Answered step by step

Verified Expert Solution

Question

1 Approved Answer

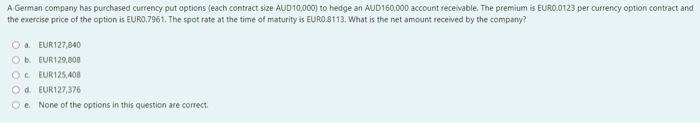

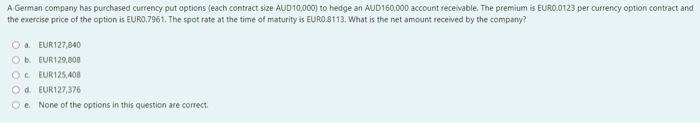

5 A German company has purchased currency put options (each contract size AUD 10,000) to hedge an AUD160,000 account receivable. The premium is EURO.0123 per

5

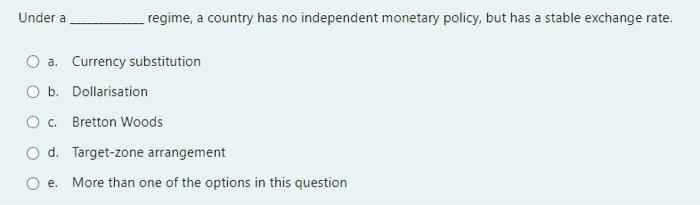

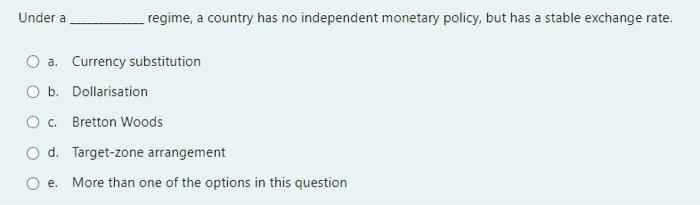

A German company has purchased currency put options (each contract size AUD 10,000) to hedge an AUD160,000 account receivable. The premium is EURO.0123 per currency option contract and the exercise price of the option is EURO.7961. The spot rate at the time of maturity is EURO.8113. What is the net amount received by the company? O a EUR 127.840 Ob EUR 129,000 OC EUR125 400 d. EUR127,376 e None of the options in this question are correct. Under a regime, a country has no independent monetary policy, but has a stable exchange rate. O a. Currency substitution O b. Dollarisation OC Bretton Woods O d. Target-zone arrangement Oe. More than one of the options in this

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started