Question

5. Compare two projects, both with the lives of 15 years. One has an initial cost of $2500 and an annual cost of $500. The

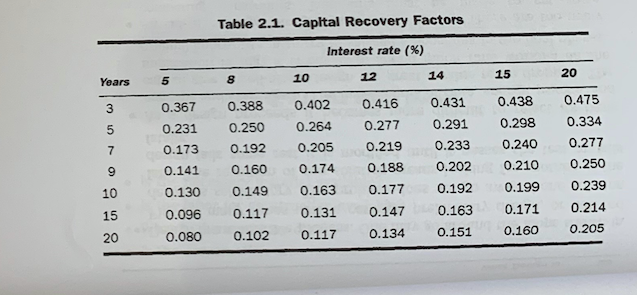

5. Compare two projects, both with the lives of 15 years. One has an initial cost of $2500 and an annual cost of $500. The other one has an initial cost of $1200 annual cost of $700. Assume the interest rate is 8%. Which project is cheaper? Would your conclusion change if the interest rate was 20%?

6. Why are projects with the high initial cost generally riskier than ones with low initial costs, even if the sum of the annual payments over the life of the project are identical?

7. Table 2.1 shows that if the duration of a loan is doubled with the capital recovery factor is not halved. Does this indicate that one pays more interest on a long-term loan than a short-term one? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started