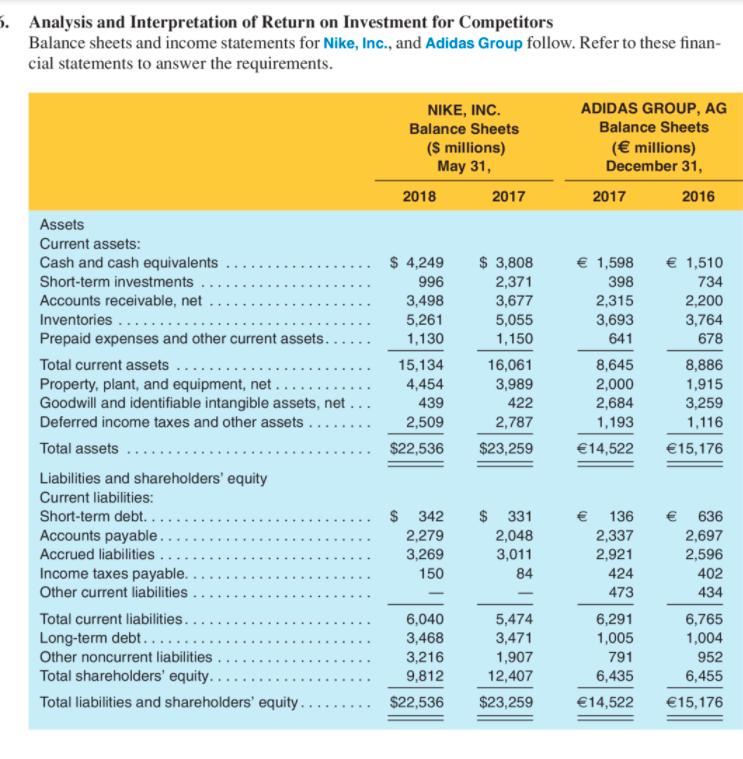

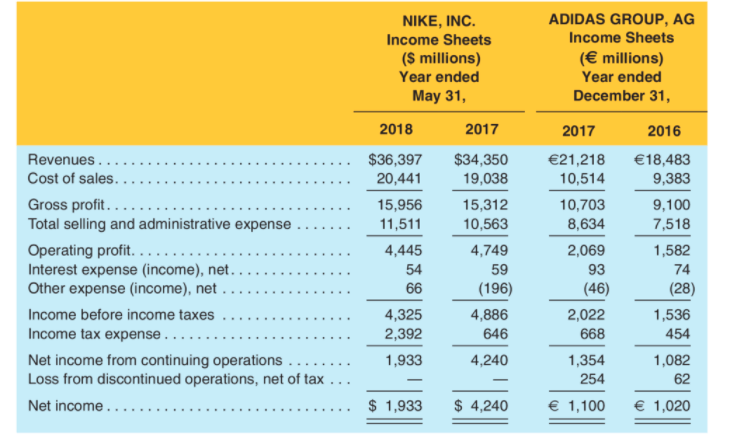

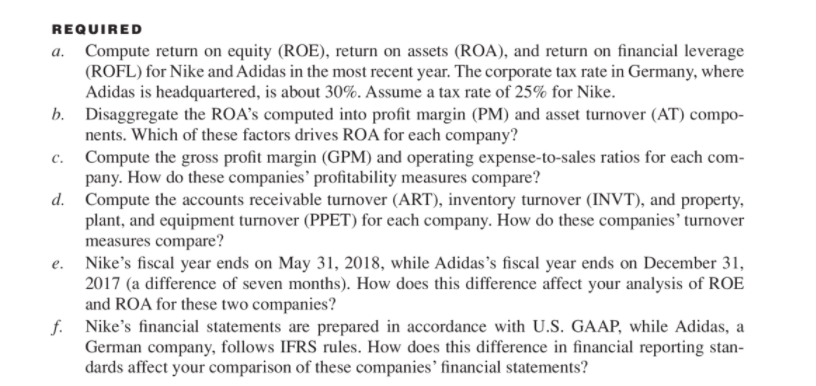

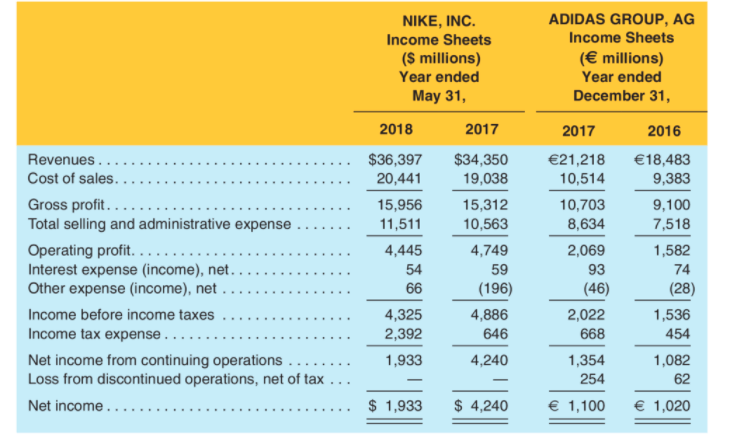

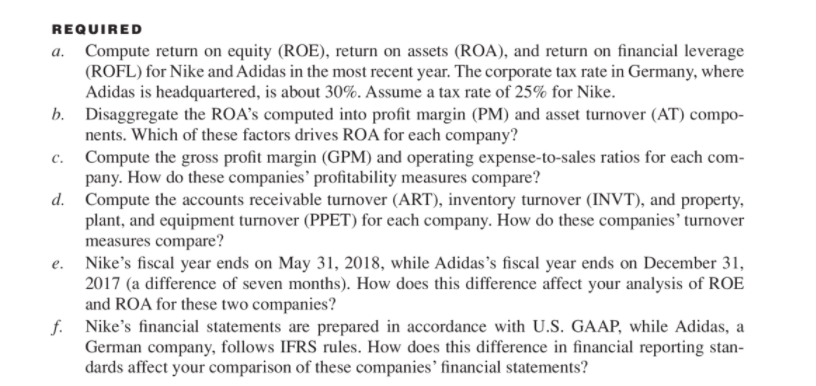

5. Analysis and Interpretation of Return on Investment for Competitors Balance sheets and income statements for Nike, Inc., and Adidas Group follow. Refer to these finan- cial statements to answer the requirements. NIKE, INC. Balance Sheets ($ millions) May 31, 2018 2017 ADIDAS GROUP, AG Balance Sheets ( millions) December 31, 2017 2016 $ 4,249 996 3,498 5,261 1,130 15,134 4,454 439 2,509 $22,536 $ 3,808 2,371 3,677 5,055 1,150 16,061 3,989 422 2,787 $23,259 1,598 398 2,315 3,693 641 8,645 2,000 2,684 1,193 14,522 1,510 734 2,200 3,764 678 8,886 1,915 3,259 1,116 15,176 Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories .. Prepaid expenses and other current assets. Total current assets ... Property, plant, and equipment, net. Goodwill and identifiable intangible assets, net... Deferred income taxes and other assets. Total assets Liabilities and shareholders' equity Current liabilities: Short-term debt... Accounts payable.. Accrued liabilities .. Income taxes payable. Other current liabilities Total current liabilities.. Long-term debt.... Other noncurrent liabilities. Total shareholders' equity.. Total liabilities and shareholders' equity.. $ 342 2,279 3,269 150 $ 331 2,048 3,011 84 136 2,337 2,921 424 473 6,291 1,005 791 6,435 14,522 636 2,697 2,596 402 434 6,765 1,004 952 6,455 15,176 6,040 3,468 3,216 9,812 $22,536 5,474 3,471 1,907 12,407 $23,259 NIKE, INC. Income Sheets (5 millions) Year ended May 31, ADIDAS GROUP, AG Income Sheets ( millions) Year ended December 31, 2018 2017 2017 2016 Revenues.. Cost of sales. Gross profit..... Total selling and administrative expense Operating profit. ..... Interest expense (income), net.. Other expense (income), net. Income before income taxes Income tax expense Net income from continuing operations .. Loss from discontinued operations, net of tax ... Net income.. $36,397 20,441 15,956 11,511 4,445 54 66 4,325 2,392 1,933 $34,350 19,038 15,312 10,563 4,749 59 (196) 4,886 646 4,240 21,218 10,514 10,703 8,634 2,069 93 (46) 2,022 668 1,354 254 1,100 18,483 9,383 9,100 7,518 1,582 74 (28) 1,536 454 1,082 62 $ 1,933 $ 4,240 1,020 C. REQUIRED a. Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for Nike and Adidas in the most recent year. The corporate tax rate in Germany, where Adidas is headquartered, is about 30%. Assume a tax rate of 25% for Nike. b. Disaggregate the ROA's computed into profit margin (PM) and asset turnover (AT) compo- nents. Which of these factors drives ROA for each company? Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each com- pany. How do these companies' profitability measures compare? d. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant, and equipment turnover (PPET) for each company. How do these companies' turnover measures compare? e. Nike's fiscal year ends on May 31, 2018, while Adidas's fiscal year ends on December 31, 2017 (a difference of seven months). How does this difference affect your analysis of ROE and ROA for these two companies? f. Nike's financial statements are prepared in accordance with U.S. GAAP, while Adidas, a German company, follows IFRS rules. How does this difference in financial reporting stan- dards affect your comparison of these companies' financial statements? 5. Analysis and Interpretation of Return on Investment for Competitors Balance sheets and income statements for Nike, Inc., and Adidas Group follow. Refer to these finan- cial statements to answer the requirements. NIKE, INC. Balance Sheets ($ millions) May 31, 2018 2017 ADIDAS GROUP, AG Balance Sheets ( millions) December 31, 2017 2016 $ 4,249 996 3,498 5,261 1,130 15,134 4,454 439 2,509 $22,536 $ 3,808 2,371 3,677 5,055 1,150 16,061 3,989 422 2,787 $23,259 1,598 398 2,315 3,693 641 8,645 2,000 2,684 1,193 14,522 1,510 734 2,200 3,764 678 8,886 1,915 3,259 1,116 15,176 Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories .. Prepaid expenses and other current assets. Total current assets ... Property, plant, and equipment, net. Goodwill and identifiable intangible assets, net... Deferred income taxes and other assets. Total assets Liabilities and shareholders' equity Current liabilities: Short-term debt... Accounts payable.. Accrued liabilities .. Income taxes payable. Other current