Question

(5) Dafa Company is a communications product manufacturing enterprise whose main business is the production and sales of mobile communications products. In order to expand

(5) Dafa Company is a communications product manufacturing enterprise whose main business is the production and sales of mobile communications products. In order to expand market share, it is preparing to put into production smart phone products (abbreviated: smart products). At present, the research and development of related technologies has been completed, and the feasibility study of the project is underway. The information is as follows: If feasible, the project is planned to be put into production in early 2016. year. The unit price of smart products is 3,000 yuan, and 100,000 units were sold in 2016. Sales will increase by 10% every year thereafter. The unit variable manufacturing cost is 2,000 yuan. The annual fixed manufacturing cost is 4 million yuan. The annual sales and management expenses are paid in cash. The ratio to sales revenue is 10%. In order to produce the smart product, a production line needs to be added. The estimated purchase cost is 120 million yuan. The production line can be installed before the end of 2015. According to the tax law, the depreciation period of the production line is 4 years, and the net residual value rate is expected to be 5%. The depreciation is calculated using the straight-line method. The realizable value of the production line is expected to be 24 million yuan in 2018. The company currently rents out an unused maternity house, and collects a rent of 800,000 yuan at the end of each year. The plant can be used to produce the smart product. Because the installation period of the production line is short, the rent during the installation period will not be affected. Due to the substitution effect of smart products on current products, the sales of current products in 2016 decreased by 15,000 units, and the decreased sales will increase by 10% per year. At the end of 2018, the production of smart products was discontinued and the substitution effect disappeared. In 2019, product sales in the current year returned to smart products. Level before production. The current unit price of the product is 1,600 yuan, and the unit variable cost is 1,200 yuan. Working capital is 20% of sales revenue. The working capital advanced for smart product projects is invested at the beginning of each year and is fully recovered at the end of the project. The reduced working capital for current product advances is recovered at the beginning of each year, and at the end of the smart product project Reinvest. The weighted average cost of capital of the project is 9%, and the company's applicable income tax rate is 25%. It is assumed that the initial cash flow of the product project occurred at the end of 2015 and the operating cash flow occurred at the end of each subsequent year. Requirements: Calculate the initial cash flow of the project (incremental net cash flow at the end of 2015), 2016-2018 incremental net cash flow and project net present value, discounted payback period and present value index, and judge the feasibility of the project.

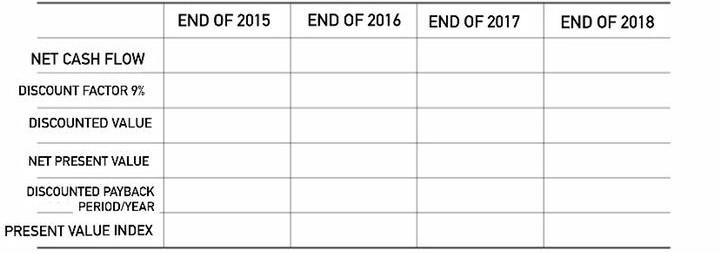

END OF 2015 END OF 2016 END OF 2017 END OF 2018 NET CASH FLOW DISCOUNT FACTOR 9% DISCOUNTED VALUE NET PRESENT VALUE DISCOUNTED PAYBACK PERIOD/YEAR PRESENT VALUE INDEX END OF 2015 END OF 2016 END OF 2017 END OF 2018 NET CASH FLOW DISCOUNT FACTOR 9% DISCOUNTED VALUE NET PRESENT VALUE DISCOUNTED PAYBACK PERIOD/YEAR PRESENT VALUE INDEX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started