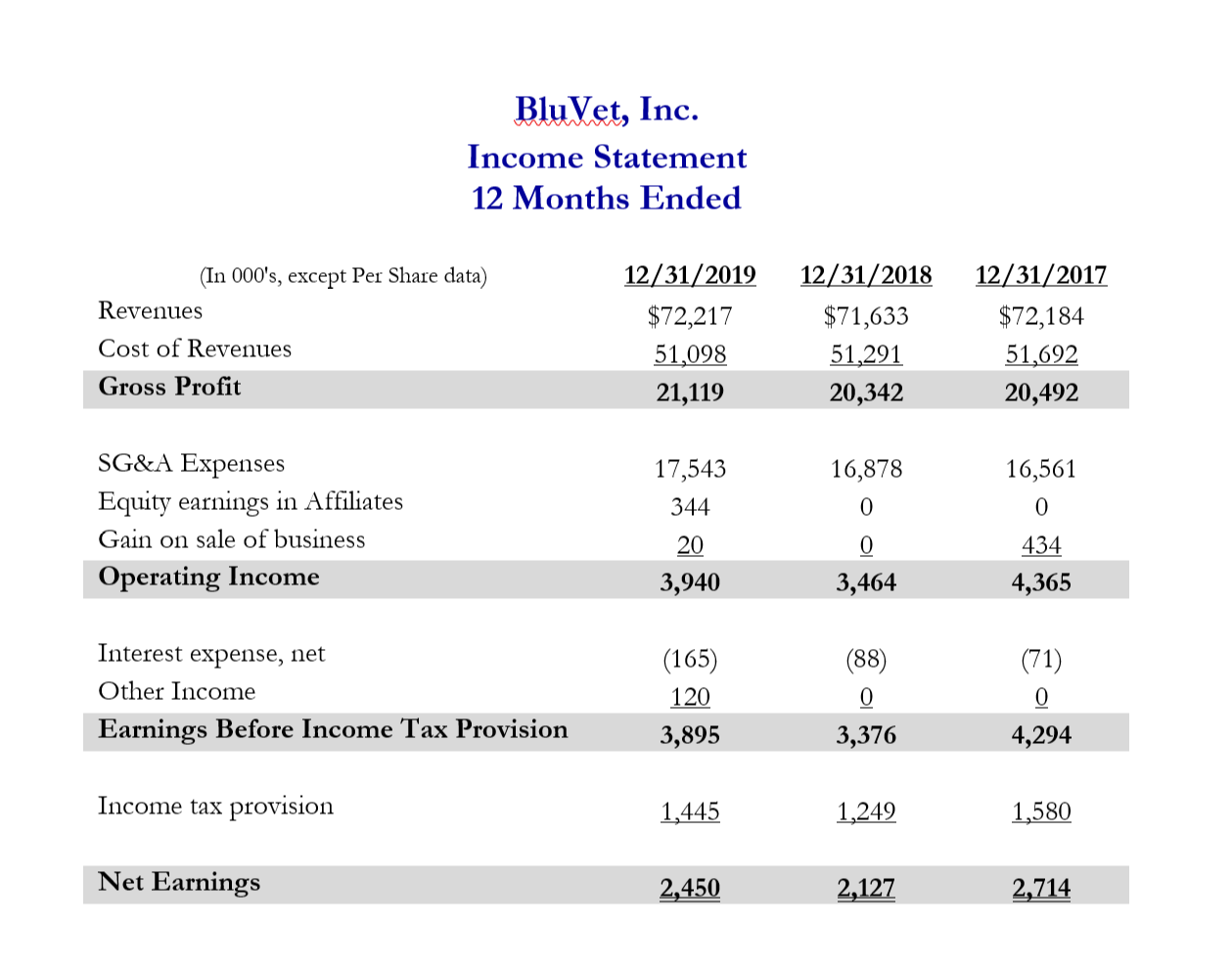

