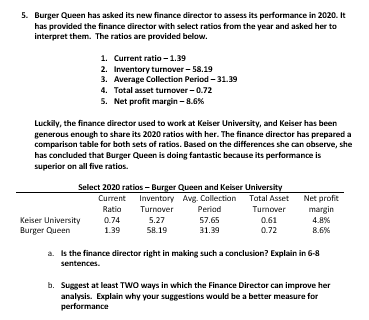

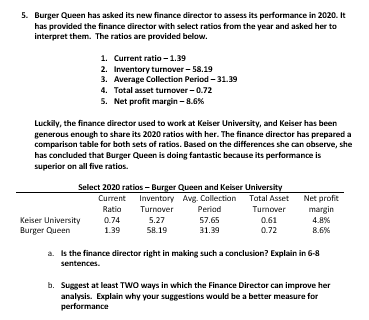

5. Burger Queen has asked its new finance director to assess its performance in 2020. It has provided the finance director with select ratios from the year and asked her to interpret them. The ratios are provided below. 1. Current ratio - 1.39 2. Inventory turnover -58.19 3. Average Collection Period - 31.39 4. Total asset turnover -0.72 5. Net profit margin-8.6% Luckily, the finance director used to work at Keiser University, and Keiser has been generous enough to share its 2020 ratios with her. The finance director has prepared a comparison table for both sets of ratios. Based on the differences she can observe, she has concluded that Burger Queen is doing fantastic because its performance is superior on all five ratios. Select 2020 ratios - Burger Queen and Keiser University Current Inventory Avg. Collection Total Asset Net profit Ratio Turnover Period Tumover margin Keiser University 0.74 5.27 57.65 0.61 4.8% Burger Queen 1.39 58.19 31.39 0.72 8.6% a. Is the finance director right in making such a conclusion? Explain in 6-8 sentences. b. Suggest at least two ways in which the Finance Director can improve her analysis. Explain why your suggestions would be a better measure for performance 5. Burger Queen has asked its new finance director to assess its performance in 2020. It has provided the finance director with select ratios from the year and asked her to interpret them. The ratios are provided below. 1. Current ratio - 1.39 2. Inventory turnover -58.19 3. Average Collection Period - 31.39 4. Total asset turnover -0.72 5. Net profit margin-8.6% Luckily, the finance director used to work at Keiser University, and Keiser has been generous enough to share its 2020 ratios with her. The finance director has prepared a comparison table for both sets of ratios. Based on the differences she can observe, she has concluded that Burger Queen is doing fantastic because its performance is superior on all five ratios. Select 2020 ratios - Burger Queen and Keiser University Current Inventory Avg. Collection Total Asset Net profit Ratio Turnover Period Tumover margin Keiser University 0.74 5.27 57.65 0.61 4.8% Burger Queen 1.39 58.19 31.39 0.72 8.6% a. Is the finance director right in making such a conclusion? Explain in 6-8 sentences. b. Suggest at least two ways in which the Finance Director can improve her analysis. Explain why your suggestions would be a better measure for performance