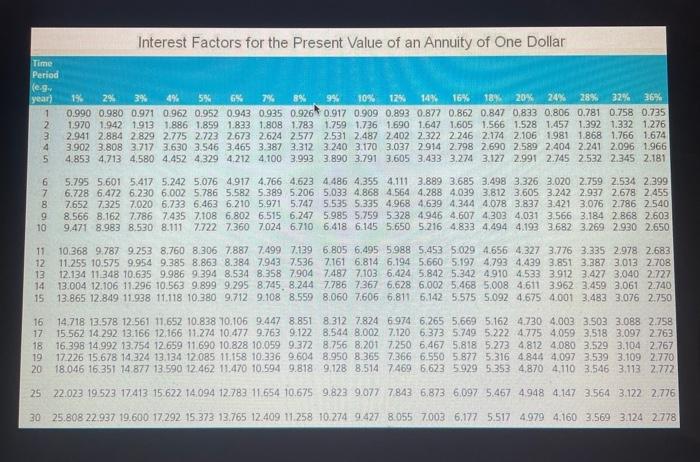

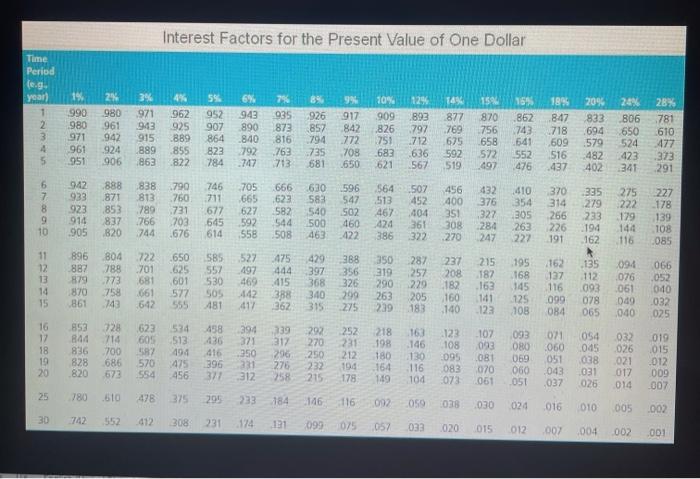

5. Check My Work 6. 2 7. 0 B ebook 8. o Problem 13-07 Fifteen years ago your grandfather purchased for you a 20-year $1,000 band with a coupon rate of 12 percent. You now wish to sell the bond and o read that yields are 9 percent. What price should you receive for the bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. 10. Interest Factors for the Present Value of an Annuity of One Dollar Time Period (eg, year) 19% 29 3% 5% GX 7% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 1 0.990 0,980 0,971 0962 0.952 0943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0,833 0.806 0.781 0.758 0.735 2 1970 1942 1913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 3 2.941 2.884 2829 2.775 2.723 2673 2624 2577 2.531 2.487 2402 2 322 2246 2.174 2.106 1981 1.868 1.766 1674 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2914 2.798 2.690 2.589 2.404 2.241 2.096 1966 5 4.853 4.713 4.580 4.452 4329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.27 2.991 2.745 2.532 2.345 2.181 6 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2937 2678 2455 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5747 5.535 5.335 4.968 4639 4,344 4.078 3.837 3.421 3,076 2.786 2.540 9 8.566 8.162 7.786 7435 7108 6.802 6.515 6.2475985 5.759 5328 4946 4,607 4.303 4.031 3.566 3.184 2.868 2.603 10 9,471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 UN- 11 12 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6,495 5988 5.453 5.029 4.556 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7943 7.536 7.161 6.814 6.194 5.660 5.197 4,793 4.439 3.851 3.387 3.013 2.708 12.134 11348 10.635 9.986 9 394 8.534 8.358 7904 7.487 7103 6.424 5.842 5.342 4.910 4.533 3912 3.427 3,040 2727 13:004 12.106 11.296 10.563 9.899 9.295 8.745. 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 13.865. 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8851 8.312 7.824 6.9746,265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 15:562 14.292 13.166 12,166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4775 4,059 3,518 3.097 2.763 18 16.398 14992 13.754 12.659 11690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 5.818 5.273 4.812 4080 3,529 3.104 2.767 19 17.226 15,678 14,324 13.134 12.085 11,158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.0973.539 3.109 2.770 20 18.046 16.351 14 877 13.590 12.462 13:470 10.594 9.818 9.128 8.514 7469 6,623 5929 5353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17413 15.622 14,094 12.783 11654 10.675 9.8239.077 7.843 6,873 6.097 5.467 4948 4.147 3.564 3.122 2.776 30 25.808 22 937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6,177 5517 4979 4.160 3569 3.124 2778 Interest Factors for the Present Value of One Dollar 2 DO ww