Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Bakkaloglu s.a. currently plows back 30 percent of its earnings and earns a return of 25 percent on this investment. The dividend yield on

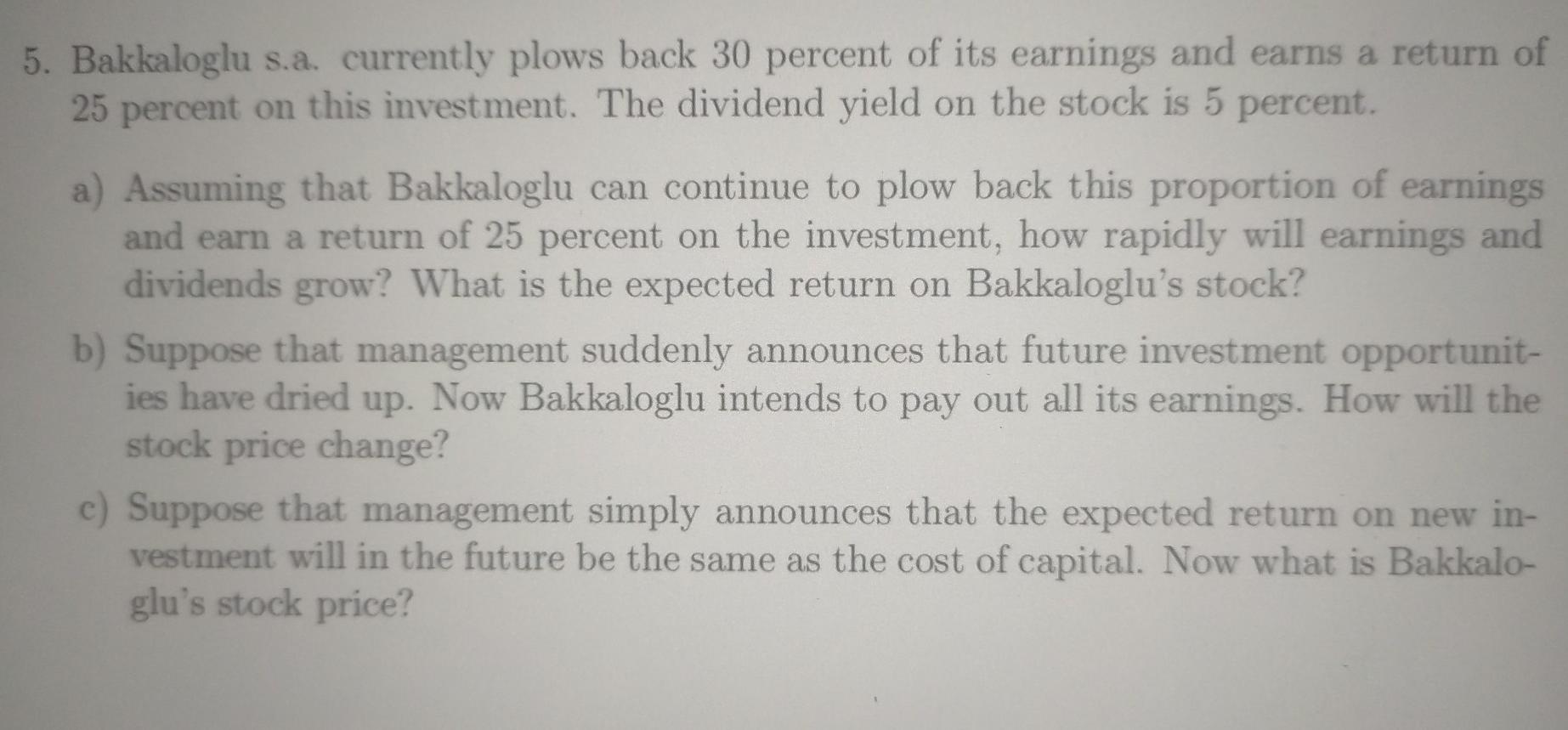

5. Bakkaloglu s.a. currently plows back 30 percent of its earnings and earns a return of 25 percent on this investment. The dividend yield on the stock is 5 percent. a) Assuming that Bakkaloglu can continue to plow back this proportion of earnings and earn a return of 25 percent on the investment, how rapidly will earnings and dividends grow? What is the expected return on Bakkaloglu's stock? b) Suppose that management suddenly announces that future investment opportunit- ies have dried up. Now Bakkaloglu intends to pay out all its earnings. How will the stock price change? c) Suppose that management simply announces that the expected return on new in- vestment will in the future be the same as the cost of capital. Now what is Bakkalo- glu's stock price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started