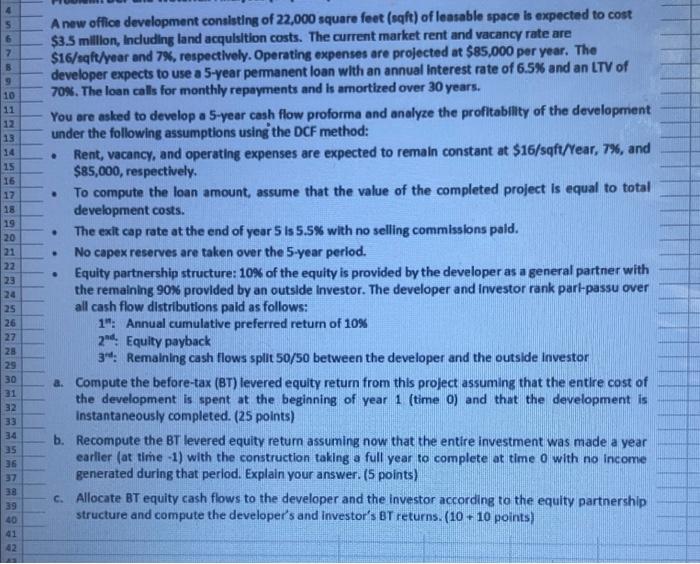

. . . 5 6 7 B 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 A new office development consisting of 22,000 square feet (sqft) of leasable space is expected to cost $3.5 million, Including land acquisition costs. The current market rent and vacancy rate are $16/sqft/year and 7%, respectively. Operating expenses are projected at $85,000 per year. The developer expects to use a 5-year permanent loan with an annual interest rate of 6.5% and an LTV of 70%. The loan calls for monthly repayments and is amortized over 30 years. You are asked to develop a 5-year cash flow proforma and analyze the profitability of the development under the following assumptions using the DCF method: Rent, vacancy, and operating expenses are expected to remain constant at $16/sqft/Year, 7%, and $85,000, respectively. To compute the loan amount, assume that the value of the completed project is equal to total development costs. The exit cap rate at the end of year 5 is 5.5% with no selling commissions pald. No capex reserves are taken over the 5-year period. Equity partnership structure: 10% of the equity is provided by the developer as a general partner with the remaining 90% provided by an outside Investor. The developer and Investor rank parl-passu over all cash flow distributions paid as follows: 1": Annual cumulative preferred return of 10% 2. Equity payback 34: Remaining cash flows split 50/50 between the developer and the outside Investor a. Compute the before-tax (BT) levered equity return from this project assuming that the entire cost of the development is spent at the beginning of year 1 (time 0) and that the development is Instantaneously completed. (25 points) b. Recompute the BT levered equity return assuming now that the entire investment was made a year earlier (at time -1) with the construction taking a full year to complete at time 0 with no Income generated during that period. Explain your answer. (5 points) c. Allocate BT equity cash flows to the developer and the investor according to the equity partnership structure and compute the developer's and Investor's BT returns. (10 - 10 points) . . . 5 6 7 B 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 A new office development consisting of 22,000 square feet (sqft) of leasable space is expected to cost $3.5 million, Including land acquisition costs. The current market rent and vacancy rate are $16/sqft/year and 7%, respectively. Operating expenses are projected at $85,000 per year. The developer expects to use a 5-year permanent loan with an annual interest rate of 6.5% and an LTV of 70%. The loan calls for monthly repayments and is amortized over 30 years. You are asked to develop a 5-year cash flow proforma and analyze the profitability of the development under the following assumptions using the DCF method: Rent, vacancy, and operating expenses are expected to remain constant at $16/sqft/Year, 7%, and $85,000, respectively. To compute the loan amount, assume that the value of the completed project is equal to total development costs. The exit cap rate at the end of year 5 is 5.5% with no selling commissions pald. No capex reserves are taken over the 5-year period. Equity partnership structure: 10% of the equity is provided by the developer as a general partner with the remaining 90% provided by an outside Investor. The developer and Investor rank parl-passu over all cash flow distributions paid as follows: 1": Annual cumulative preferred return of 10% 2. Equity payback 34: Remaining cash flows split 50/50 between the developer and the outside Investor a. Compute the before-tax (BT) levered equity return from this project assuming that the entire cost of the development is spent at the beginning of year 1 (time 0) and that the development is Instantaneously completed. (25 points) b. Recompute the BT levered equity return assuming now that the entire investment was made a year earlier (at time -1) with the construction taking a full year to complete at time 0 with no Income generated during that period. Explain your answer. (5 points) c. Allocate BT equity cash flows to the developer and the investor according to the equity partnership structure and compute the developer's and Investor's BT returns. (10 - 10 points)