Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Assume a rate of interest of 10%. We have a debt to pay and are given a choice of paying 1,000 now or some

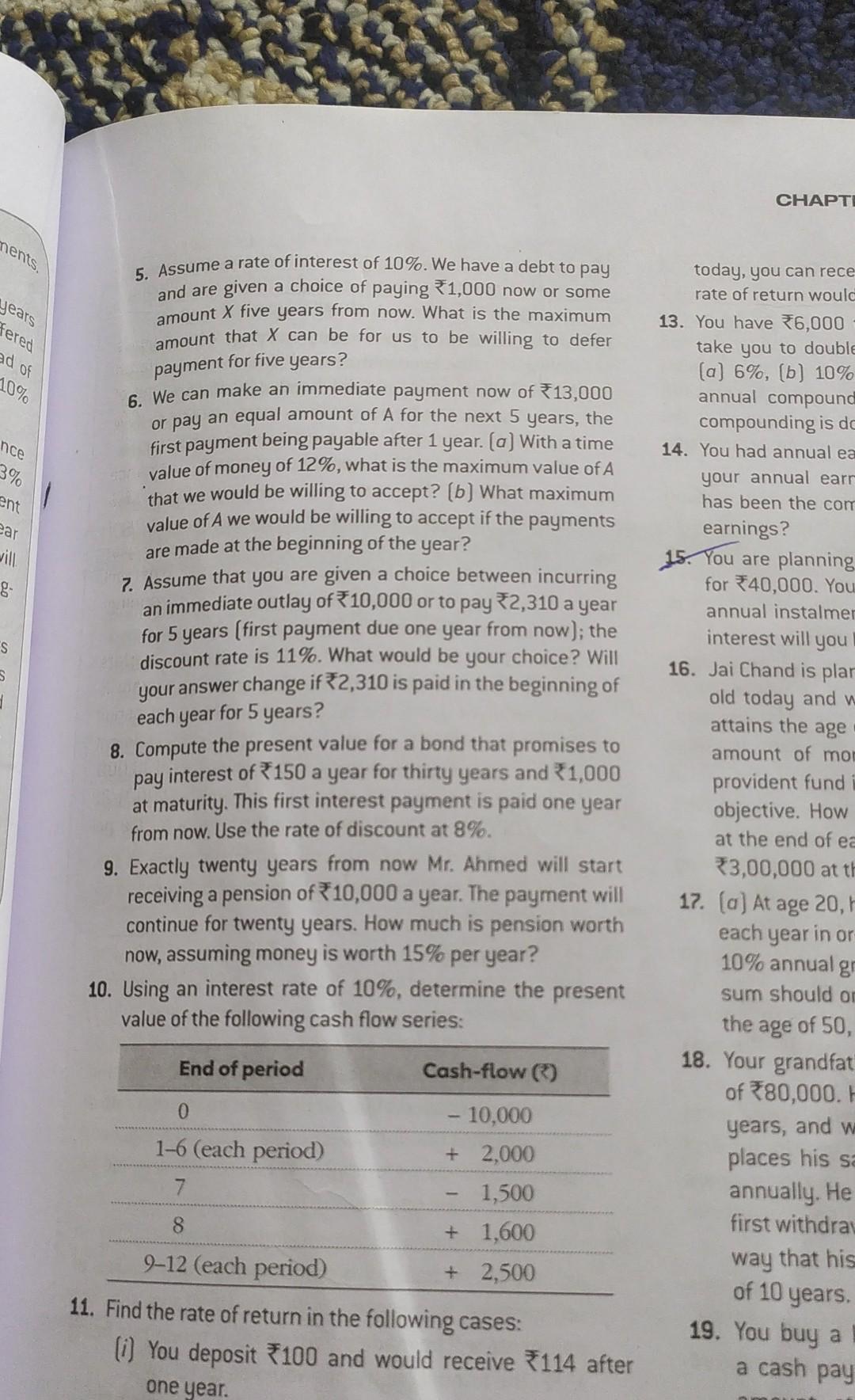

5. Assume a rate of interest of 10%. We have a debt to pay and are given a choice of paying 1,000 now or some amount X five years from now. What is the maximum amount that X can be for us to be willing to defer payment for five years? 6. We can make an immediate payment now of 13,000 or pay an equal amount of A for the next 5 years, the first payment being payable after 1 year. [a] With a time value of money of 12%, what is the maximum value of A that we would be willing to accept? [b] What maximum value of A we would be willing to accept if the payments are made at the beginning of the year? 7. Assume that you are given a choice between incurring an immediate outlay of 10,000 or to pay 2,310 a year for 5 years (first payment due one year from now); the discount rate is 11%. What would be your choice? Will your answer change if 2,310 is paid in the beginning of each year for 5 years? 8. Compute the present value for a bond that promises to pay interest of 150 a year for thirty years and 1,000 at maturity. This first interest payment is paid one year from now. Use the rate of discount at 8%. 9. Exactly twenty years from now Mr. Ahmed will start receiving a pension of 10,000 a year. The payment will continue for twenty years. How much is pension worth now, assuming money is worth 15% per year? 10. Using an interest rate of 10%, determine the present value of the following cash flow series: 11. Find the rate of return in the following cases: (i) You deposit 100 and would receive 114 after one year. today, you can rece rate of return woulc 13. You have 6,000 take you to double [a] 6%,(b]10% annual compound compounding is de 14. You had annual ea your annual earr has been the com earnings? 15. You are planning for 40,000. You annual instalme interest will you 16. Jai Chand is plar old today and attains the age amount of mo provident fund objective. How at the end of e 3,00,000 at tt 17. [a] At age 20,t each year in or 10% annual gr sum should oi the age of 50 , 18. Your grandfat of 80,000. years, and places his 5 annually. He first withdra way that his of 10 years. 19. You buy a a cash pay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started