Answered step by step

Verified Expert Solution

Question

1 Approved Answer

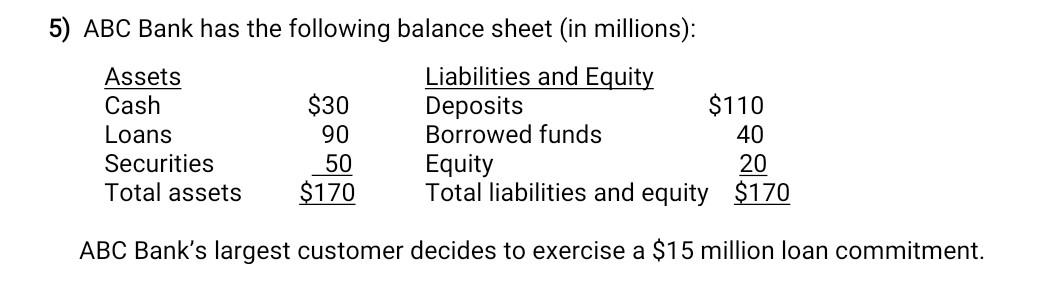

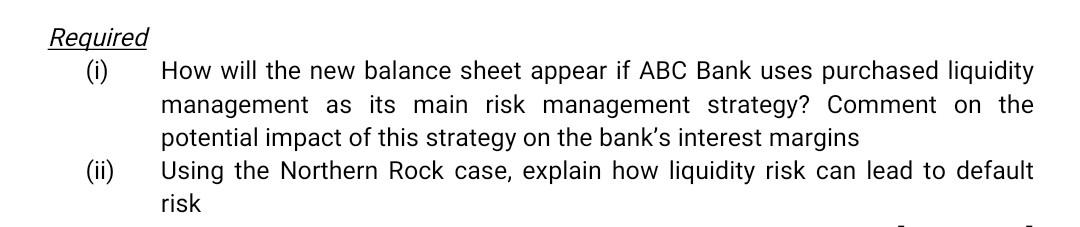

5) ABC Bank has the following balance sheet (in millions): Assets Liabilities and Equity Cash $30 Deposits $110 Loans 90 Borrowed funds 40 Securities 50

5) ABC Bank has the following balance sheet (in millions): Assets Liabilities and Equity Cash $30 Deposits $110 Loans 90 Borrowed funds 40 Securities 50 Equity 20 Total assets $170 Total liabilities and equity $170 ABC Bank's largest customer decides to exercise a $15 million loan commitment. Required (i) How will the new balance sheet appear if ABC Bank uses purchased liquidity management as its main risk management strategy? Comment on the potential impact of this strategy on the bank's interest margins (ii) Using the Northern Rock case, explain how liquidity risk can lead to default risk 5) ABC Bank has the following balance sheet (in millions): Assets Liabilities and Equity Cash $30 Deposits $110 Loans 90 Borrowed funds 40 Securities 50 Equity 20 Total assets $170 Total liabilities and equity $170 ABC Bank's largest customer decides to exercise a $15 million loan commitment. Required (i) How will the new balance sheet appear if ABC Bank uses purchased liquidity management as its main risk management strategy? Comment on the potential impact of this strategy on the bank's interest margins (ii) Using the Northern Rock case, explain how liquidity risk can lead to default risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started