Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following time series of Yearly close prices and dividends for XYZ co. ltd. Time Yearly close price Calendar year dividends 2007 74.6

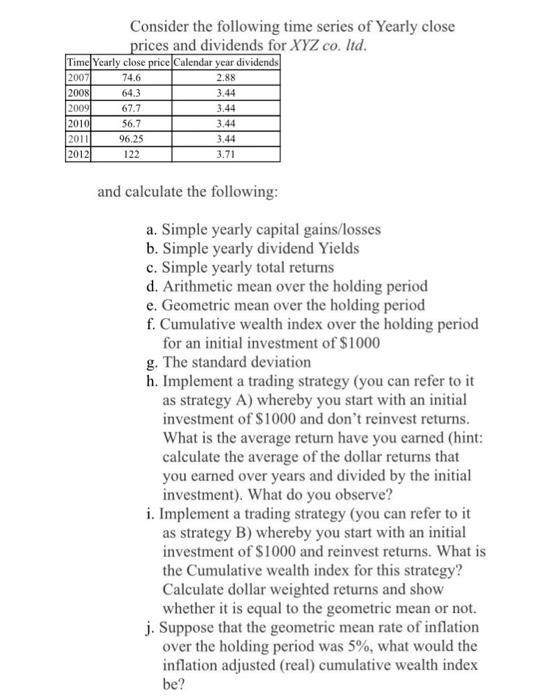

Consider the following time series of Yearly close prices and dividends for XYZ co. ltd. Time Yearly close price Calendar year dividends 2007 74.6 2.88 2008 64.3 3.44 2009 67.7 3.44 2010 56.7 3.44 2011 96.25 3.44 2012 122 3.71 and calculate the following: a. Simple yearly capital gains/losses b. Simple yearly dividend Yields c. Simple yearly total returns d. Arithmetic mean over the holding period e. Geometric mean over the holding period f. Cumulative wealth index over the holding period for an initial investment of $1000 g. The standard deviation h. Implement a trading strategy (you can refer to it as strategy A) whereby you start with an initial investment of $1000 and don't reinvest returns. What is the average return have you earned (hint: calculate the average of the dollar returns that you earned over years and divided by the initial investment). What do you observe? i. Implement a trading strategy (you can refer to it as strategy B) whereby you start with an initial investment of $1000 and reinvest returns. What is the Cumulative wealth index for this strategy? Calculate dollar weighted returns and show whether it is equal to the geometric mean or not. j. Suppose that the geometric mean rate of inflation over the holding period was 5%, what would the inflation adjusted (real) cumulative wealth index be?

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started