Answered step by step

Verified Expert Solution

Question

1 Approved Answer

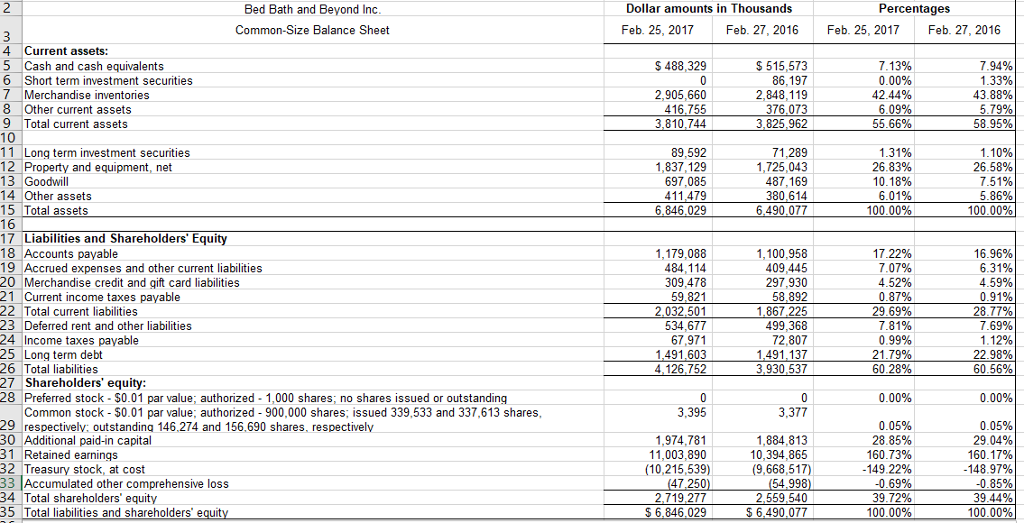

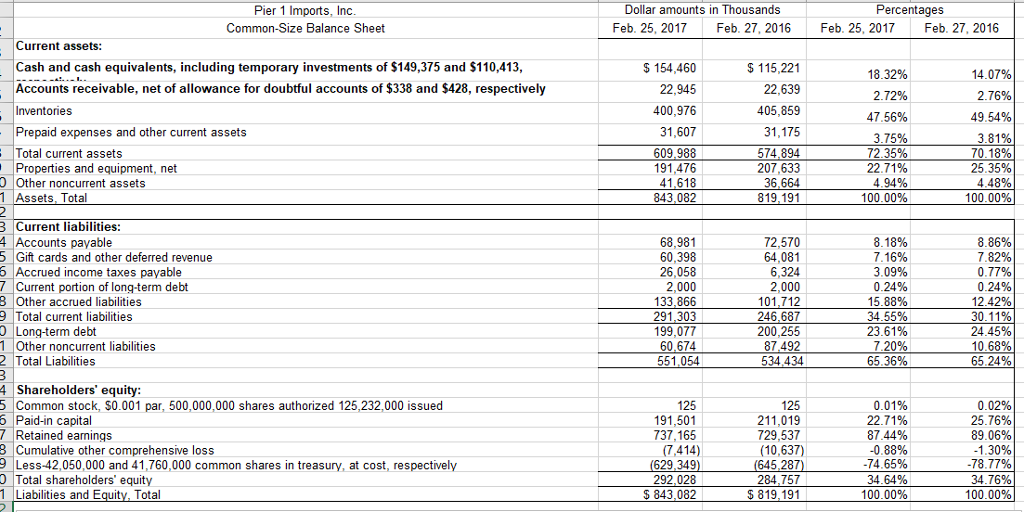

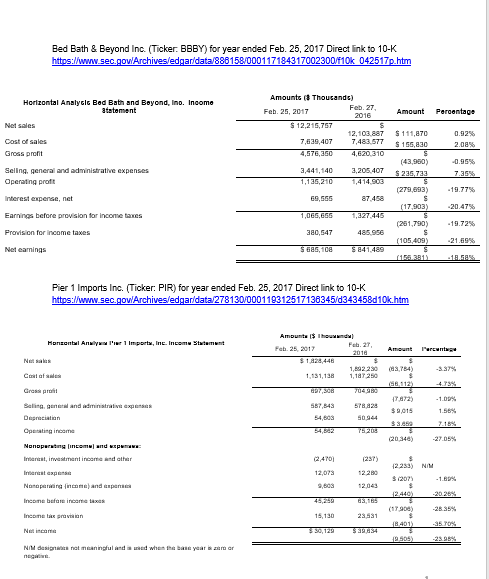

5. Analyze the net fixed assets (PPE-Property, Plant, and Equipment) and answer the following questions: a. Look at both companies financial statements in respect to

5. Analyze the net fixed assets (PPE-Property, Plant, and Equipment) and answer the following questions:

a. Look at both companies financial statements in respect to Property Plant or equipment or fixed assets owned by the corporation. Are net fixed assets significant for the companies? What percentage of total assets is held as fixed assets for the current year? You can use the vertical analysis you developed in Part 2 to identify this percentage. What financial statement did you look at to find the fixed assets?

Dollar amounts in Thousands Bed Bath and Beyond Inc Common-Size Balance Sheet Percentages Feb. 25, 2017Feb. 27, 2016Feb. 25, 2017Feb. 27, 2016 4 Current assets: 5 Cash and cash equivalents 6 Short term investment securities 7 Merchandise inventories 8 Other current assets 9 Total current assets S 515,573 S488,329 2,905,660 416,755 0.00% 42.44% 60996 2,848,119 376.073 43.88% 57996 3,810,744 11 Long term investment securities 12 Property and equipment, net 13 Goodwill 14 Other assets 15 Total assets 89,592 1,837,129 697,085 411,479 029 1,725,043 487,169 380,614 26.58% 7.51% 58696 100.00% 26. 83% 10.18% 100.00% 17 Liabilities and Shareholders' Equity 18 Accounts payable 19 Accrued expenses and other current liabilities 20 Merchandise credit and gift card liabilities 21 Current income taxes payable 22 Total current liabilities 23 Deferred rent and other liabilities 24 Income taxes payable 25 Long term debt 26 Total liabilities 27 Shareholders' equity: 28 Preferred stock-$0.01 par value; authorized 1,000 shares; no shares issued or outstanding 16.96% 6.31% 4.59% 0.91% 28 77% 7.69% 1,179,088 84,114 309.478 1,100,958 09,445 297,930 17.22% 7.07% 4.52% 534,677 67,971 1.491.603 4,126,752 1,867.225 499,368 72,807 1491.137 29 69% 7.81% 0 9996 21.79% 22.98% 60 56% 0.00% Common stock- $0.01 par value; authorized 900,000 shares; issued 339,533 and 337,613 shares 29 respectively: outstanding 146,274 and 156,690 shares, respectively 30 Additional paid-in capital 31 Retained earnings 32 Treasury stock, at cost 33 Accumulated other comprehensive loss 34 Total shareholders' equity 35 Total liabilities and shareholders e 3,395 1,974,781 11,003,890 (10,215,539) 1,884,813 10,394,865 (9,668,517) 54.998 0.05% 28.85% 160.73% 149 22% 0.69% 0.05% 29 04% 160.17% 148.97% -0.85% 2,719,277 $6,846,029 100.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started