liabilities Total current liabilities.. Long-term debt.... Other noncurrent liabilities. Total shareholders' equity.. Total liabilities and shareholders' equity.. $ 342 2,279 3,269 150 $ 331 2,048 3,011 84 136 2,337 2,921 424 473 6,291 1,005 791 6,435 14,522 636 2,697 2,596 402 434 6,765 1,004 952 6,455 15,176 6,040 3,468 3,216 9,812 $22,536 5,474 3,471 1,907 12,407 $23,259 NIKE, INC. Income Sheets (5 millions) Year ended May 31, ADIDAS GROUP, AG Income Sheets ( millions) Year ended December 31, 2018 2017 2017 2016 Revenues.. Cost of sales. Gross profit..... Total selling and administrative expense Operating profit. ..... Interest expense (income), net.. Other expense (income), net. Income before income taxes Income tax expense Net income from continuing operations .. Loss from discontinued operations, net of tax ... Net income.. $36,397 20,441 15,956 11,511 4,445 54 66 4,325 2,392 1,933 $34,350 19,038 15,312 10,563 4,749 59 (196) 4,886 646 4,240 21,218 10,514 10,703 8,634 2,069 93 (46) 2,022 668 1,354 254 1,100 18,483 9,383 9,100 7,518 1,582 74 (28) 1,536 454 1,082 62 $ 1,933 $ 4,240 1,020 C. REQUIRED a. Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for Nike and Adidas in the most recent year. The corporate tax rate in Germany, where Adidas is headquartered, is about 30%. Assume a tax rate of 25% for Nike. b. Disaggregate the ROA's computed into profit margin (PM) and asset turnover (AT) compo- nents. Which of these factors drives ROA for each company? Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each com- pany. How do these companies' profitability measures compare? d. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant, and equipment turnover (PPET) for each company. How do these companies' turnover measures compare? e. Nike's fiscal year ends on May 31, 2018, while Adidas's fiscal year ends on December 31, 2017 (a difference of seven months). How does this difference affect your analysis of ROE and ROA for these two companies? f. Nike's financial statements are prepared in accordance with U.S. GAAP, while Adidas, a German company, follows IFRS rules. How does this difference in financial reporting stan- dards affect your comparison of these companies' financial statements