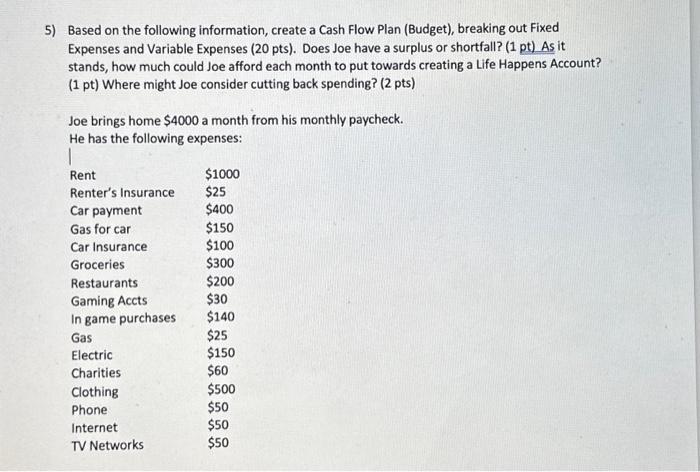

Question: 5) Based on the following information, create a Cash Flow Plan (Budget), breaking out Fixed Expenses and Variable Expenses (20 pts). Does Joe have a

Based on the following information, create a Cash Flow Plan (Budget), breaking out Fixed Expenses and Variable Expenses (20 pts). Does Joe have a surplus or shortfall? (1 pt) As it stands, how much could Joe afford each month to put towards creating a Life Happens Account? (1 pt) Where might Joe consider cutting back spending? (2 pts) Joe brings home $4000 a month from his monthly paycheck. He has the following expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts