Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. A B C Two different companies, Vogel Corporation and Hatcher Corporation, entered into the following inventory transactions during December. Both companies use a perpetual

5. A B C

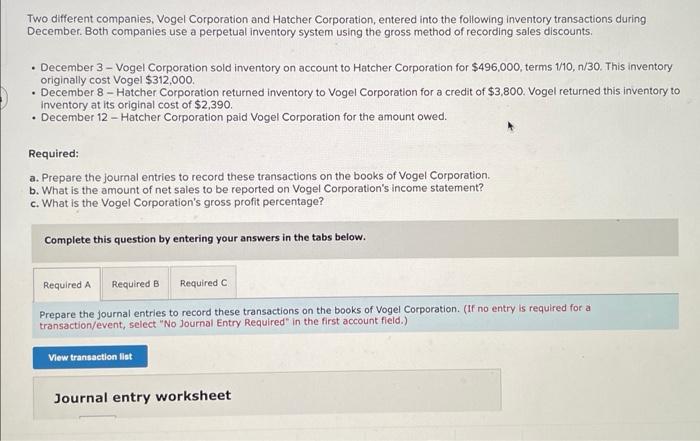

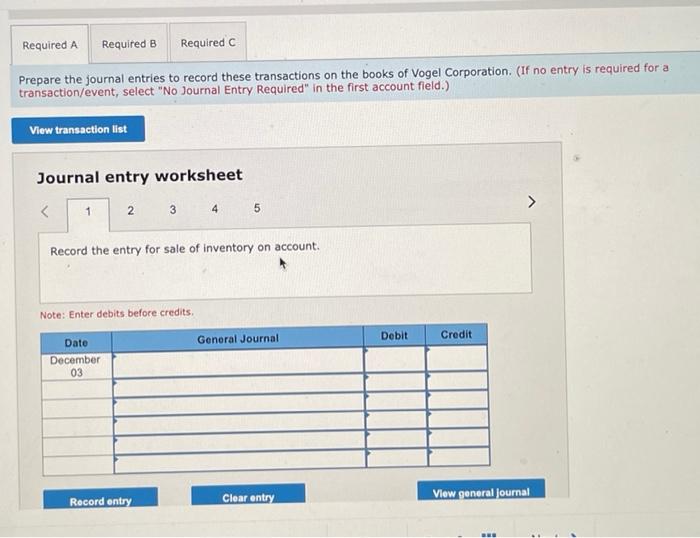

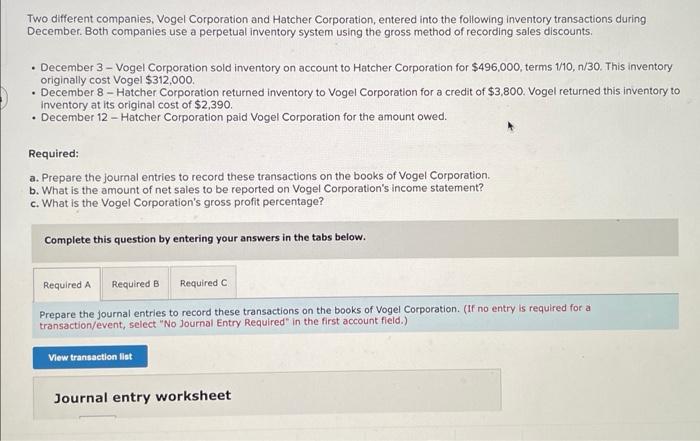

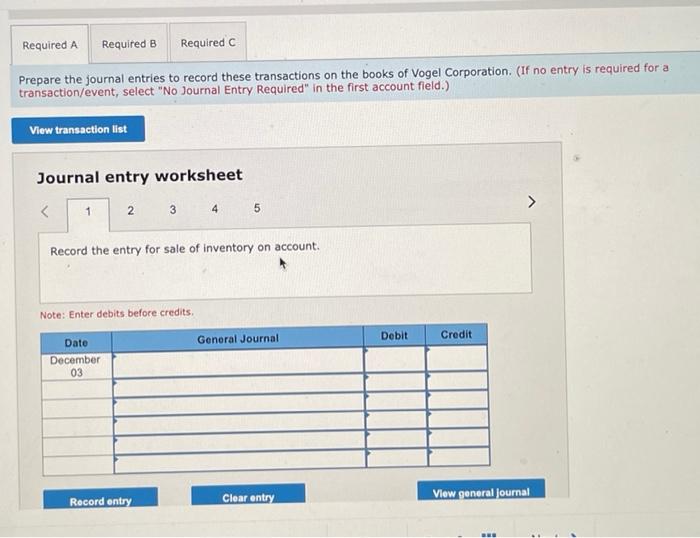

Two different companies, Vogel Corporation and Hatcher Corporation, entered into the following inventory transactions during December. Both companies use a perpetual inventory system using the gross method of recording sales discounts. - December 3 - Vogel Corporation sold inventory on account to Hatcher Corporation for $496,000, terms 1/10, n/30. This inventory originally cost Vogel $312,000 - December 8 - Hatcher Corporation returned inventory to Vogel Corporation for a credit of $3,800. Vogel returned this inventory to inventory at its original cost of $2,390. - December 12 - Hatcher Corporation paid Vogel Corporation for the amount owed. Required: a. Prepare the journal entries to record these transactions on the books of Vogel Corporation. b. What is the amount of net sales to be reported on Vogel Corporation's income statement? c. What is the Vogel Corporation's gross profit percentage? Complete this question by entering your answers in the tabs below. Prepare the journal entries to record these transactions on the books of Vogel Corporation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Prepare the journal entries to record these transactions on the books of Vogel Corporation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry for sale of inventory on account. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started