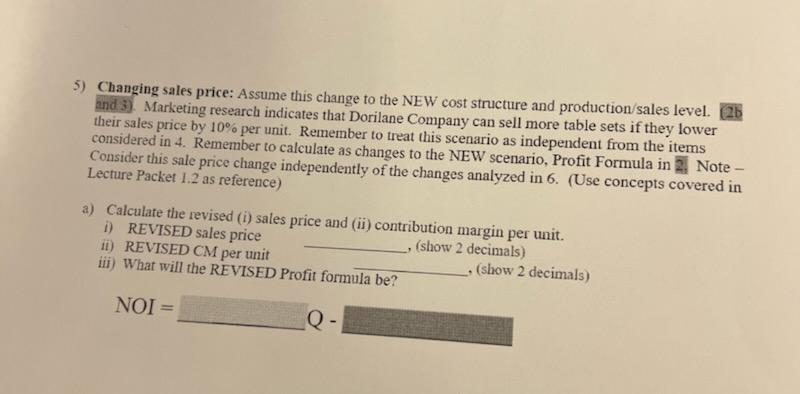

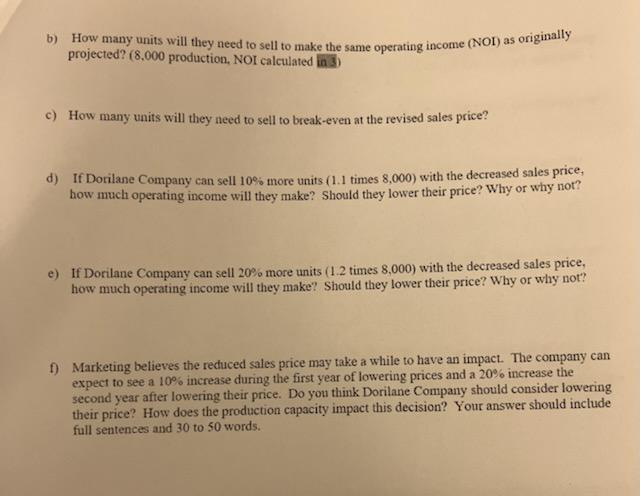

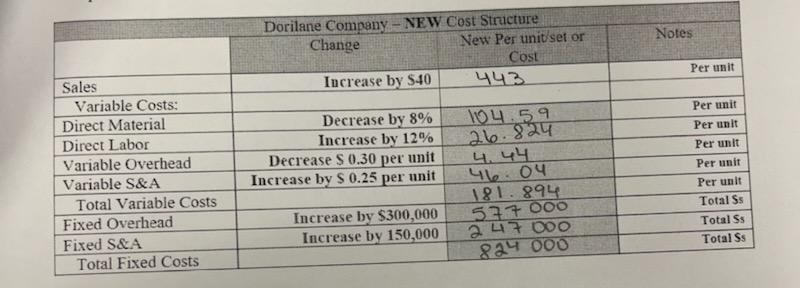

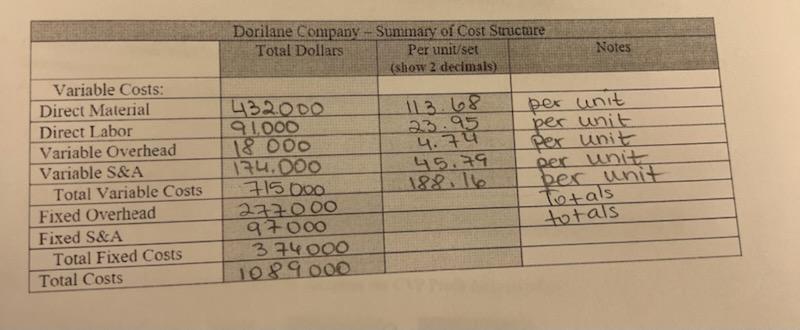

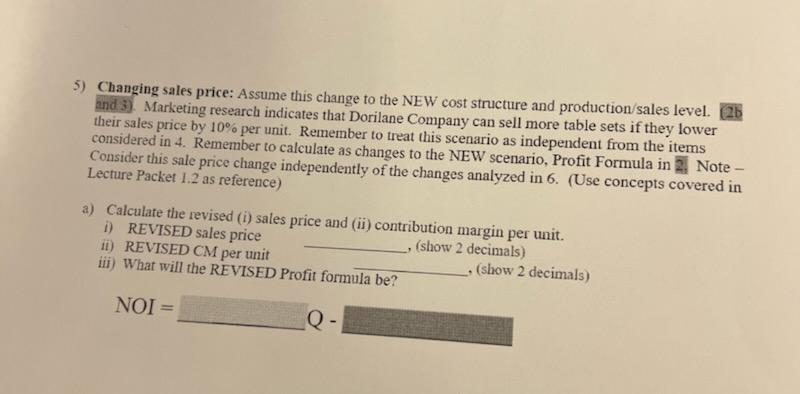

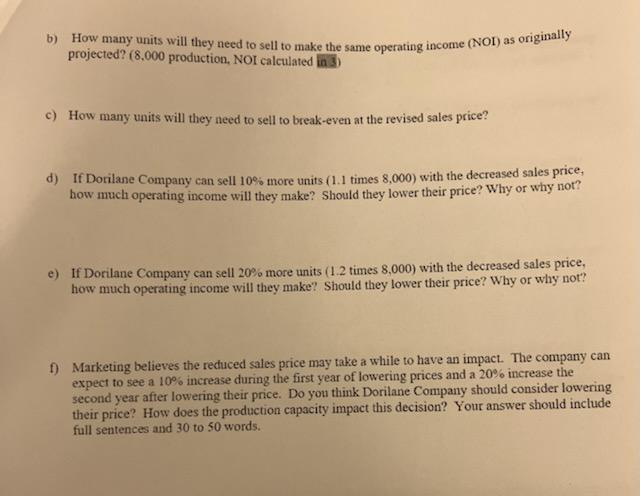

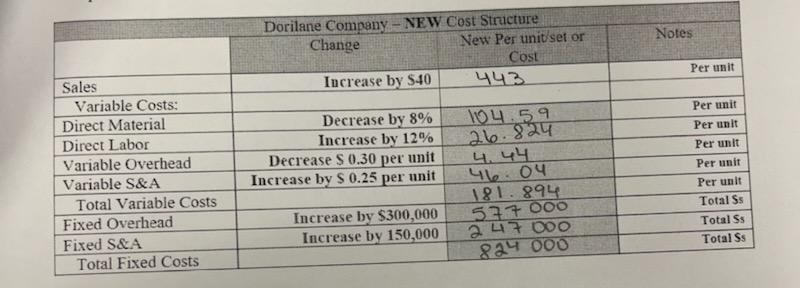

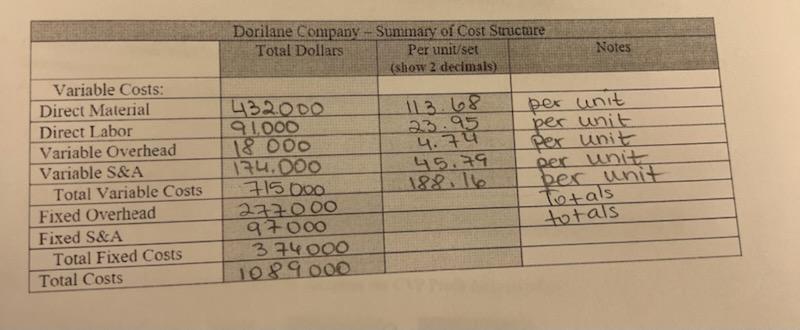

5) Changing sales price: Assume this change to the NEW cost structure and prociuction/sales level. (2b and 3). Marketing research indicates that Dorilane Company can sell more table sets if they lower their sales price by 10% per unit. Remember to treat this scenario as independent from the items considered in 4. Remember to calculate as changes to the NEW scenario, Profit Formula in 2 Note Consider this sale price change independently of the changes analyzed in 6 . (Use concepts covered in Lecture Packet 1.2 as reference) a) Calculate the revised (i) sales price and (ii) contribution margin per unit. i) REVISED sales price ii) REVISED CM per unit , (show 2 decimals) iii) What will the REVISED Profit formula be? , (show 2 decimals) NOI= b) How many units will they need to sell to make the same operating income (NOI) as originally projected? (8.000 production, NOI calculated in 3) c) How many units will they need to sell to break-even at the revised sales price? d) If Dorilane Company can sell 10% more units (1.1 times 8,000) with the decreased sales price, how much operating income will they make? Should they lower their price? Why or why not? e) If Dorilane Company can sell 20% more units (1.2 times 8,000) with the decreased sales price, how much operating income will they make? Should they lower their price? Why or why not? f) Marketing believes the reduced sales price