Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5) 6) Siatkowski Industries began the year with inventory of $91,000. Purchases of inventory on account during the year totaled $316.000. Inventory costing $341,000 was

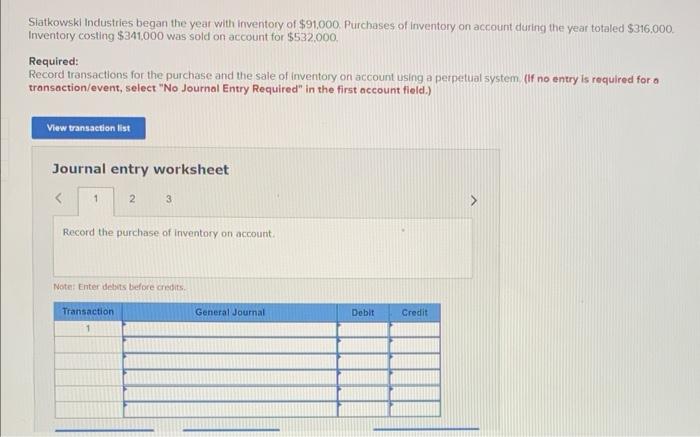

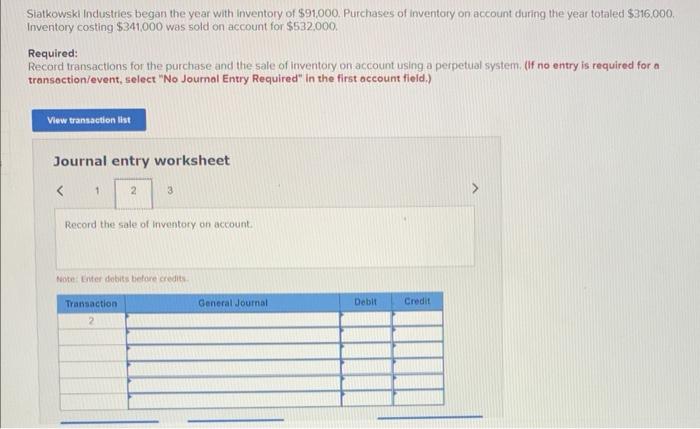

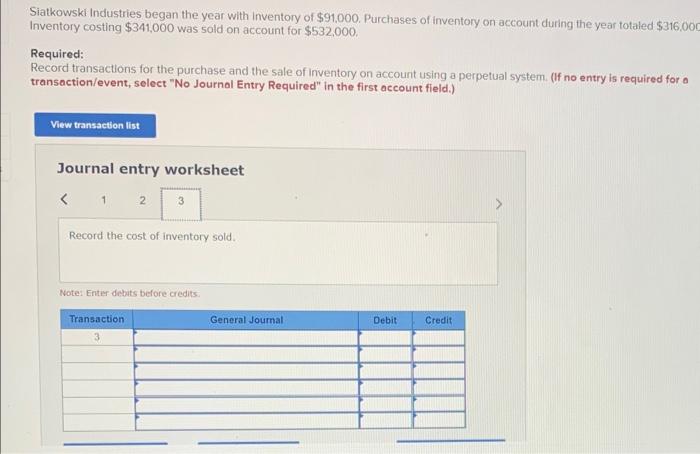

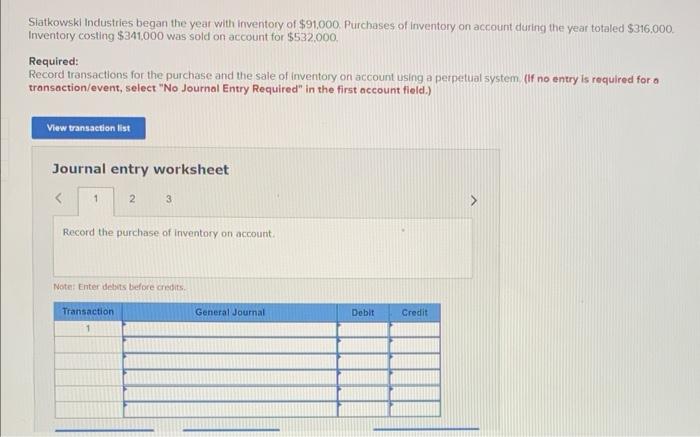

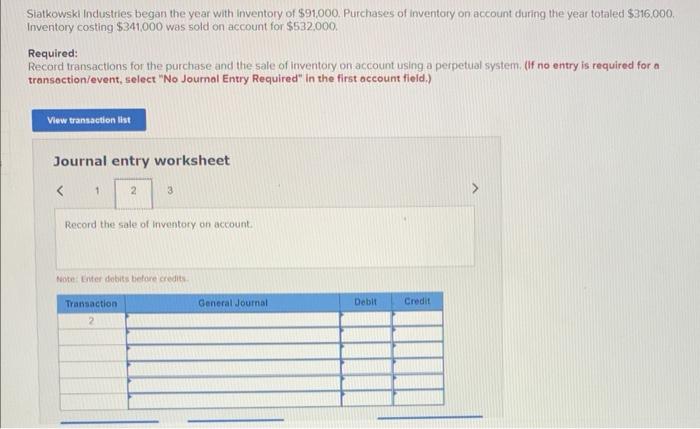

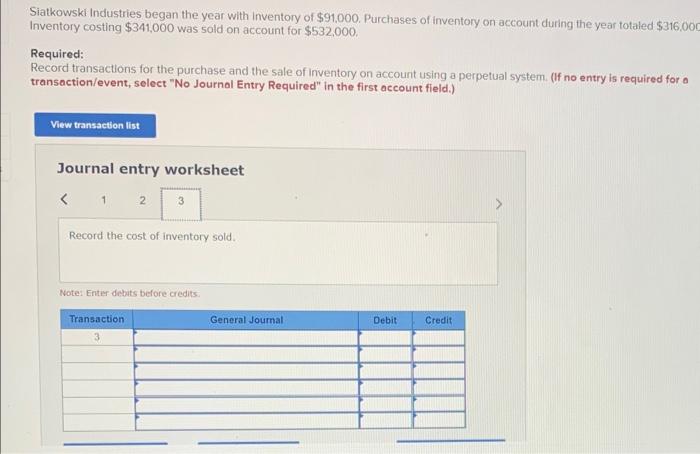

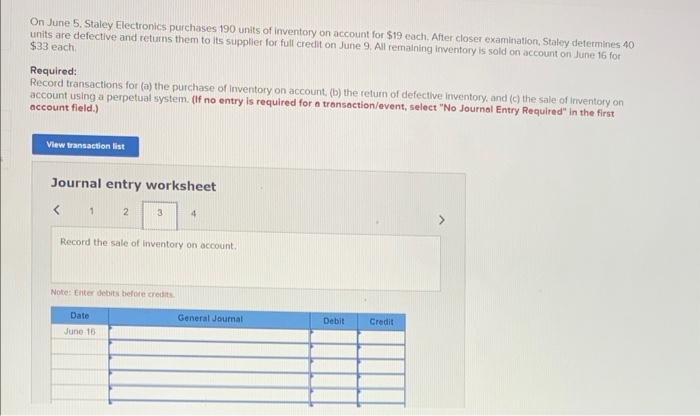

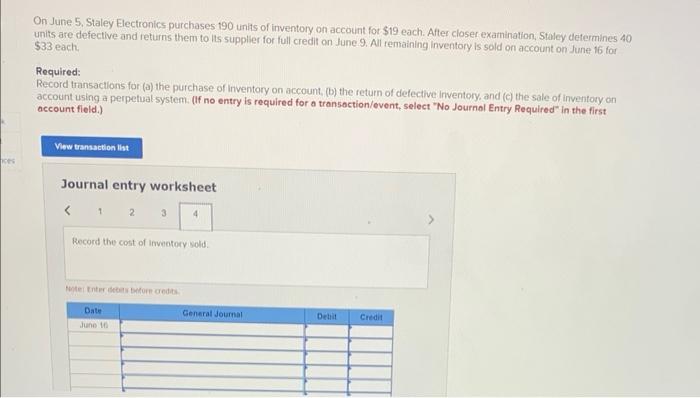

5)

