Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. At June 30, 2016, before any adjustments for errors and other year-end adjusting entries, a company's allowance for bad debts was a credit

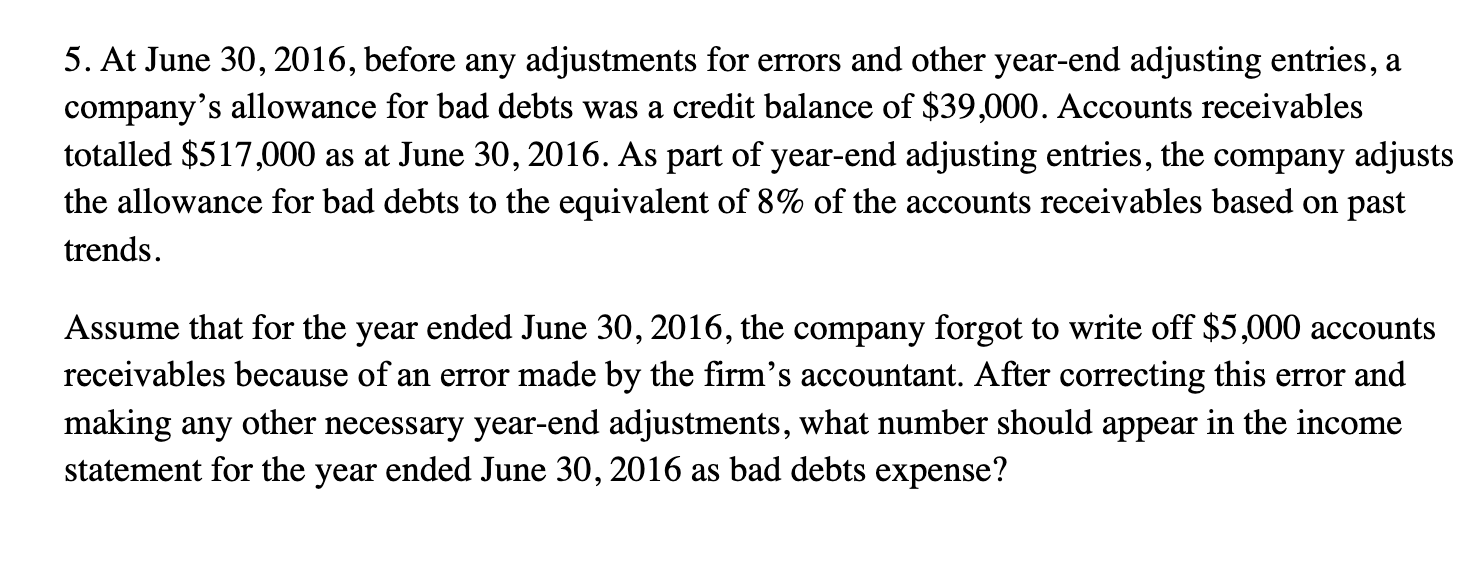

5. At June 30, 2016, before any adjustments for errors and other year-end adjusting entries, a company's allowance for bad debts was a credit balance of $39,000. Accounts receivables totalled $517,000 as at June 30, 2016. As part of year-end adjusting entries, the company adjusts the allowance for bad debts to the equivalent of 8% of the accounts receivables based on past trends. Assume that for the year ended June 30, 2016, the company forgot to write off $5,000 accounts receivables because of an error made by the firm's accountant. After correcting this error and making any other necessary year-end adjustments, what number should appear in the income statement for the year ended June 30, 2016 as bad debts expense?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the bad debts expense that should appear in the income statement for the year ended Jun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e6649a4e31_956938.pdf

180 KBs PDF File

663e6649a4e31_956938.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started