Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Chicken Coop Corporation's (a real estate company) stock is owned as follows: 10 percent by Paul Jenner, 10 percent by Paul's brother Jimmy,

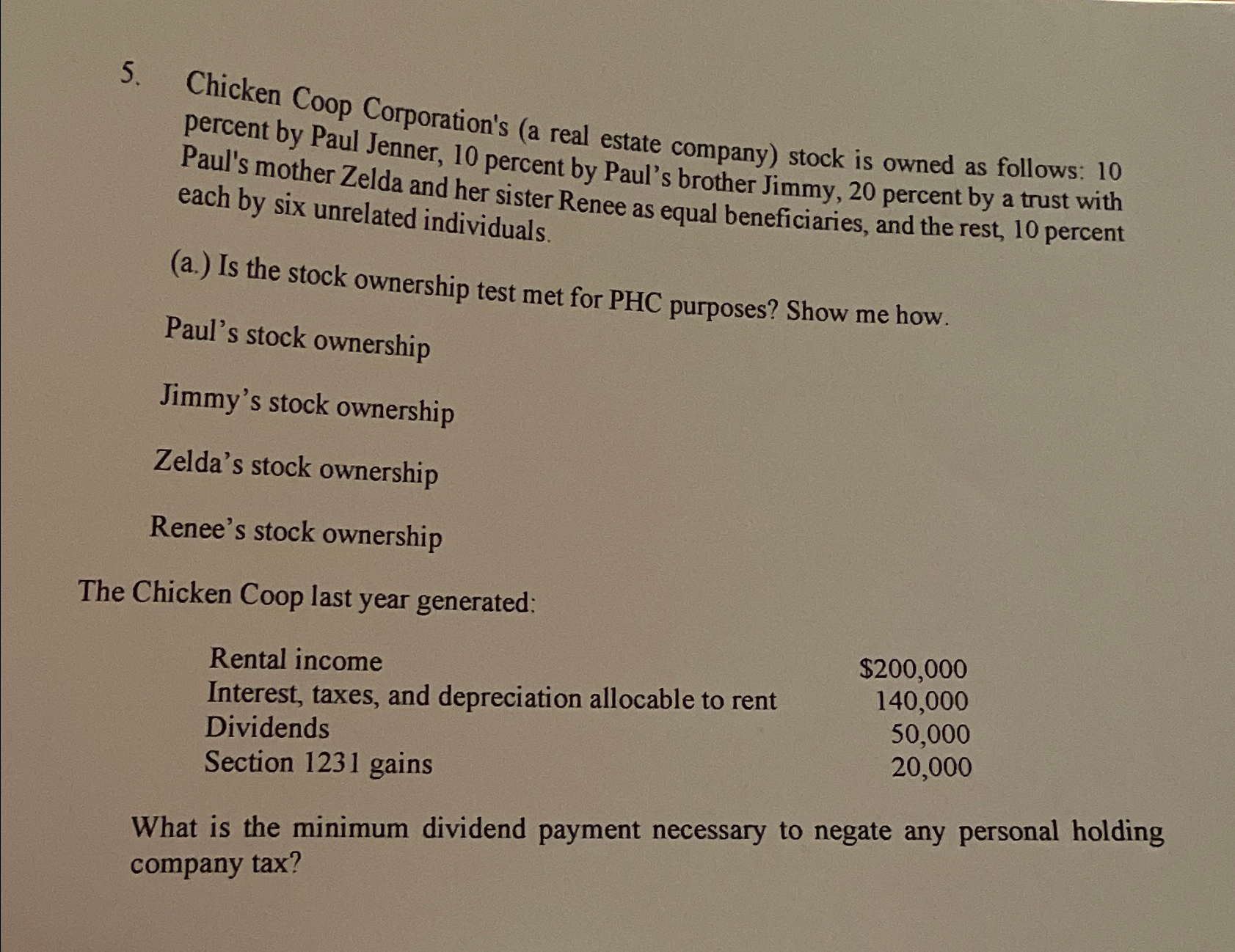

5. Chicken Coop Corporation's (a real estate company) stock is owned as follows: 10 percent by Paul Jenner, 10 percent by Paul's brother Jimmy, 20 percent by a trust with Paul's mother Zelda and her sister Renee as equal beneficiaries, and the rest, 10 percent each by six unrelated individuals. (a.) Is the stock ownership test met for PHC purposes? Show me how. Paul's stock ownership Jimmy's stock ownership Zelda's stock ownership Renee's stock ownership The Chicken Coop last year generated: Rental income Interest, taxes, and depreciation allocable to rent Dividends $200,000 140,000 50,000 20,000 Section 1231 gains What is the minimum dividend payment necessary to negate any personal holding company tax?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The stock ownership test for personal holding company PHC purposes is met if more than 50 of the val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started