Question

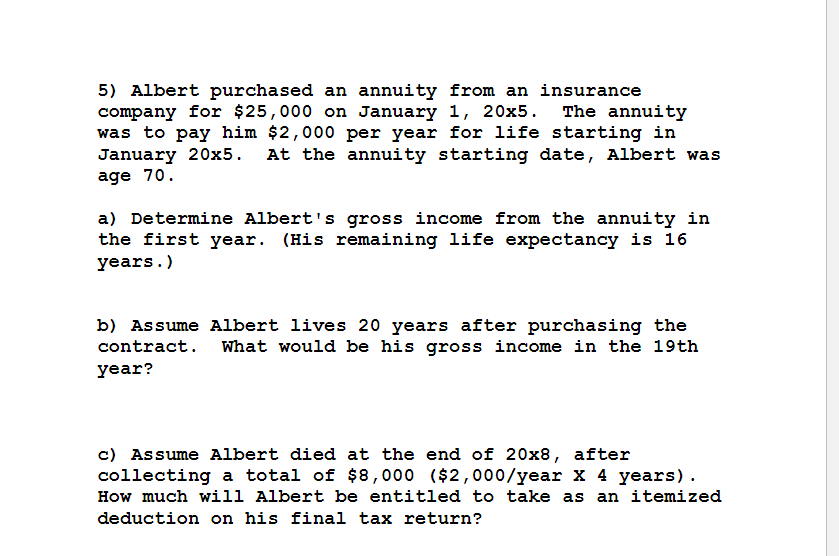

5) Albert purchased an annuity from an insurance company for $25,000 on January 1, 20x5. The annuity was to pay him $2,000 per year

5) Albert purchased an annuity from an insurance company for $25,000 on January 1, 20x5. The annuity was to pay him $2,000 per year for life starting in January 20x5. age 70. At the annuity starting date, Albert was a) Determine Albert's gross income from the annuity in the first year. (His remaining life expectancy is 16 years.) b) Assume Albert lives 20 years after purchasing the contract. What would be his gross income in the 19th year? c) Assume Albert died at the end of 20x8, after collecting a total of $8,000 ($2,000/year X 4 years). How much will Albert be entitled to take as an itemized deduction on his final tax return?

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To determine Alberts gross income from the annuity in the first year we need to calculate the taxa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Finance Act 2020

Authors: Alan Melville

26th Edition

1292360712, 978-1292360713

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App