Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(5) c. A policyholder has a regular premium unit-linked endowment assurance contract, which was sold to her in conjunction with a mortgage on her property.

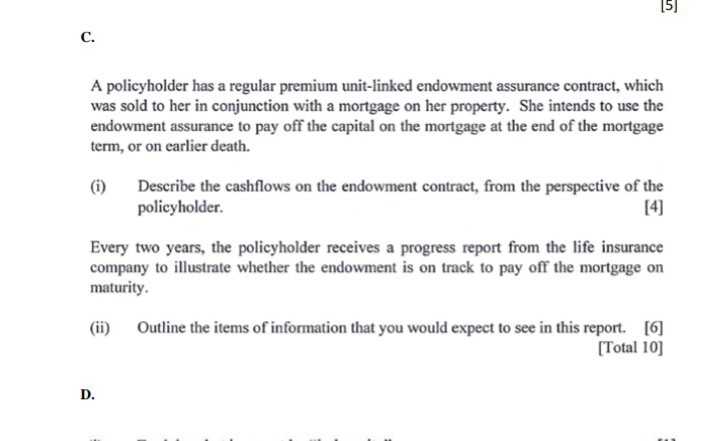

(5) c. A policyholder has a regular premium unit-linked endowment assurance contract, which was sold to her in conjunction with a mortgage on her property. She intends to use the endowment assurance to pay off the capital on the mortgage at the end of the mortgage term, or on earlier death. Describe the cashflows on the endowment contract, from the perspective of the policyholder. [4] Every two years, the policyholder receives a progress report from the life insurance company to illustrate whether the endowment is on track to pay off the mortgage on maturity (ii) Outline the items of information that you would expect to see in this report. [6] [Total 10] D. (5) c. A policyholder has a regular premium unit-linked endowment assurance contract, which was sold to her in conjunction with a mortgage on her property. She intends to use the endowment assurance to pay off the capital on the mortgage at the end of the mortgage term, or on earlier death. Describe the cashflows on the endowment contract, from the perspective of the policyholder. [4] Every two years, the policyholder receives a progress report from the life insurance company to illustrate whether the endowment is on track to pay off the mortgage on maturity (ii) Outline the items of information that you would expect to see in this report. [6] [Total 10] D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started