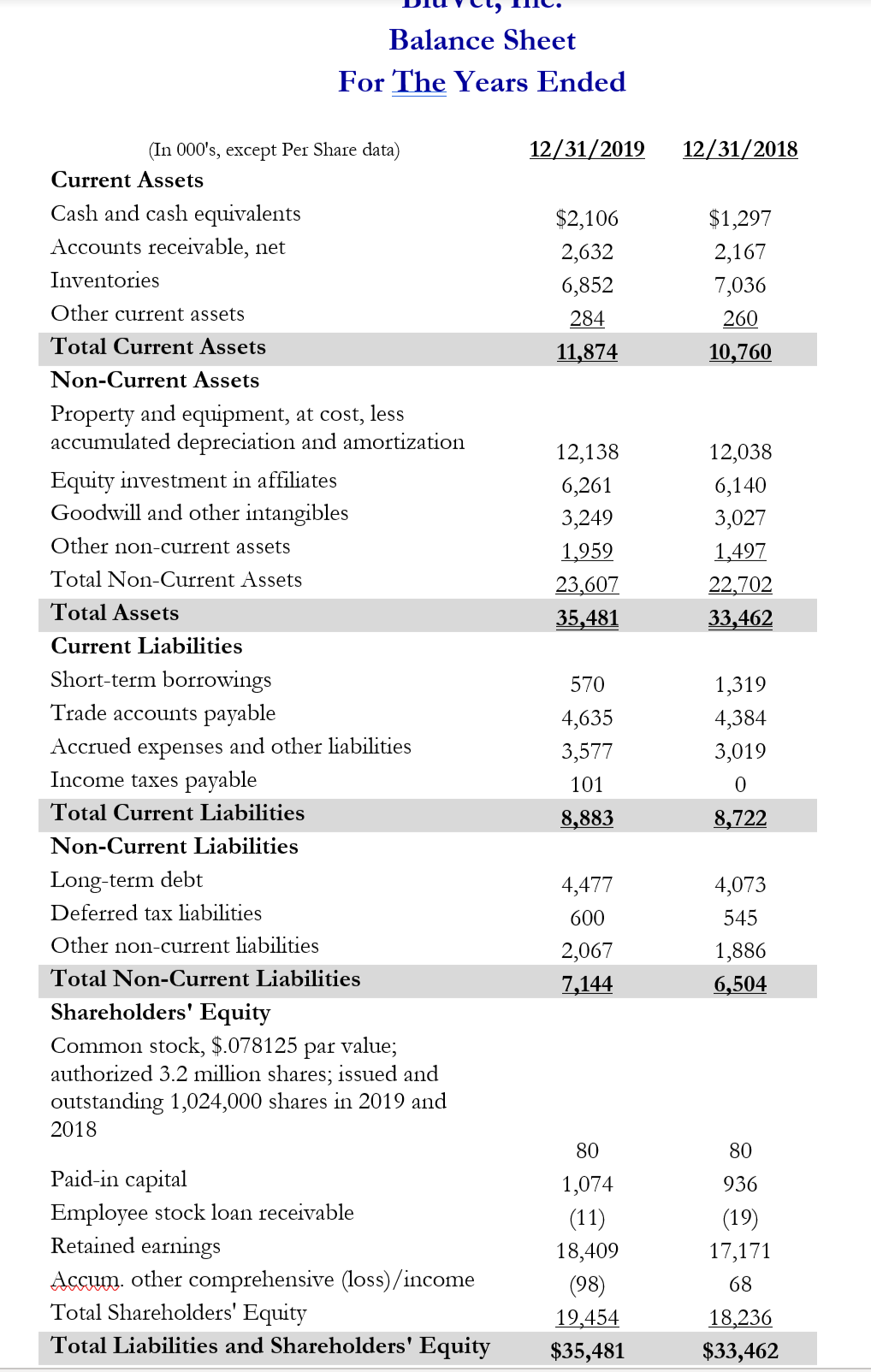

