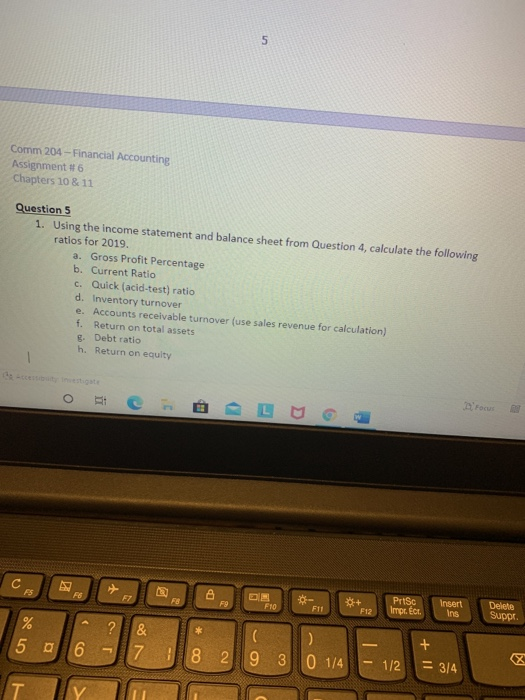

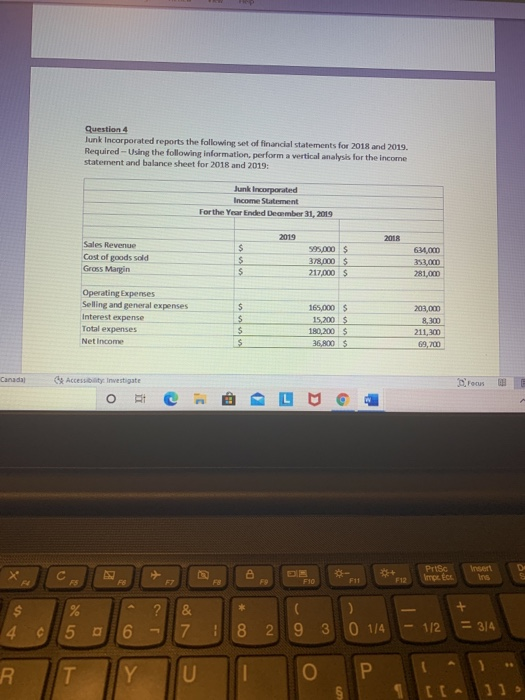

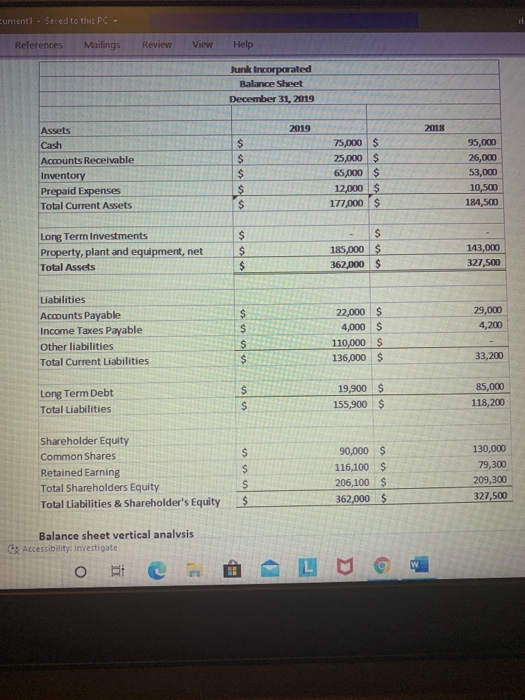

5 Comm 204 - Financial Accounting Assignment #6 Chapters 10 & 11 Questions 1. Using the income statement and balance sheet from Question 4, calculate the following ratios for 2019. a. Gross Profit Percentage b. Current Ratio c. Quick (acid-test) ratio d. Inventory turnover e. Accounts receivable turnover (use sales revenue for calculation) f. Return on total assets g. Debt ratio h. Return on equity O It focus AS FE co FB F9 F10 F11 Prisc Impr. ct. F12 Insert ins Delete Suppr > % ? & 5 06 - 7 8 2 9 3 0 1/4 ) + 11 1/2 = 3/4 X Question 4 lunk Incorporated reports the following set of financial statements for 2018 and 2019. Required - Using the following information, perform a vertical analysis for the income statement and balance sheet for 2018 and 2019: Junk Incorporated Income Statement For the Year Ended December 31, 2019 2019 2018 Sales Revenue Cost of goods sold Gross Margin $ $ $ 595.000$ 378,000 $ 217,000 $ 634,000 353.00 281,000 Operating Expenses Selling and general expenses Interest expense Total expenses Net Income $ $ $ $ 165,000 $ 15,200 $ 180,200 $ 36,800 $ 203,0m 8,300 211,300 69,700 Canada Accessibility Investigate Drous o c X PISC Ampe dos Inser ins F8 F7 F8 F F10 F12 * ? ) $ 4 % 50 & 7 + II 6 8 2 9 3 01/4 1/2 = 314 R IT Y U o 5 cumenti - Saved to this PC. References Mailings Review View Help Junk Incorporated Balance Sheet December 31, 2019 2019 2018 Assets Cash Acounts Receivable Inventory Prepaid Expenses Total Current Assets $ $ $ $ $ 75,000 $ 25,000 $ 65,000 $ 12,000 $ 177,000 $ 95,000 26,000 53,000 10,500 184,500 Long Term Investments Property, plant and equipment, net Total Assets $ $ $ $ 185,000 $ 362,000 $ 143,000 327,500 $ 29,000 4,200 Liabilities Accounts Payable Income Taxes Payable Other liabilities Total Current Liabilities $ $ $ 22,000 $ 4,000 $ 110,000 $ 136,000 $ 33,200 Long Term Debt Total Liabilities $ $ 19,900 $ 155,900 $ 85,000 118,200 $ Shareholder Equity Common Shares Retained Earning Total Shareholders Equity Total Liabilities & Shareholder's Equity $ $ $ 90,000 $ 116,100 $ 206,100 $ 362,000 $ 130,000 79,300 209,300 327,500 Balance sheet vertical analysis Accessibility: Investigate o