Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5 7 In 2 0 0 8 , Francine purchased a cottage in the country for $ 1 1 0 , 0 0 0 .

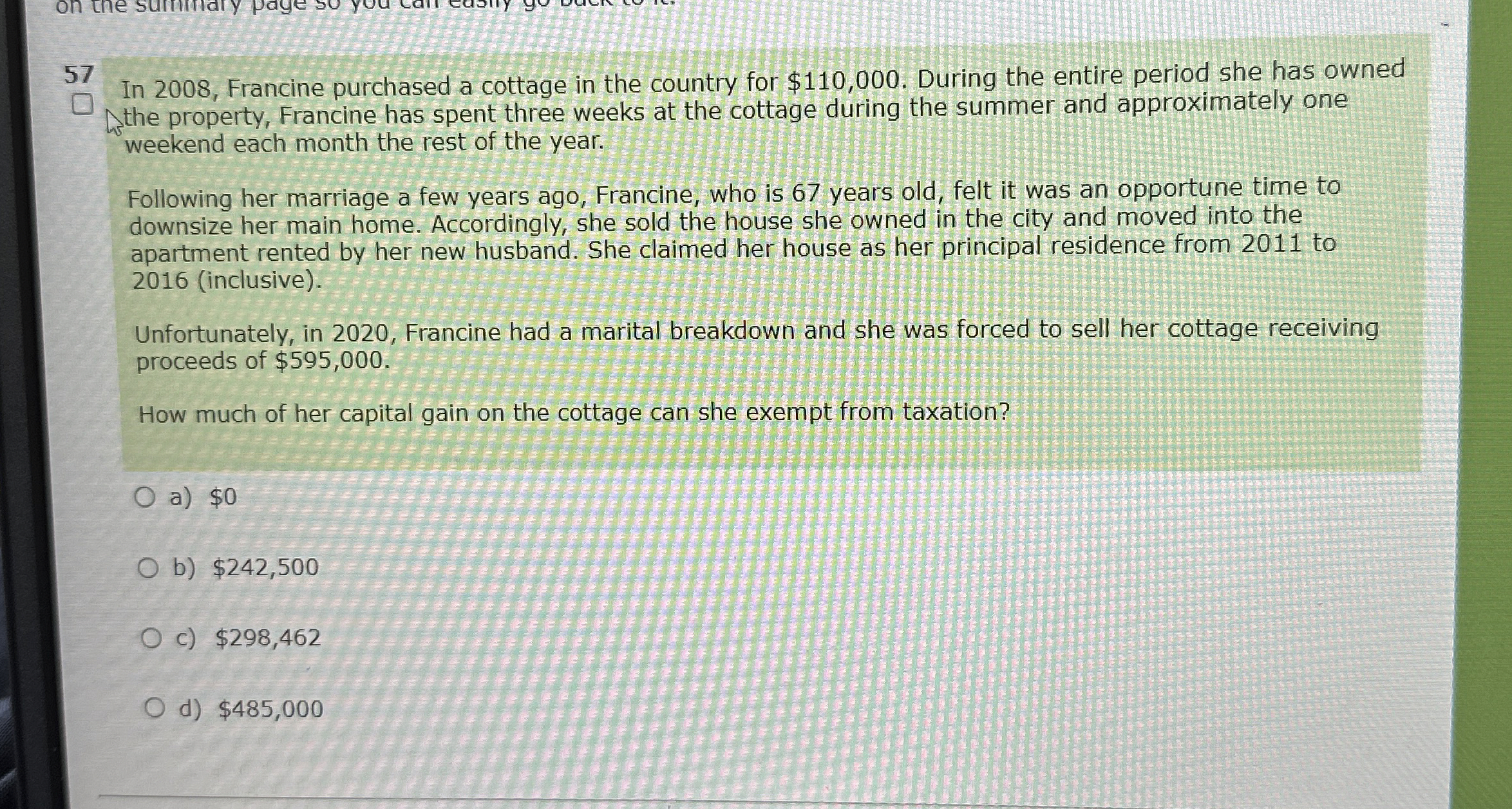

In Francine purchased a cottage in the country for $ During the entire period she has owned

the property, Francine has spent three weeks at the cottage during the summer and approximately one

weekend each month the rest of the year.

Following her marriage a few years ago, Francine, who is years old, felt it was an opportune time to

downsize her main home. Accordingly, she sold the house she owned in the city and moved into the

apartment rented by her new husband. She claimed her house as her principal residence from to

inclusive

Unfortunately, in Francine had a marital breakdown and she was forced to sell her cottage receiving

proceeds of $

How much of her capital gain on the cottage can she exempt from taxation?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started