Answered step by step

Verified Expert Solution

Question

1 Approved Answer

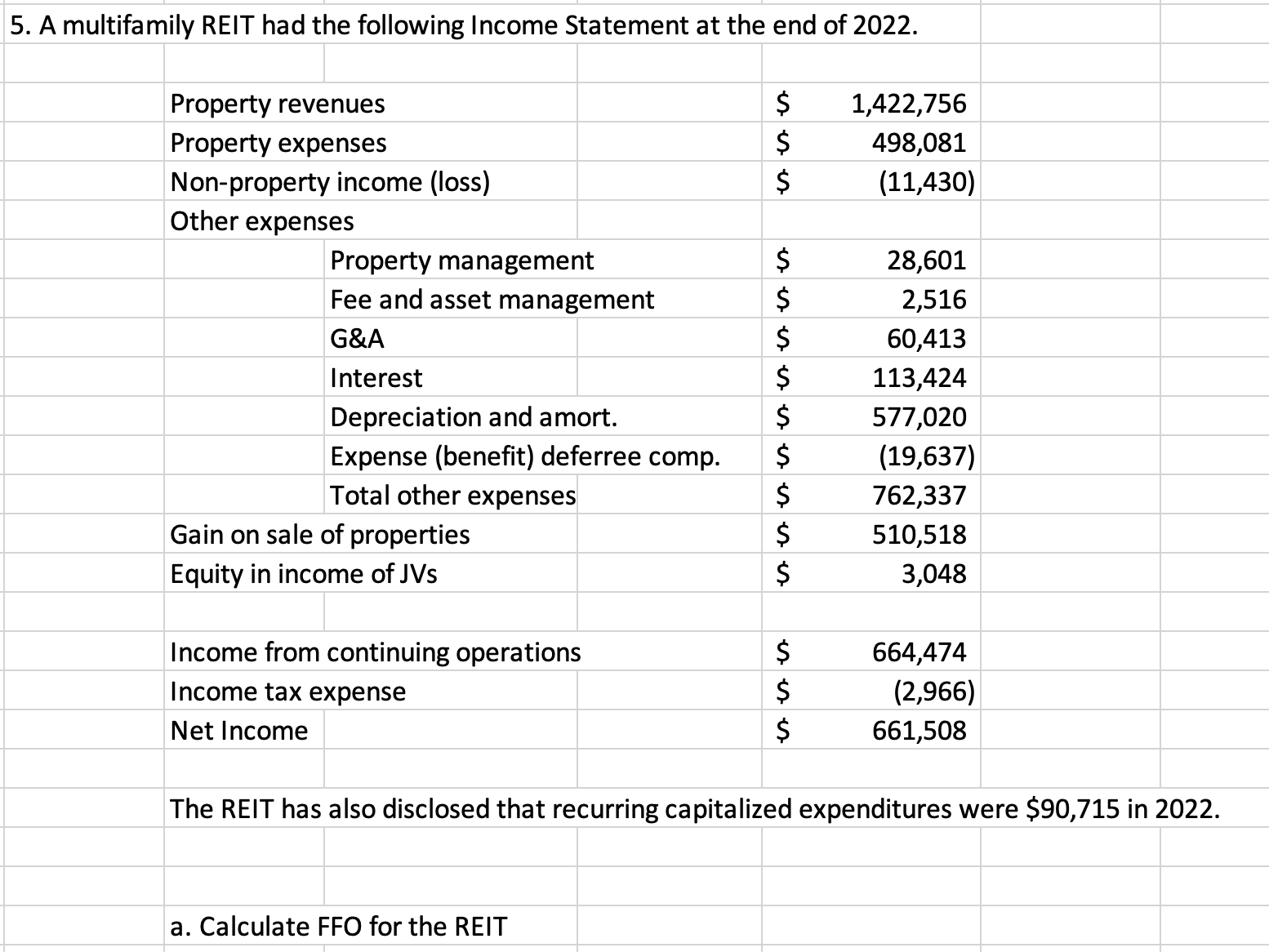

5. A multifamily REIT had the following Income Statement at the end of 2022. begin{tabular}{|l|rr|} hline Property revenues & $ & 1,422,756 hline Property

5. A multifamily REIT had the following Income Statement at the end of 2022. \begin{tabular}{|l|rr|} \hline Property revenues & $ & 1,422,756 \\ \hline Property expenses & $ & 498,081 \\ \hline Non-property income (loss) & $ & (11,430) \\ \hline Other expenses & & \\ \hline Property management & $ & 28,601 \\ \hline Fee and asset management & $ & 2,516 \\ \hline G\&A & $ & 60,413 \\ \hline Interest & $ & 113,424 \\ \hline Depreciation and amort. & $ & 577,020 \\ \hline Expense (benefit) deferree comp. & $ & (19,637) \\ \hline Total other expenses & $ & 762,337 \\ \hline Gain on sale of properties & $ & 510,518 \\ \hline Equity in income of JVs & $ & 3,048 \\ \hline \end{tabular} \begin{tabular}{|l|lr} \hline Income from continuing operations & $ & 664,474 \\ \hline Income tax expense & $ & (2,966) \\ \hline Net Income & $ & 661,508 \\ \hline \end{tabular} The REIT has also disclosed that recurring capitalized expenditures were $90,715 in 2022. a. Calculate FFO for the REIT c. Why do investors look at FFO rather than Net Income

5. A multifamily REIT had the following Income Statement at the end of 2022. \begin{tabular}{|l|rr|} \hline Property revenues & $ & 1,422,756 \\ \hline Property expenses & $ & 498,081 \\ \hline Non-property income (loss) & $ & (11,430) \\ \hline Other expenses & & \\ \hline Property management & $ & 28,601 \\ \hline Fee and asset management & $ & 2,516 \\ \hline G\&A & $ & 60,413 \\ \hline Interest & $ & 113,424 \\ \hline Depreciation and amort. & $ & 577,020 \\ \hline Expense (benefit) deferree comp. & $ & (19,637) \\ \hline Total other expenses & $ & 762,337 \\ \hline Gain on sale of properties & $ & 510,518 \\ \hline Equity in income of JVs & $ & 3,048 \\ \hline \end{tabular} \begin{tabular}{|l|lr} \hline Income from continuing operations & $ & 664,474 \\ \hline Income tax expense & $ & (2,966) \\ \hline Net Income & $ & 661,508 \\ \hline \end{tabular} The REIT has also disclosed that recurring capitalized expenditures were $90,715 in 2022. a. Calculate FFO for the REIT c. Why do investors look at FFO rather than Net Income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started