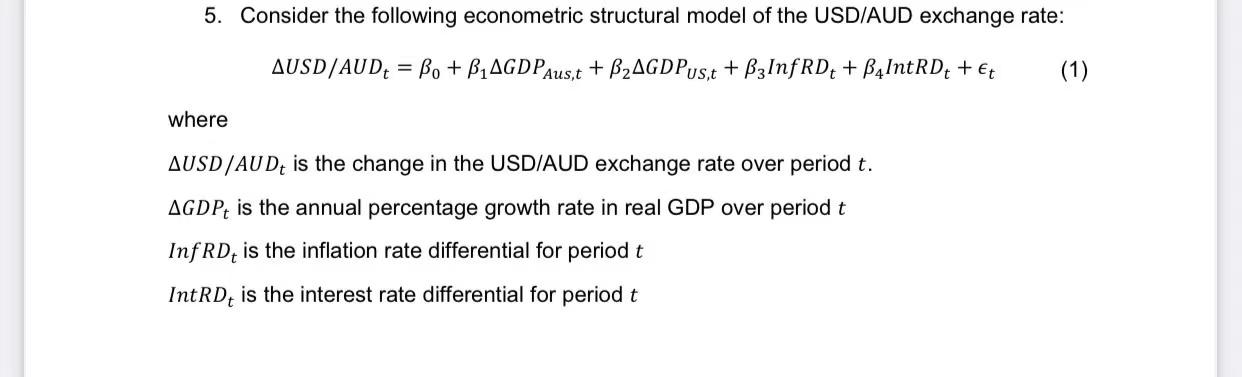

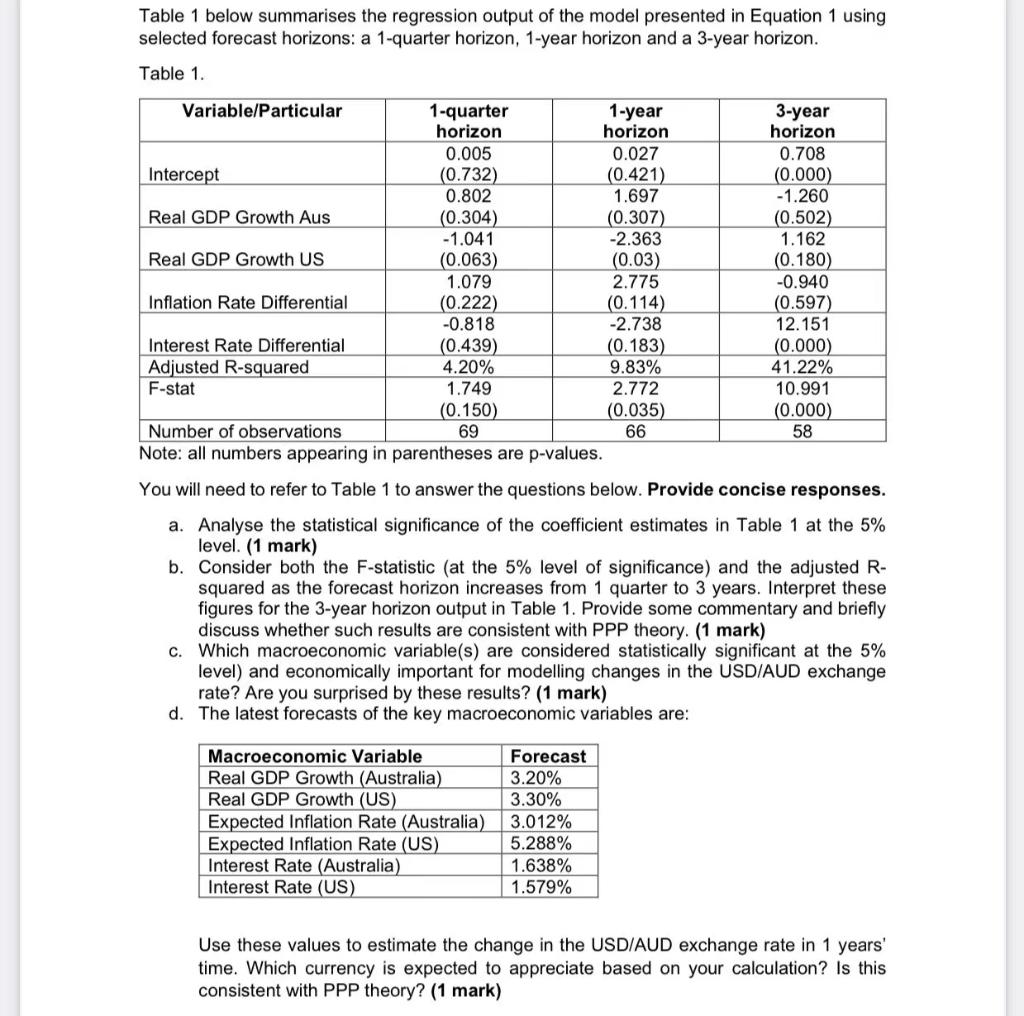

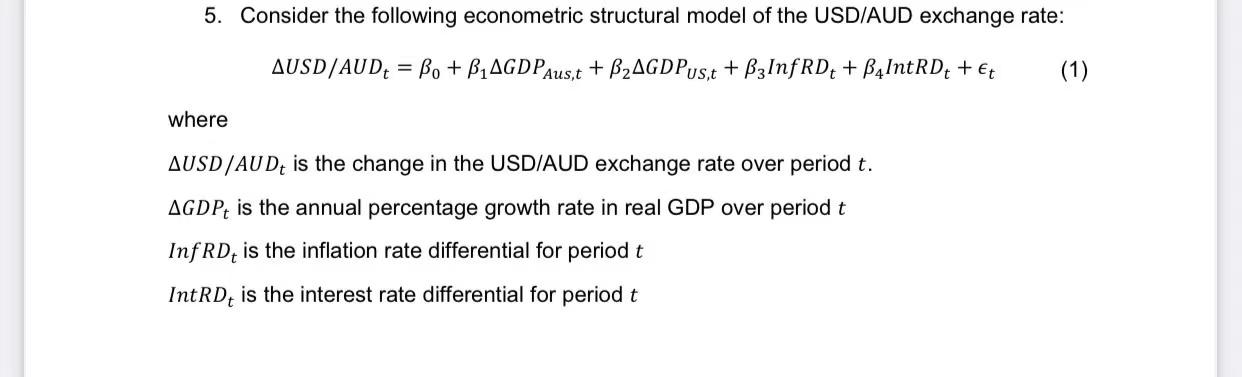

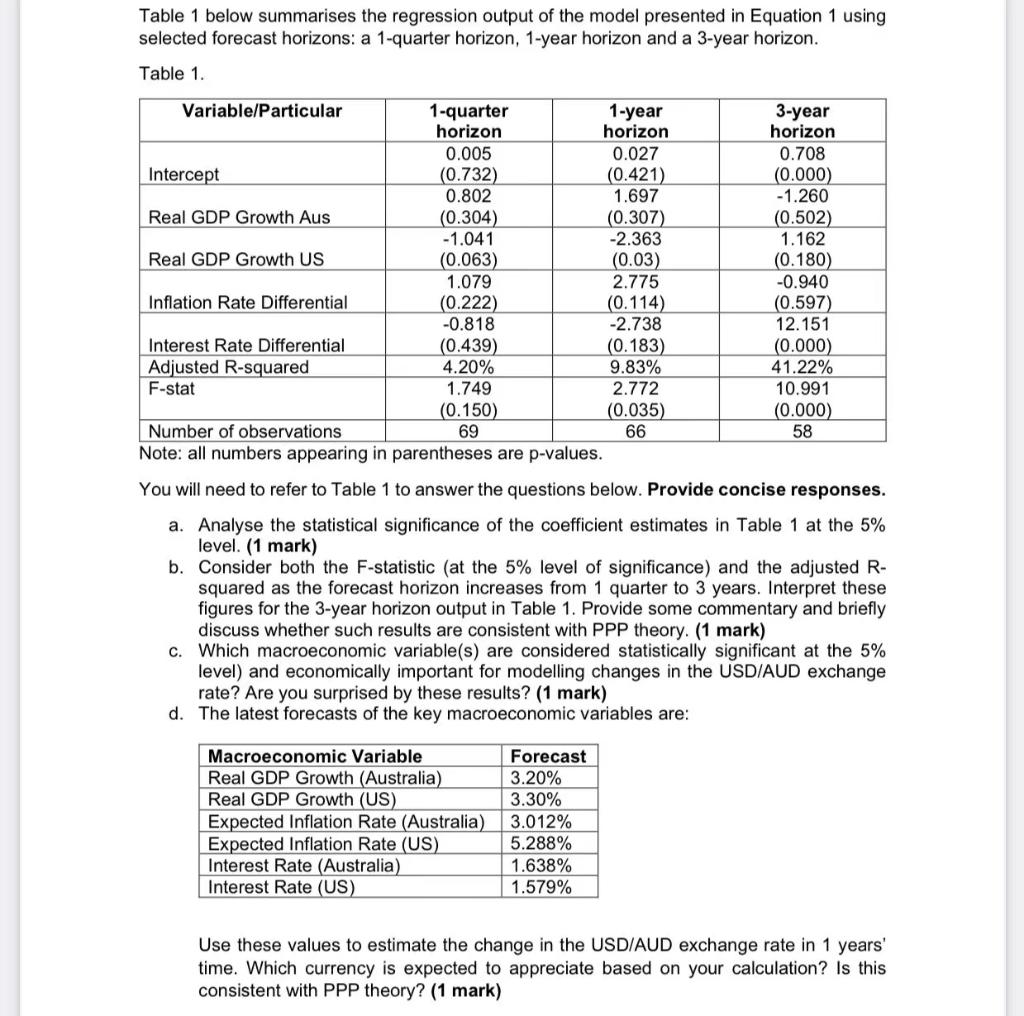

5. Consider the following econometric structural model of the USD/AUD exchange rate: AUSD/AUD+ = Be + BLAGDPAus,t + B2AGDPUS,t + B3InfRD; + B4IntRD+ + t (1) where AUSD/AU Dt is the change in the USD/AUD exchange rate over period t. AGDPt is the annual percentage growth rate in real GDP over period t Inf RD, is the inflation rate differential for period t IntRD, is the interest rate differential for period t Table 1 below summarises the regression output of the model presented in Equation 1 using selected forecast horizons: a 1-quarter horizon, 1-year horizon and a 3-year horizon. Table 1. Variable/Particular 1-quarter 1-year 3-year horizon horizon horizon 0.005 0.027 0.708 Intercept (0.732) (0.421) (0.000) 0.802 1.697 -1.260 Real GDP Growth Aus (0.304) (0.307) (0.502) -1.041 -2.363 1.162 Real GDP Growth US (0.063) (0.03) (0.180) 1.079 2.775 -0.940 Inflation Rate Differential (0.222) (0.114) (0.597) -0.818 -2.738 12.151 Interest Rate Differential (0.439) (0.183) (0.000) Adjusted R-squared 4.20% 9.83% 41.22% F-stat 1.749 2.772 10.991 (0.150) (0.035) (0.000) Number of observations 69 66 58 Note: all numbers appearing in parentheses are p-values. You will need to refer to Table 1 to answer the questions below. Provide concise responses. a. Analyse the statistical significance of the coefficient estimates in Table 1 at the 5% level. (1 mark) b. Consider both the F-statistic (at the 5% level of significance) and the adjusted R- squared as the forecast horizon increases