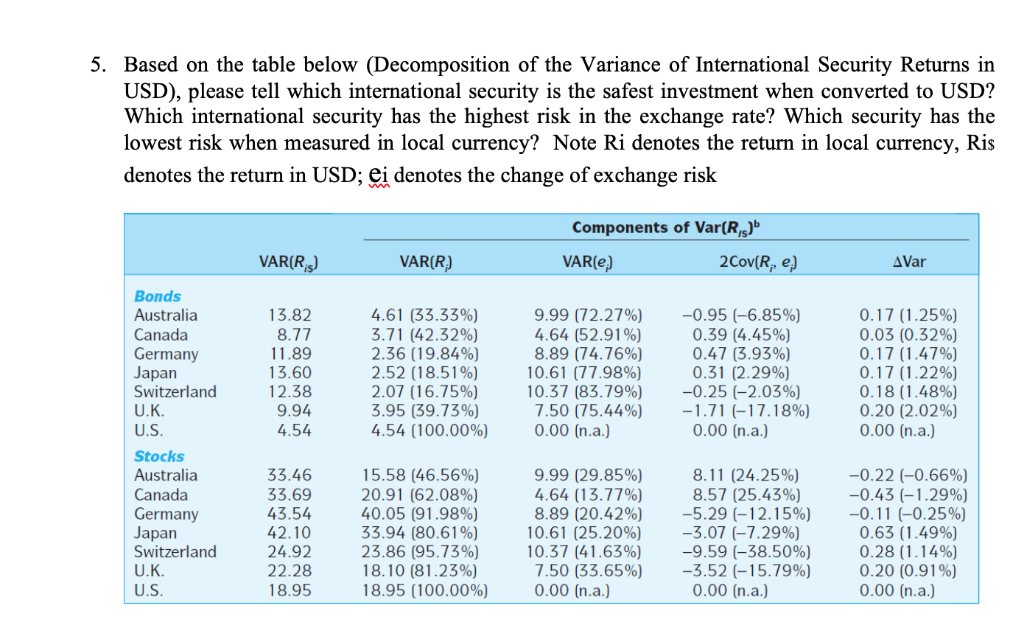

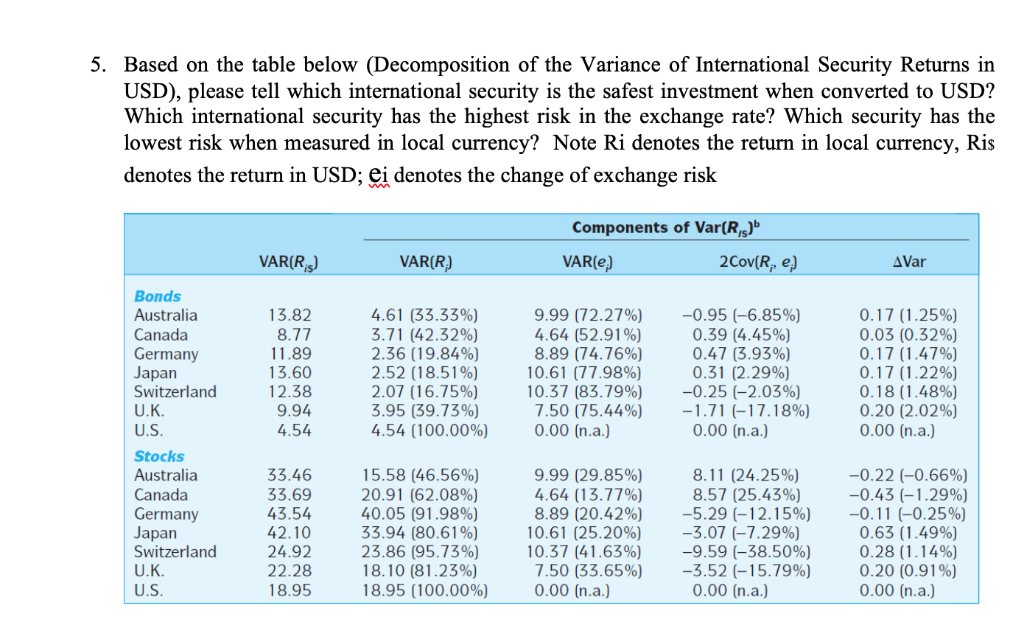

5. Based on the table below (Decomposition of the Variance of International Security Returns in USD), please tell which international security is the safest investment when converted to USD? Which international security has the highest risk in the exchange rate? Which security has the lowest risk when measured in local currency? Note Ri denotes the return in local currency, Ris denotes the return in USD; ei denotes the change of exchange risk Components of Var(Rs)b VAR(Rs VAR(e VAR(R 2Cov(R, e, AVar Bonds 13.82 8.77 11.89 13.60 2.38 9.94 4.54 461 (33.33%) 3.71 (42.32%) 2.36(19.84%) 2.52 (18.51%) 2.07 (16.75%) 3.95 (39.73%) 4.54 (100.00%) 9.99 (72.27%) 4.64 (52.91%) 8.89 (74.76%) 10.61 (77.98%) 10.37 (83.79%) 7.50 (75.44%) 0.00 (n.a.) -0.95 (-6.85%) 0.17(1.25%) 0.03 (0.32%) 0. I 7 (1.47%) O. 1 7 ( 1.22%) O. 1 8 ( 1.48%) 0.20 (2.02%) 0.00 (n..) Australia Canada Germany Japan Switzerland U.K. U.S 0.39 (4.45%) 0.47 (3.93%) 0.31 (2.29%) -0.25 (-2.03%) 1.71 (-17.18%) 0.00 (n.a.) Stocks 15.58 (46.56%) 20.91 (62.08%) 40.05 (91.98%) 33.94 (80.61%) 23.86 (95.73%) 18. 10 (81.23%) 18.95 (100.00%) 33.46 33.69 43.54 42.10 24.92 22.28 18.95 -0.22 (-0.66%) Australia Canada Germany Japan Switzerland U.K. U.S 9.99 (29.85%) 464 (13.77%) 8.89 (20.42%) 10.61 (25.20%) 10.37 (41.63%) 7.50 (33.65%) 0.00 (n.a.) 8.11 (24.25%) 8.57 (25.43%) 5.29 (-12. 1 5%) 3.07 (-7.29%) 959 (-38.50%) 3.52 (-15.79%) 0.00 (n.a.) 0.43 (-1.29%) -0. 1 1 (-0.25%) 0.63 ( 1.4996) 0.28 (1 . 