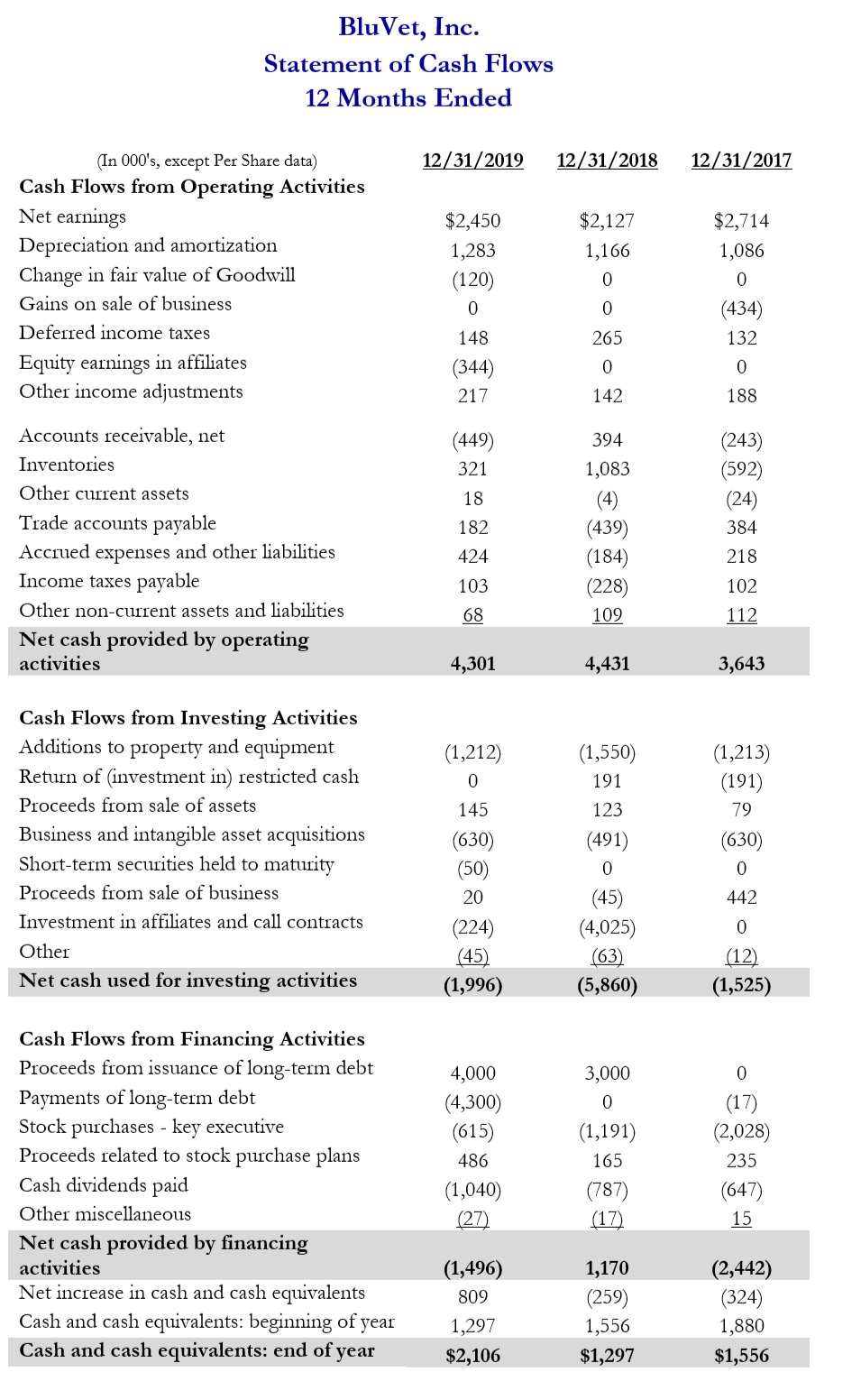

