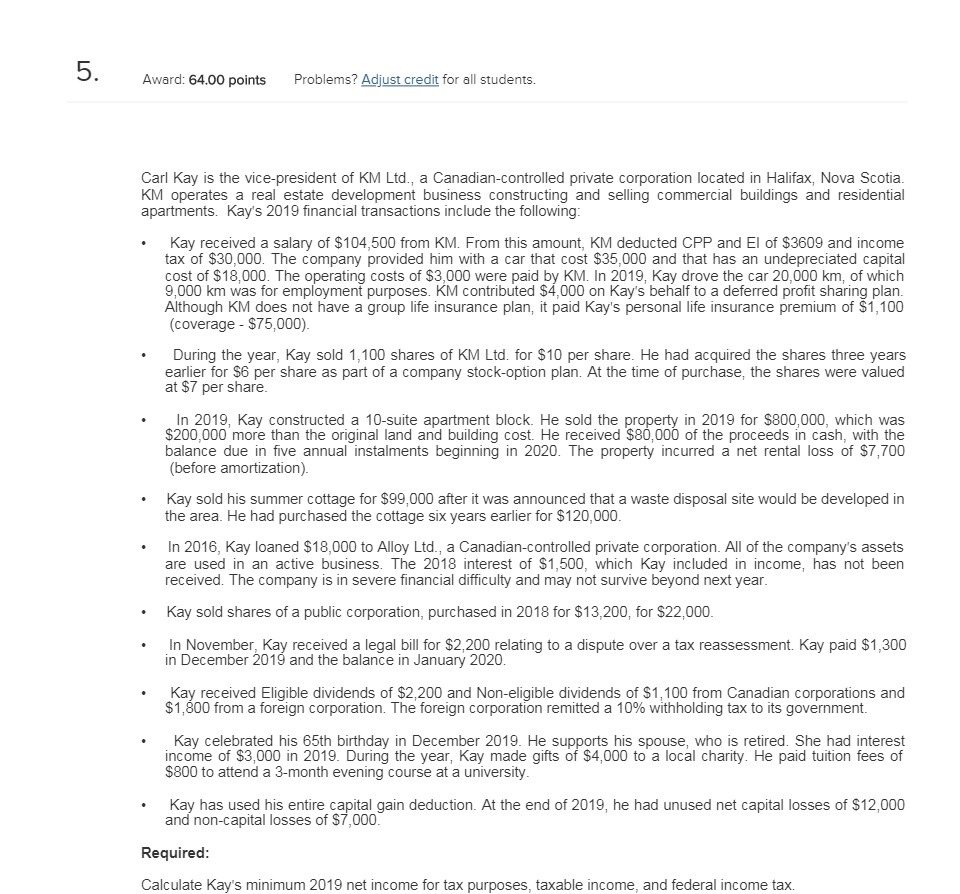

5 - Award: 64.00 polnts Problems? Ellust credit for all students. Carl Kay is the vicepresident of KM Ltd, a Canadiancontrolled private corporation located in Halifax, Nova Scotia. KM operates a real estate development business constructing and selling commercial buildings and residential apartments. Kay's 2019 nancial transactions include the following: Kay received a salary of $104,500 from KM. From this amount, KM deducted CF? and El of $3609 and income tax of $30,000. The company provided him with a car that cost $35,000 and that has an undepreciated capital cost of $13,000. The operating costs of $3,000 were paid by KM. In 2010, Kay drove the car 20,000 km, of which 9,000 km was for employment purposes. KM contributed $4,000 on Kay's behalf to a deferred prot sharing plan. Although KM does not have a group life insurance plan, it paid Kay's personal life insurance premium of $1,100 (coverage $75,000). During the year, Kay sold 1,100 shares of KM Ltd. for $10 per share. He had acquired the shares three years earlier for $6 per share as part of a company stock-option plan. At the time of purchase, the shares were valued at $i' per share. in 2010, Kay constructed a 10-suite apartment block. He sold the property in 2010 for $800,000, which was $200,000 more than the original land and building cost. He received $80,000 of the proceeds in cash, with the balance due in ve annual instalments beginning in 2020. The property incurred a net rental loss of $?,700 (before amortization). Kay sold his summer cottage for $99,000 aer it was announced that a waste disposal site would be developed in the area. He had purchased the cottage six years eariier for $120,000. In 2016, Kay loaned $18,000 to Alon Ltd., a Canadian-controlled private corporation. All of the company's assets are used in an active business. The 2018 interest of $1,500, which Kay included in income, has not been received. The company is in severe nancial difculty and may not survive beyond next year. Kay sold shares of a public corporation, purchased in 2013 for $13,200, for $22,000. In November, Kay received a legal bill for $2,200 relating to a dispute over a tax reassessment. Kay paid $1,300 in December 2019 and the balance in January 2020. Kay received Eligible dividends of $2,200 and Noneligible dividends of $1,100 from Canadian corporations and $1 ,800 from a foreign corporation. The foreign corporation remitted a 10% withholding tax to its government. Kay celebrated his 65th birthday in December 2019. He supports his spouse, who is retired. She had interest income of $3,000 in 2019. During the year, Kay made gis of $4,000 to a local charity. He paid tuition fees of $800 to attend a 3-month evening course at a university. Kay has used his entire capital gain deduction. At the end of 2019, he had unused net capital losses of $12,000 and non-capital losses of $7,000. Required: Calculate Kay's minimum 2019 net income for tax purposes, taxable income, and federal income tax