conversations Statistics Historical Data Previous Close 75.20 119.426B Open 76.32 Market Cap Beta (3Y Monthly) PE Ratio (TTM) 0.96 Bid 74.49 x 800 59.59 Ask 82.76 x 3000 EPS (TTM) 1.26 Day's Range 74.89 - 77.49 Earnings Date Dec 19, 2018 - Dec 24, 2018 52 Week Range 56.41 - 86.04 0.80 (1.07%) Volume 7,984,223 Forward Dividend & Yield Ex-Dividend Date 1y Target Est 2018-08-31 Avg. Volume 7,538,563 87.76