from 1 quarter to 3 years. Interpret these figures for the 3-year horizon output in Table 1. Provide some commentary and briefly discuss whether such results are consistent with PPP theory. (1 mark) C. Which macroeconomic variable(s) are considered statistically significant at the 5% level and economically important for modelling changes in the USD/AUD exchange rate? Are you surprised by these results ? (1 mark) d. The latest forecasts of the key macroeconomic variables are: Macroeconomic Variable Real GDP Growth (Australia) Real GDP Growth (US) Expected Inflation Rate (Australia) Expected Inflation Rate (US) Interest Rate (Australia) Interest Rate (US) Forecast 3.20% 3.30% 3.012% 5.288% 1.638% 1.579% Use these values to estimate the change in the USD/AUD exchange rate in 1 years' time. Which currency is expected to appreciate based on your calculation? Is this consistent with PPP theory? (1 mark) 5. Consider the following econometric structural model of the USD/AUD exchange rate: AUSD/AUD+ = Be + BLAGDPAus,t + B2AGDPUS,t + B3InfRD; + B4IntRD+ + t (1) where AUSD/AU Dt is the change in the USD/AUD exchange rate over period t. AGDPt is the annual percentage growth rate in real GDP over period t Inf RD, is the inflation rate differential for period t IntRD, is the interest rate differential for period t Table 1 below summarises the regression output of the model presented in Equation 1 using selected forecast horizons: a 1-quarter horizon, 1-year horizon and a 3-year horizon. Table 1. Variable/Particular 1-quarter 1-year 3-year horizon horizon horizon 0.005 0.027 0.708 Intercept (0.732) (0.421) (0.000) 0.802 1.697 -1.260 Real GDP Growth Aus (0.304) (0.307) (0.502) -1.041 -2.363 1.162 Real GDP Growth US (0.063) (0.03) (0.180) 1.079 2.775 -0.940 Inflation Rate Differential (0.222) (0.114) (0.597) -0.818 -2.738 12.151 Interest Rate Differential (0.439) (0.183) (0.000) Adjusted R-squared 4.20% 9.83% 41.22% F-stat 1.749 2.772 10.991 (0.150) (0.035) (0.000) Number of observations 69 66 58 Note: all numbers appearing in parentheses are p-values. You will need to refer to Table 1 to answer the questions below. Provide concise responses. a. Analyse the statistical significance of the coefficient estimates in Table 1 at the 5% level. (1 mark) b. Consider both the F-statistic (at the 5% level of significance) and the adjusted R- squared as the forecast horizon increases from 1 quarter to 3 years. Interpret these figures for the 3-year horizon output in Table 1. Provide some commentary and briefly discuss whether such results are consistent with PPP theory. (1 mark) C. Which macroeconomic variable(s) are considered statistically significant at the 5% level and economically important for modelling changes in the USD/AUD exchange rate? Are you surprised by these results ? (1 mark) d. The latest forecasts of the key macroeconomic variables are: Macroeconomic Variable Real GDP Growth (Australia) Real GDP Growth (US) Expected Inflation Rate (Australia) Expected Inflation Rate (US) Interest Rate (Australia) Interest Rate (US) Forecast 3.20% 3.30% 3.012% 5.288% 1.638% 1.579% Use these values to estimate the change in the USD/AUD exchange rate in 1 years' time. Which currency is expected to appreciate based on your calculation? Is this consistent with PPP theory? (1 mark)