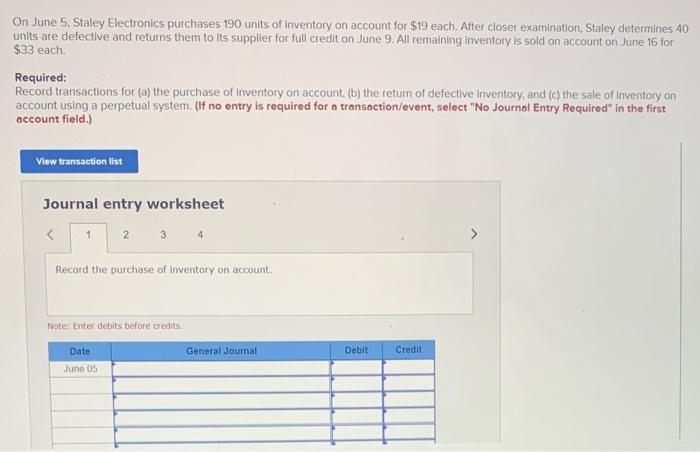

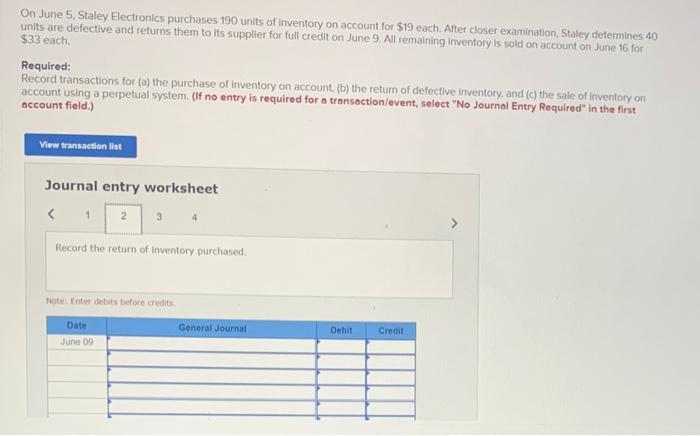

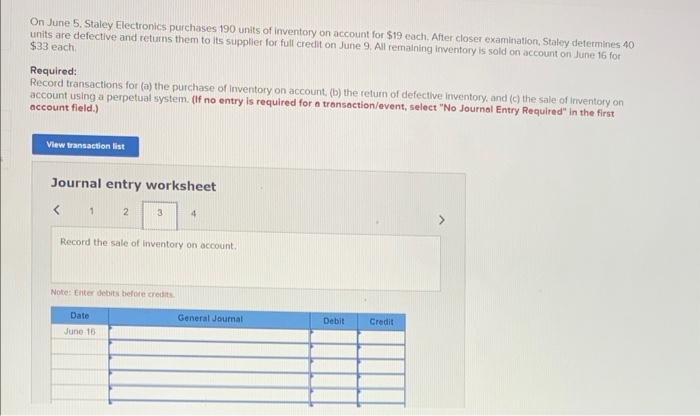

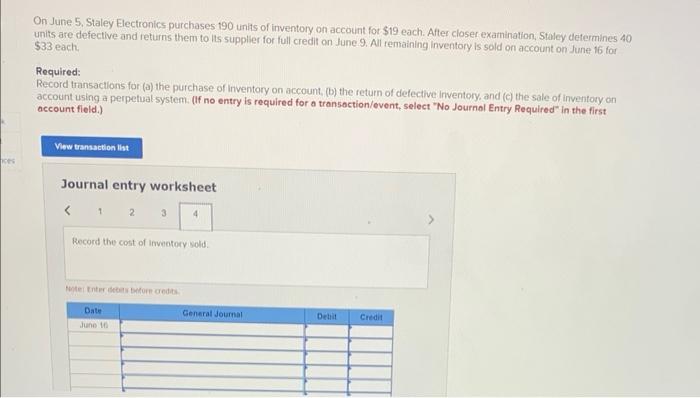

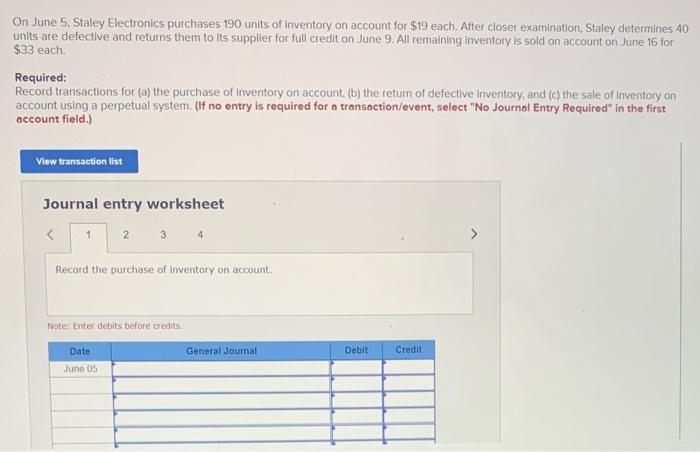

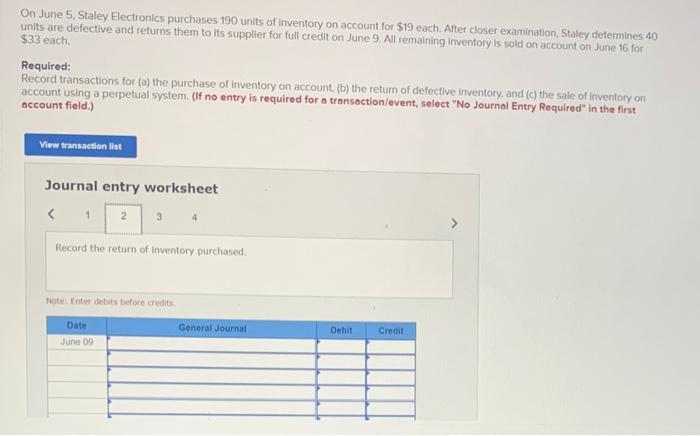

Siatkowski Industries began the year with inventory of $91,000. Purchases of inventory on account during the year totaled $316.000. Inventory costing $341,000 was sold on account for $532,000 Required: Record transactions for the purchase and the sale of inventory on account using a perpetual system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the purchase of inventory on account. Notel Enter debits before credits. Siatkowski Industries began the year with inventory of $91,000. Purchases of inventory on account during the year totaled $316,000. Inventory costing $341,000 was sold on account for $532.000. Required: Record transactions for the purchase and the sale of inventory on account using a perpetual system. (If no entry is required for a transoction/event, select "No Journal Entry Required" In the first occount field.) Journal entry worksheet Record the sale of Inventory on account. Note: Lner debits betore creditt. Siatkowski Industries began the year with inventory of $91,000. Purchases of inventory on account during the year totaled $316,00 i Inventory costing $341,000 was sold on account for $532,000. Required: Record transactions for the purchase and the sale of inventory on account using a perpetual system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet On June 5. Staley Electronics purchases 190 units of inventory on account for $19 each. After closer examination, Staley determines 40 units are defective and returns them to its supplier for full credit on June 9 . All remaining inventory is sold on account on June 16 for $33 each. Required: Record transactions for (a) the purchase of inventory on account, (b) the return of defective inventory, and (c) the sale of Inventory on account using a perpetual system. (If no entry is required for a