1 496) 0.20 (0.91%) 0.00 (n.a.) 5. Based on the table below (Decomposition of the Variance of International Security Returns in USD), please tell which international security is the safest investment when converted to USD? Which international security has the highest risk in the exchange rate? Which security has the lowest risk when measured in local currency? Note Ri denotes the return in local currency, Ris denotes the return in USD; ei denotes the change of exchange risk Components of Var(Rs)b VAR(Rs VAR(e VAR(R 2Cov(R, e, AVar Bonds 13.82 8.77 11.89 13.60 2.38 9.94 4.54 461 (33.33%) 3.71 (42.32%) 2.36(19.84%) 2.52 (18.51%) 2.07 (16.75%) 3.95 (39.73%) 4.54 (100.00%) 9.99 (72.27%) 4.64 (52.91%) 8.89 (74.76%) 10.61 (77.98%) 10.37 (83.79%) 7.50 (75.44%) 0.00 (n.a.) -0.95 (-6.85%) 0.17(1.25%) 0.03 (0.32%) 0. I 7 (1.47%) O. 1 7 ( 1.22%) O. 1 8 ( 1.48%) 0.20 (2.02%) 0.00 (n..) Australia Canada Germany Japan Switzerland U.K. U.S 0.39 (4.45%) 0.47 (3.93%) 0.31 (2.29%) -0.25 (-2.03%) 1.71 (-17.18%) 0.00 (n.a.) Stocks 15.58 (46.56%) 20.91 (62.08%) 40.05 (91.98%) 33.94 (80.61%) 23.86 (95.73%) 18. 10 (81.23%) 18.95 (100.00%) 33.46 33.69 43.54 42.10 24.92 22.28 18.95 -0.22 (-0.66%) Australia Canada Germany Japan Switzerland U.K. U.S 9.99 (29.85%) 464 (13.77%) 8.89 (20.42%) 10.61 (25.20%) 10.37 (41.63%) 7.50 (33.65%) 0.00 (n.a.) 8.11 (24.25%) 8.57 (25.43%) 5.29 (-12. 1 5%) 3.07 (-7.29%) 959 (-38.50%) 3.52 (-15.79%) 0.00 (n.a.) 0.43 (-1.29%) -0. 1 1 (-0.25%) 0.63 ( 1.4996) 0.28 (1 . 1 496) 0.20 (0.91%) 0.00 (n.a.)