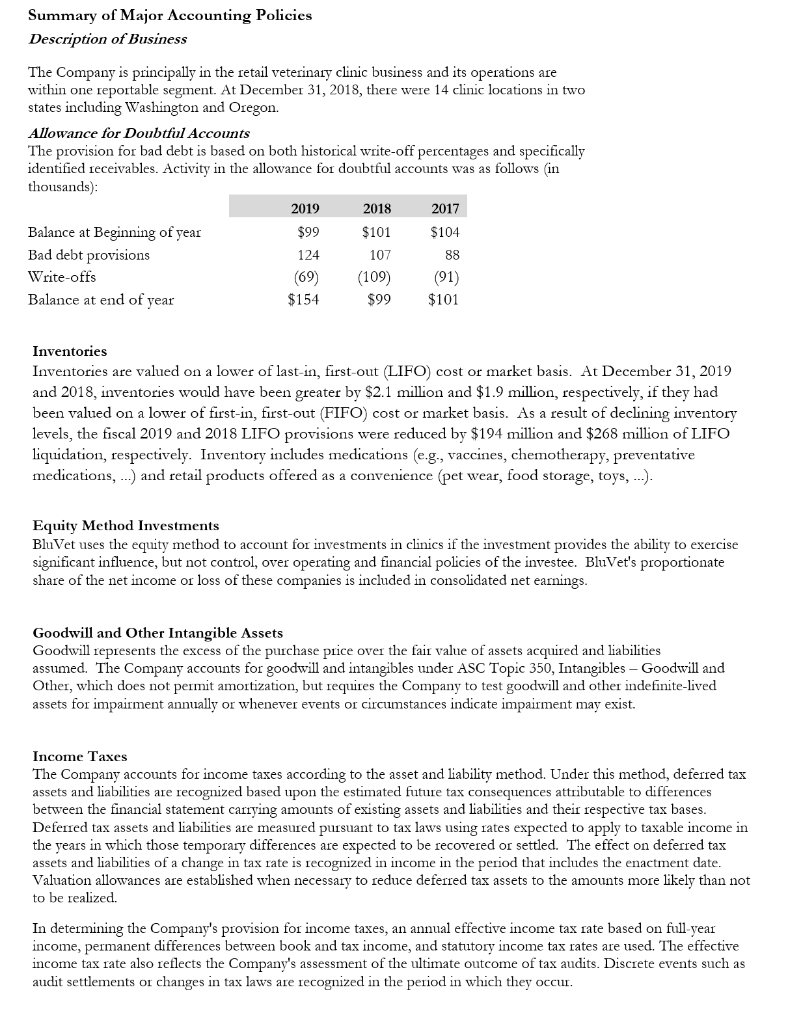

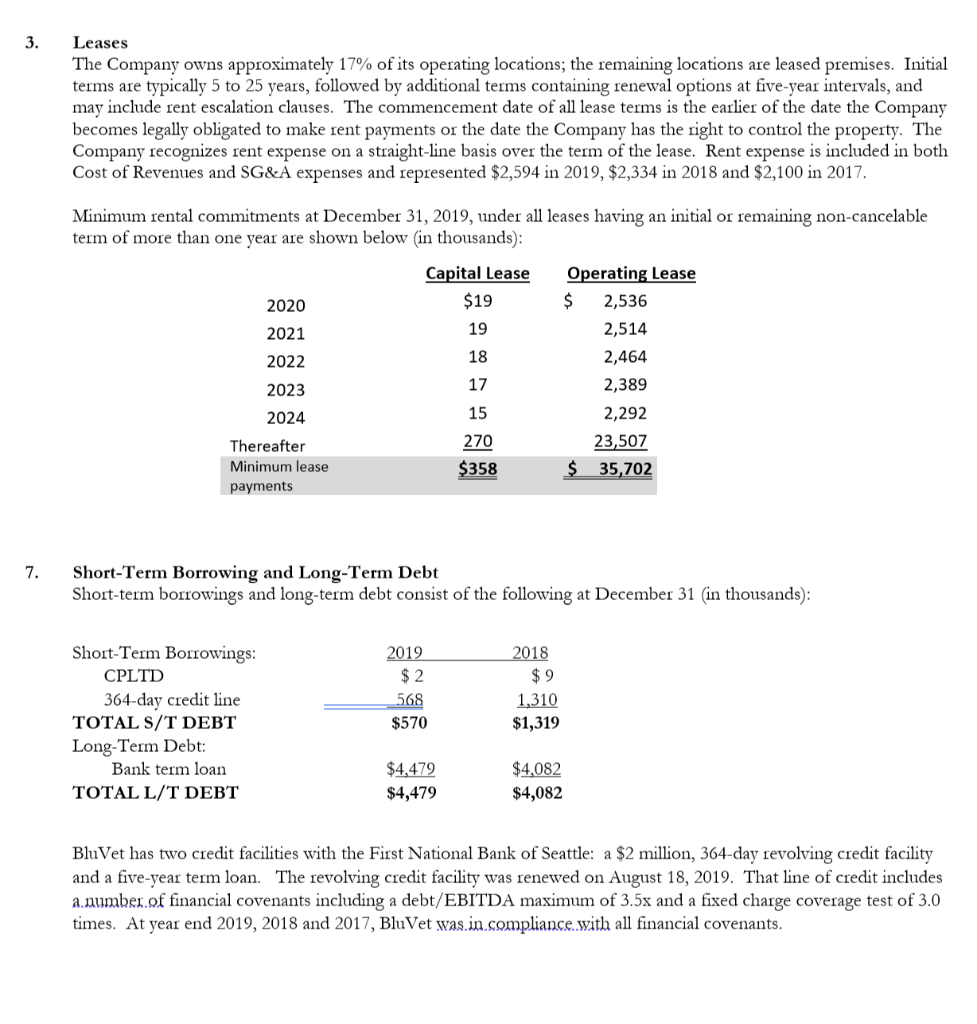

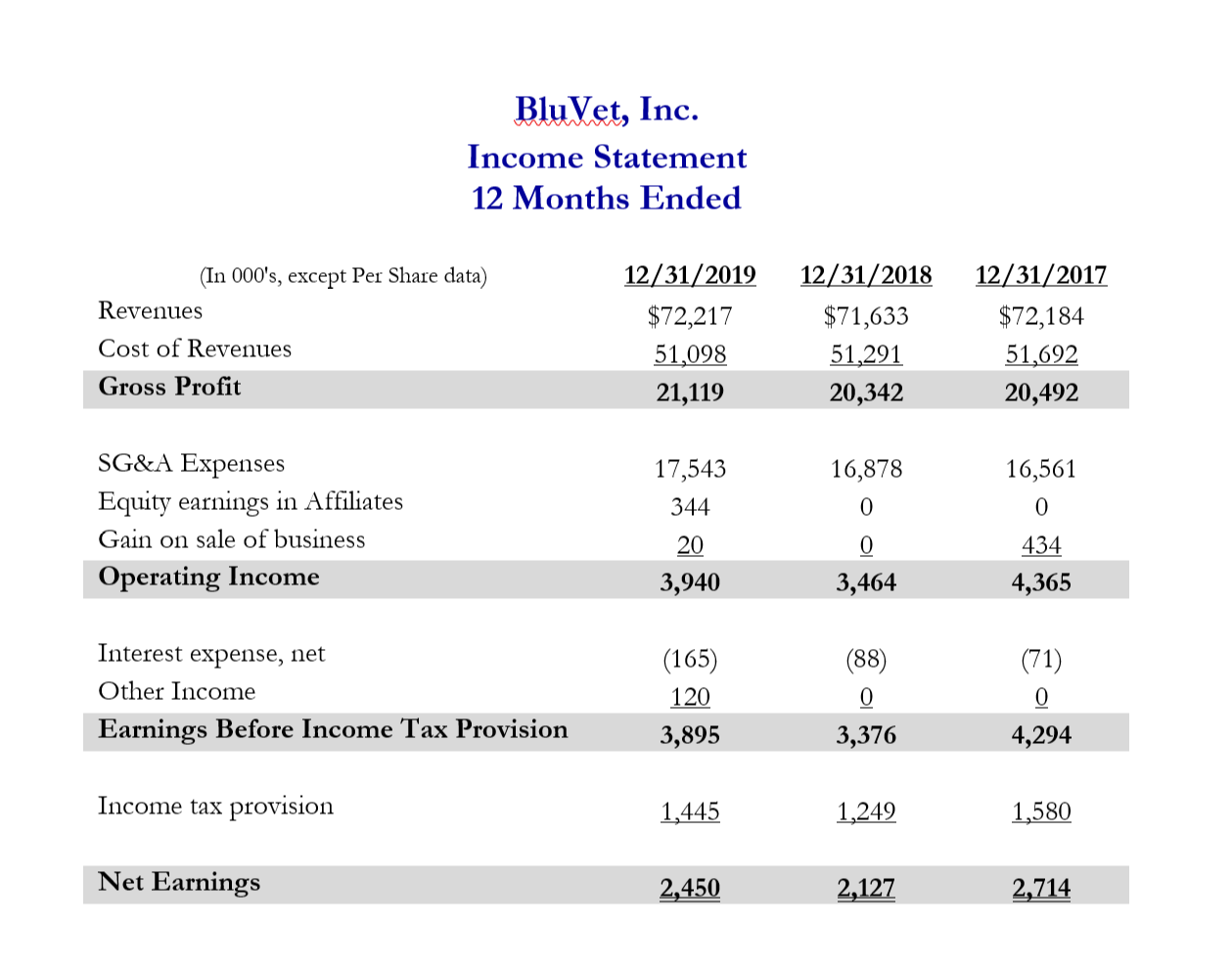

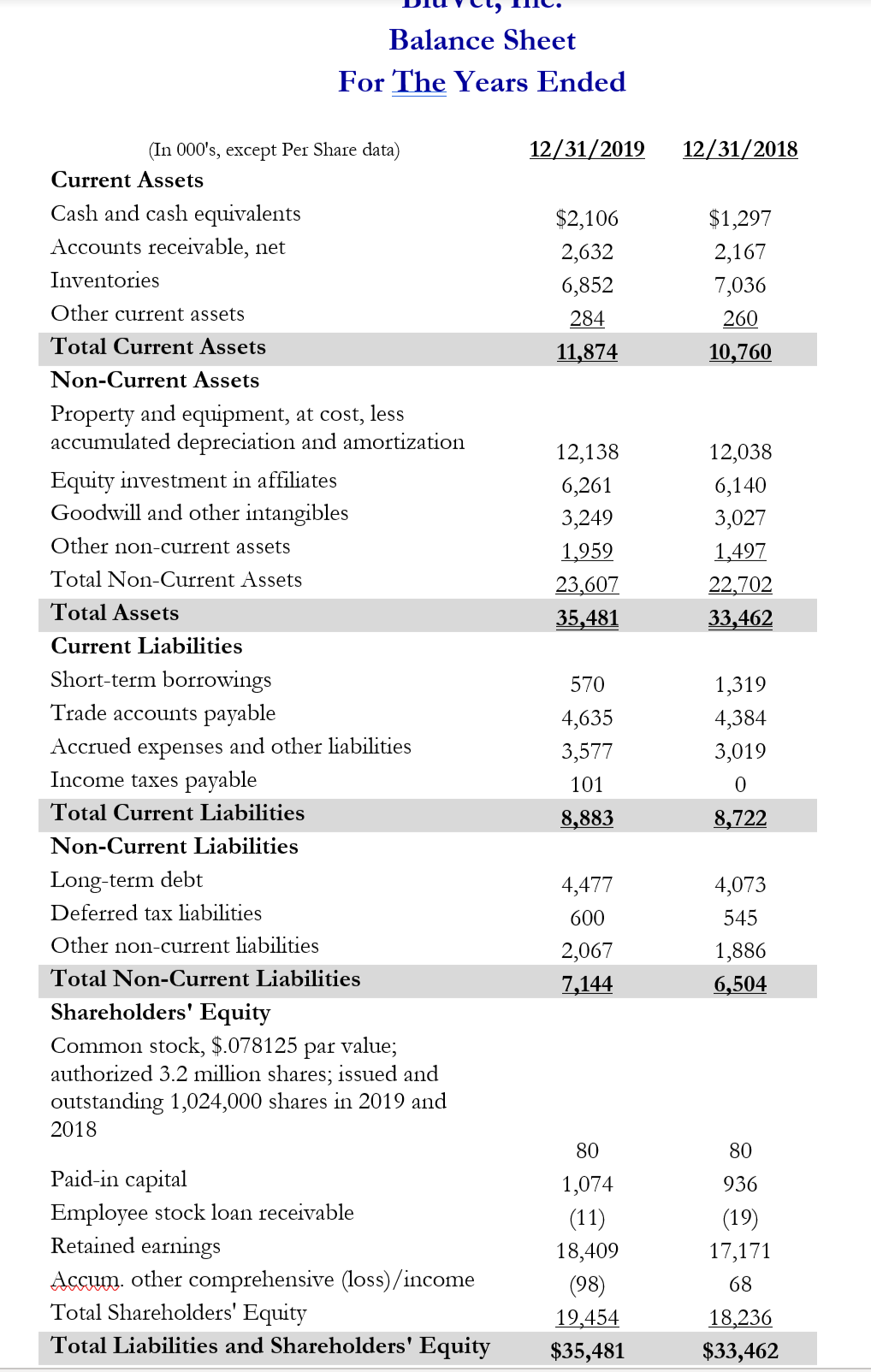