transaction/event, select "No Journol Entry Required" in the first account field.) Journal entry worksheet Record the purchase of inventory on account. Note: Enter debits before credits: On June 5, Staley Electronics purchases 190 units of inventory on account for $19 each. After closer examination, Staley determines 40 units are defective and returns them to its supplier for full credit on June 9 . All remaining inventory is sold on account on June 16 for. $33 each. Required: Record transactions for (a) the purchase of iriventory on account, (b) the return of defective inventory. and (c) the sale of inventory on account using a perpetual system. (If no entry is required for o transoction/event, select "No Journal Entry Required" in the first occount field.) Journal entry worksheet Record the return of inventory purchased. Notet Enter detaits before credits. On June 5. Staley Electronics purchases 190 units of inventory on account for $19 each. After closer examitiation, 5 taley determines 40 units are defective and returns them to its supplief for full crecit on June 9. All remaining inventory is sold on account on June 16 for $33 each. Required: Record transactions for (a) the purchase of inventory on account, (b) the return of defective inventory, and (c) the sale of irventory on account using a perpetual system. (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet On June 5. Staley Electronics purchases 190 units of inventory on account fot $19 each. After closer examination, Staley determines 40 units are defective and returns them to lits supplier for full credit on June 9. All remaining inventory is sold on account on June 16 for $33 each. Required: Record transactions for (a) the purchase of inventory on account, (b) the return of defective inventory, and (c) the sale of inventory on account using a perpetual system. (If no entry is required for a transoction/event, select 'No Journol Entry Required" in the first occount field.) Journal entry worksheet

6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started