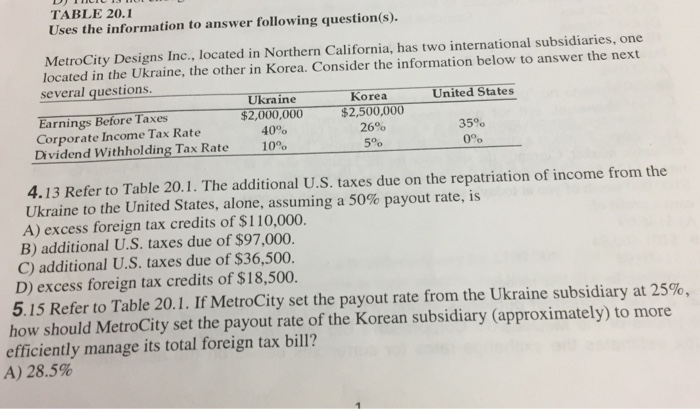

Question: #5 B) 24.5 C) 42.6 D) 82.3 Uses the information to answer following question(s). MetroCity Designs Inc., located in Northern California, has two international subsidiaries,

Uses the information to answer following question(s). MetroCity Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions. Refer to Table 20.1. The additional U.S. taxes due on the repatriation of income from the Ukraine to the United States, alone, assuming a 50% payout rate, is excess foreign tax credits of $ 110, 000. additional U.S. taxes due of $97, 000. additional U.S. taxes due of $36, 500. excess foreign tax credits of $18, 500. Refer to Table 20.1. If MetroCity set the payout rate from the Ukraine subsidiary at 25%, how should MetroCity set the payout rate of the Korean subsidiary (approximately) to more efficiently manage its total foreign tax bill? 28.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts