Answered step by step

Verified Expert Solution

Question

1 Approved Answer

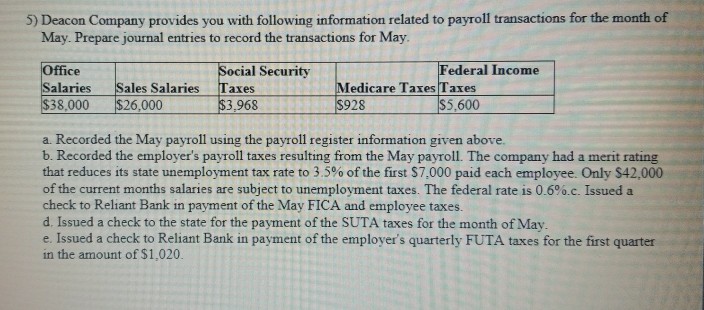

5) Deacon Company provides you with following information related to payroll transactions for the month of May. Prepare journal entries to record the transactions for

5) Deacon Company provides you with following information related to payroll transactions for the month of May. Prepare journal entries to record the transactions for May Federal Income Office Salaries Sales SalariesTaxes $38,000 Social Security Medicare Taxes Taxes S928 26,000 $3,968 a. Recorded the May payroll using the payroll register information given above. b. Recorded the employer's payroll taxes resulting from the May payroll. The company had a merit rating that reduces its state unemployment tax rate to 35% of the first S 7,000 paid each employee. Only S42.000 of the current months salaries are subject to unemployment taxes. The federal rate is 0.6%,c. Issued a check to Reliant Bank in payment of the May FICA and employee taxes. d. Issued a check to the state for the payment of the SUTA taxes for the month of May e. Issued a check to Reliant Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started