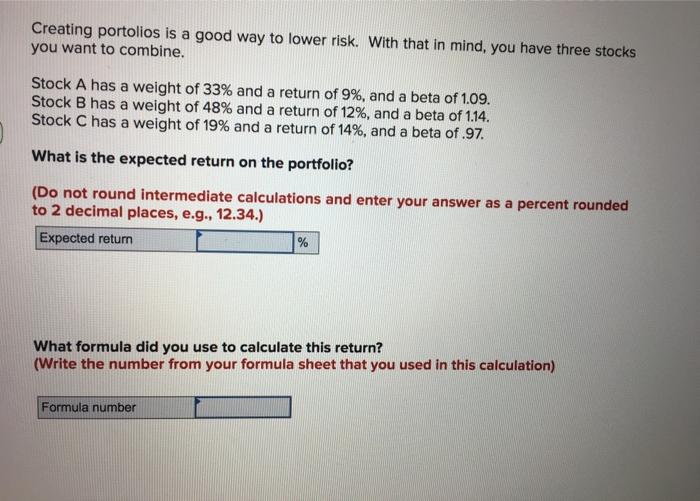

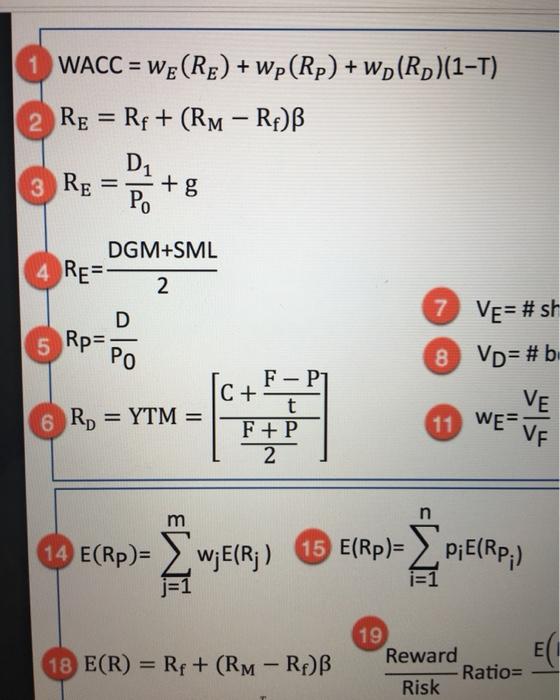

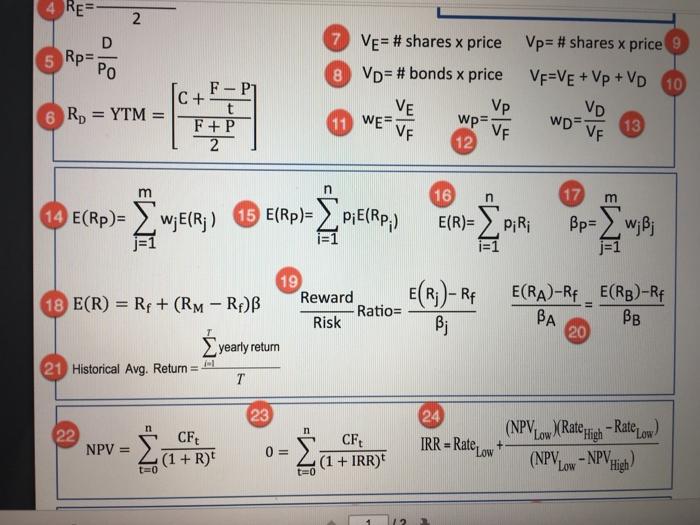

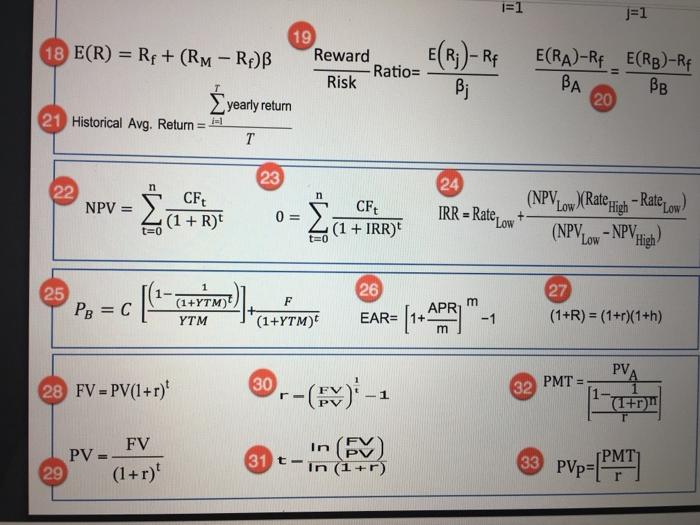

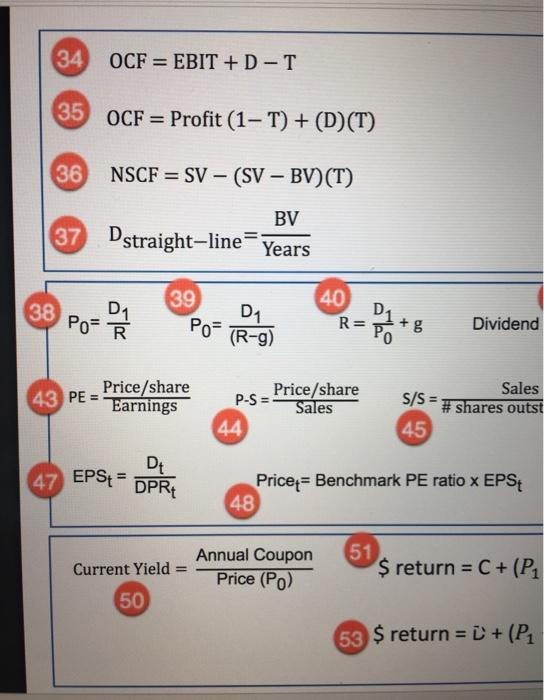

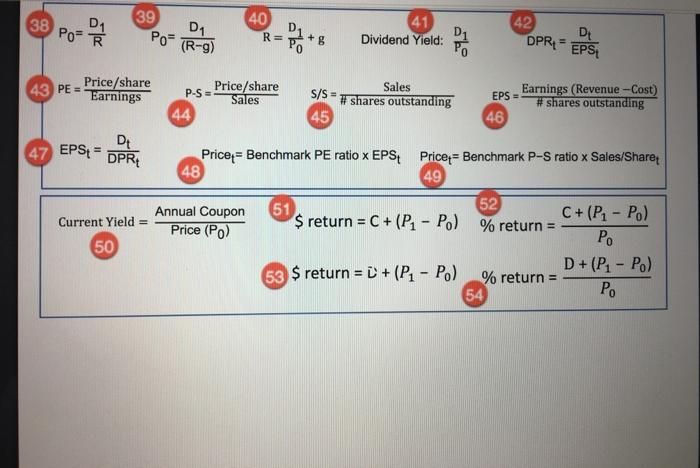

Creating portolios is a good way to lower risk. With that in mind, you have three stocks you want to combine. Stock A has a weight of 33% and a return of 9%, and a beta of 1.09. Stock B has a weight of 48% and a return of 12%, and a beta of 1.14. Stock C has a weight of 19% and a return of 14%, and a beta of.97. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) Expected return % What formula did you use to calculate this return? (Write the number from your formula sheet that you used in this calculation) Formula number 1 WACC = we(Re) + wp(Rp) + wp(RD)(1-T) 2 Re = Rp + (RM Rp) B D1 3 RE + g P. = Po DGM+SML 4 RE: 2 7 Ve= #sh 8 Vp=#b 5 D 5 Rp= VE 6 R, = YTM = F-P1 C + t F+P 2 11 WE= VF m 14 E(Rp)= w;(R;) E(Rp)= XP;E(RP;) j=1 18 E(R) = Rp + (RM-RPB 19 Reward Ratio= Risk RE 2 D 5 Rp= 7 Ve= # shares x price Vp=#shares x price 9 8 Vo= # bonds x price VF=VE + Vp +VD 10 Vp VD Wps WD- 13 VF VE 12 F-P1 C + F+P 2 6 RD = YTM VE 1 WEF VF - -- m n n 17 m 14 E(Rp)= WE(R;) 15 E(Rp)= 16 E(R)= P;R; i=1 Bp= I wii j=1 e(Ri)- RF Bj E(RA)-RF_E(RB)-RF BB 19 18 E(R) = Rp + (RM-RPB Reward -Ratio= Risk yearly return 21 Historical Avg. Return = T BA 20 23 24 22 (NPVLow Rate ligh Rate.ow) CF NPV = IRR = Rate Low CFt (1 + R) 0 = (1 + IRR) (NPV Low-NPV - NPV tigh t=0 t=0 i=1 1=1 19 18 E(R) = Rp + (RM - RPB Reward Ratio Risk yearly return 21 Historical Avg. Return I=1 T E(R.;) - Rf E(RA)-RF E(RB)-RF BA BB 20 23 n 22 n 24 IRR = Rate Low CFt (1 + R) NPV = 0 = CF (1 + IRR) (NPVLow (Rate High-Rate Low (NPV-NPV. t=0 Low - NPV High 25 26 [ F PB = C m (1+YTM) YTM APR1 27 (1+R) = (1+r)(1+h) (1+YTM) EAR= [1 -1 m PVA 30 28 FV - PV(1+r)! PMT = 32 Pr-(EV): 1 1+r) In FV PV = 29 (1+r) (FM 31 t- In (1+r) 33 PVP=[PMT 34 OCF = EBIT + D-T 35 OCF = Profit (1-T) + (D)(T) 36 NSCF = SV - (SV BV)(T) BV 37 Dstraight-line Years 38 D1 39 Po Po o D1 40 R= D1 (R-9) - 3 +8 Dividend Sales 43 PE = Price/share Earnings Price/share P-S = Sales 44 S/S = # shares outst 45 Dt 47 EPS+ = DPRE Price = Benchmark PE ratio x EPS 48 Current Yield Annual Coupon Price (PO) 51 $ return = C + (P1 50 53 $ return = D + (PA 39 38 (Po D1 D1 40 R= Po- (R-9) +8 Dividend Yield: Pop 42 DE DPR - EPS Price/share 43 PE = Earnings P-S = Price/share Sales 44 S/S = 45 Sales shares outstanding Earnings (Revenue --Cost) EPS = #shares outstanding 46 47 EPS = Dt DPRE Price = Benchmark PE ratio x EPS Price = Benchmark P-S ratio x Sales/Share 48 49 Current Yield = Annual Coupon Price (PO) 50 51 52 $ return = C + (P1 - Po) % return = C+ (P1 - Po) Po D+ (P1 - Po) 53 $ return = + (P1 - P.) % return = 54 Po