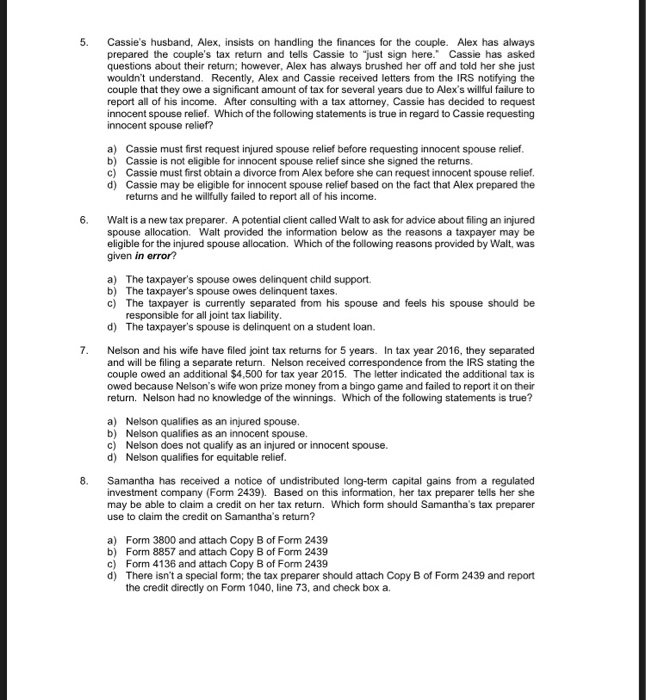

5. Cassie's husband, Alex, insists on handling the finances for the couple. Alex has always prepared the couple's tax return and tells Cassie to just sign here. Cassie has asked questions about their return; however, Alx has always brushed her off and told her she just wouldn't understand. Recently, Alex and Cassie received letters from the IRS notifying the couple that they owe a significant amount of tax for several years due to Alex's willful failure to report all of his income. After consulting with a tax attorney, Cassie has decided to request innocent spouse relief. Which of the following statements is true in regard to Cassie requesting innocent spouse relief? a) Cassie must first request injured spouse relief before requesting innocent spouse relief b) Cassie is not eligible for innocent spouse relief since she signed the returns. c) Cassie must first obtain a divorce from Alex before she can request innocent spouse relief. d) Cassie may be eligible for innocent spouse relief based on the fact that Alex prepared the returns and he willfully failed to report all of his income. 6. Walt is a new tax preparer. A potential client called Walt to ask for advice about filing an injured spouse allocation. Walt provided the information below as the reasons a taxpayer may be eligible for the injured spouse allocation. Which of the following reasons provided by Walt, was given in error? a) The taxpayer's spouse owes delinquent child support. b) The taxpayer's spouse owes delinquent taxes. c) The taxpayer is currently separated from his spouse and feels his spouse should be responsible for all joint tax liability d) The taxpayer's spouse is delinquent on a student loan. 7. Nelson and his wife have filed joint tax returns for 5 years. In tax year 2016, they separated and will be filing a separate return. Nelson received correspondence from the IRS stating the couple owed an additional $4,500 for tax year 2015. The letter indicated the additional tax is owed because Nelson's wife won prize money from a bingo game and failed to report it on their return. Nelson had no knowledge of the winnings. Which of the following statements is true? a) Nelson qualifies as an injured spouse b) Nelson qualifies as an innocent spouse. c) Nelson does not qualify as an injured or innocent spouse. d) Nelson qualifies for equitable relief 8. Samantha has received a notice of undistributed long-term capital gains from a regulated investment company (Form 2439). Based on this information, her tax preparer tells her she may be able to claim a credit on her tax return. Which form should Samantha's tax preparer use to claim the credit on Samantha's return? a) b) c) d) Form 3800 and attach Copy B of Form 2439 Form 8857 and attach Copy B of Form 2439 Form 4136 and attach Copy B of Form 2439 There isn't a special form; the tax preparer should attach Copy B of Form 2439 and report the credit directly on Form 1040, line 73, and check box a