may take a while to have an impact. The company can expect to see a 10% increase during the first year of lowering prices and a 20% increase the second year after lowering their price. Do you think Dorilane Company should consider lowering their price? How does the production capacity impact this decision? Your answer should include full sentences and 30 to 50 words. \begin{tabular}{|l|l|c|c|} \hline & Dorilane Company - Summary of Cost Structare \\ \hline \multicolumn{1}{|c|}{ Total Dollars } & Per unilset (show 2 decimals) & Notes \\ \hline Variable Costs: & & 113.68 & per unit \\ \hline Direct Material & 432000 & 23.95 & per wnit \\ \hline Direct Labor & 91.000 & 4.74 & per unit \\ \hline Variable Overhead & 18000 & 45.79 & per unit \\ \hline Variable S\&A & 174.000 & 188.16 & per unit \\ \hline Total Variable Costs & 715000 & & Totals \\ \hline Fixed Overhead & 277000 & & totals \\ \hline Fixed S\&A & 97000 & & \\ \hline Total Fixed Costs & 374000 & & \\ \hline Total Costs & 1089000 & & \\ \hline \end{tabular} 5) Changing sales price: Assume this change to the NEW cost structure and prociuction/sales level. (2b and 3). Marketing research indicates that Dorilane Company can sell more table sets if they lower their sales price by 10% per unit. Remember to treat this scenario as independent from the items considered in 4. Remember to calculate as changes to the NEW scenario, Profit Formula in 2 Note Consider this sale price change independently of the changes analyzed in 6 . (Use concepts covered in Lecture Packet 1.2 as reference) a) Calculate the revised (i) sales price and (ii) contribution margin per unit. i) REVISED sales price ii) REVISED CM per unit , (show 2 decimals) iii) What will the