Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. An investment firm has just been instructed by one of its clients to invest $1,500,000 of his money. The client's goal is to

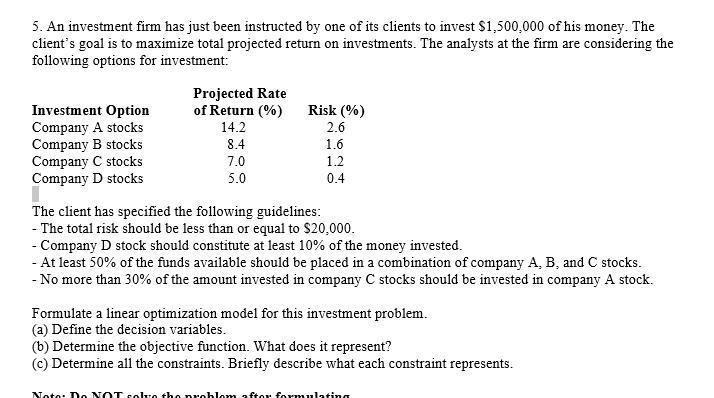

5. An investment firm has just been instructed by one of its clients to invest $1,500,000 of his money. The client's goal is to maximize total projected return on investments. The analysts at the firm are considering the following options for investment: Investment Option Company A stocks Company B stocks Company C stocks Company D stocks Projected Rate of Return (%) 14.2 8.4 7.0 5.0 Risk (%) 2.6 1.6 1.2 0.4 The client has specified the following guidelines: - The total risk should be less than or equal to $20,000. - Company D stock should constitute at least 10% of the money invested. At least 50% of the funds available should be placed in a combination of company A, B, and C stocks. - No more than 30% of the amount invested in company C stocks should be invested in company A stock. Formulate a linear optimization model for this investment problem. (a) Define the decision variables. (b) Determine the objective function. What does it represent? (c) Determine all the constraints. Briefly describe what each constraint represents. Note: Do NOT solve the problem aftor formulating

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started