Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Assume that a firm can invest an initial outlay of $100,000 in a 10-year project that yields EBITDA of $22,000 per year. The

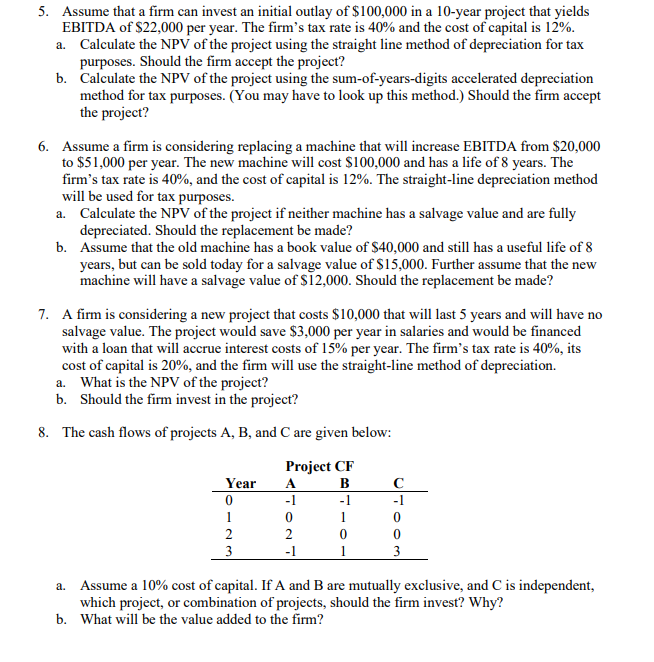

5. Assume that a firm can invest an initial outlay of $100,000 in a 10-year project that yields EBITDA of $22,000 per year. The firm's tax rate is 40% and the cost of capital is 12%. a. Calculate the NPV of the project using the straight line method of depreciation for tax purposes. Should the firm accept the project? b. Calculate the NPV of the project using the sum-of-years-digits accelerated depreciation method for tax purposes. (You may have to look up this method.) Should the firm accept the project? 6. Assume a firm is considering replacing a machine that will increase EBITDA from $20,000 to $51,000 per year. The new machine will cost $100,000 and has a life of 8 years. The firm's tax rate is 40%, and the cost of capital is 12%. The straight-line depreciation method will be used for tax purposes. a. Calculate the NPV of the project if neither machine has a salvage value and are fully depreciated. Should the replacement be made? b. Assume that the old machine has a book value of $40,000 and still has a useful life of 8 years, but can be sold today for a salvage value of $15,000. Further assume that the new machine will have a salvage value of $12,000. Should the replacement be made? 7. A firm is considering a new project that costs $10,000 that will last 5 years and will have no salvage value. The project would save $3,000 per year in salaries and would be financed with a loan that will accrue interest costs of 15% per year. The firm's tax rate is 40%, its cost of capital is 20%, and the firm will use the straight-line method of depreciation. a. What is the NPV of the project? b. Should the firm invest in the project? 8. The cash flows of projects A, B, and C are given below: Year Project CF A B C 0 -1 -1 -1 1 0 1 2 2 0 0 3 -1 1 3 a. Assume a 10% cost of capital. If A and B are mutually exclusive, and C is independent, which project, or combination of projects, should the firm invest? Why? b. What will be the value added to the firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started