REVISED Profit formula be? , (show 2 decimals) NOI= b) How many units will they need to sell to make the same operating income (NOI) as originally projected? (8.000 production, NOI calculated in 3) c) How many units will they need to sell to break-even at the revised sales price? d) If Dorilane Company can sell 10% more units (1.1 times 8,000) with the decreased sales price, how much operating income will they make? Should they lower their price? Why or why not? e) If Dorilane Company can sell 20% more units (1.2 times 8,000) with the decreased sales price, how much operating income will they make? Should they lower their price? Why or why not? f) Marketing believes the reduced sales price may take a while to have an impact. The company can expect to see a 10% increase during the first year of lowering prices and a 20% increase the second year after lowering their price. Do you think Dorilane Company should consider lowering their price? How does the production capacity impact this decision? Your answer should include full sentences and 30 to 50 words. \begin{tabular}{|l|l|c|c|} \hline & Dorilane Company - Summary of Cost Structare \\ \hline \multicolumn{1}{|c|}{ Total Dollars } & Per unilset (show 2 decimals) & Notes \\ \hline Variable Costs: & & 113.68 & per unit \\ \hline Direct Material & 432000 & 23.95 & per wnit \\ \hline Direct Labor & 91.000 & 4.74 & per unit \\ \hline Variable Overhead & 18000 & 45.79 & per unit \\ \hline Variable S\&A & 174.000 & 188.16 & per unit \\ \hline Total Variable Costs & 715000 & & Totals \\ \hline Fixed Overhead & 277000 & & totals \\ \hline Fixed S\&A & 97000 & & \\ \hline Total Fixed Costs & 374000 & & \\ \hline Total Costs & 1089000 & & \\ \hline \end{tabular}