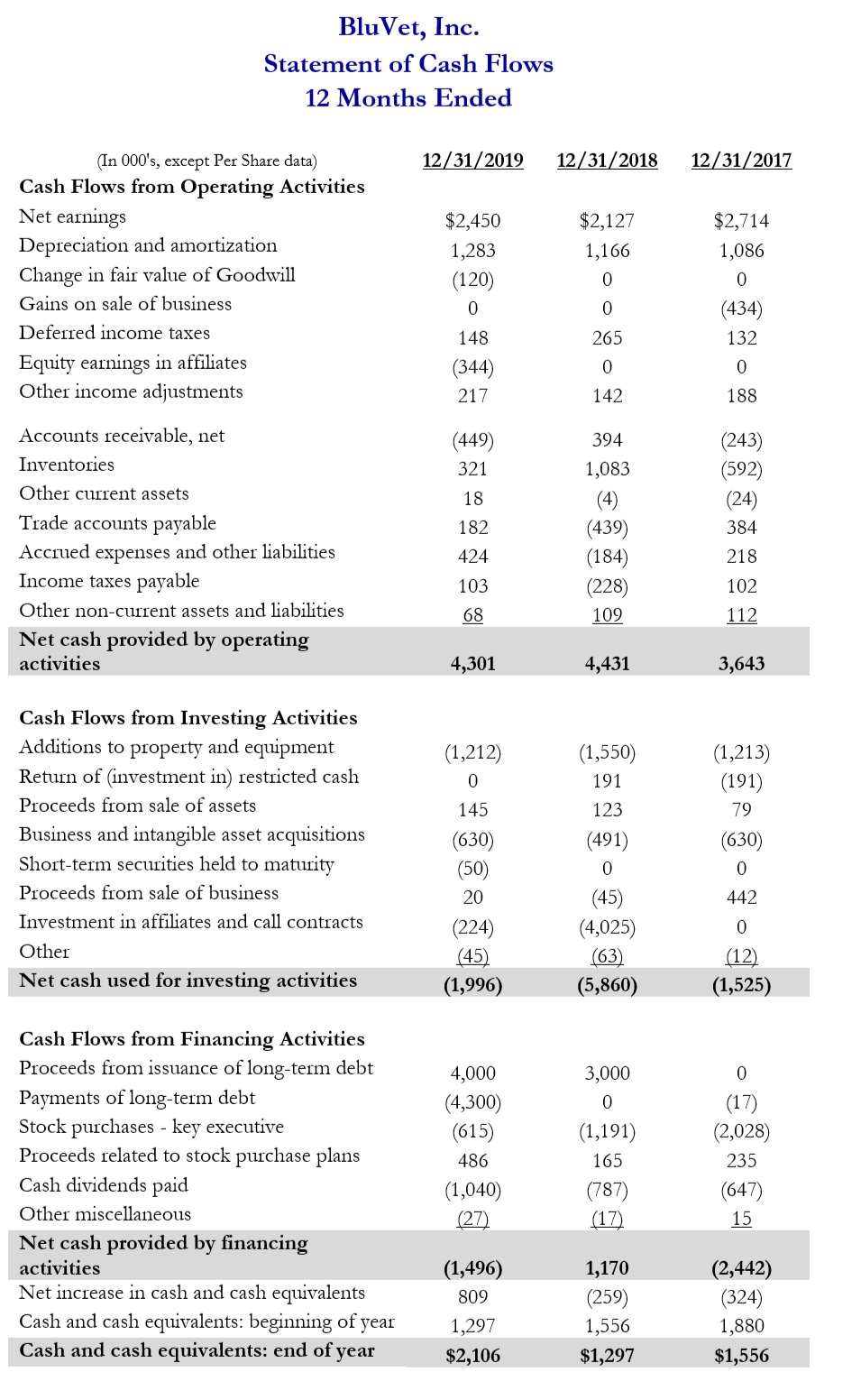

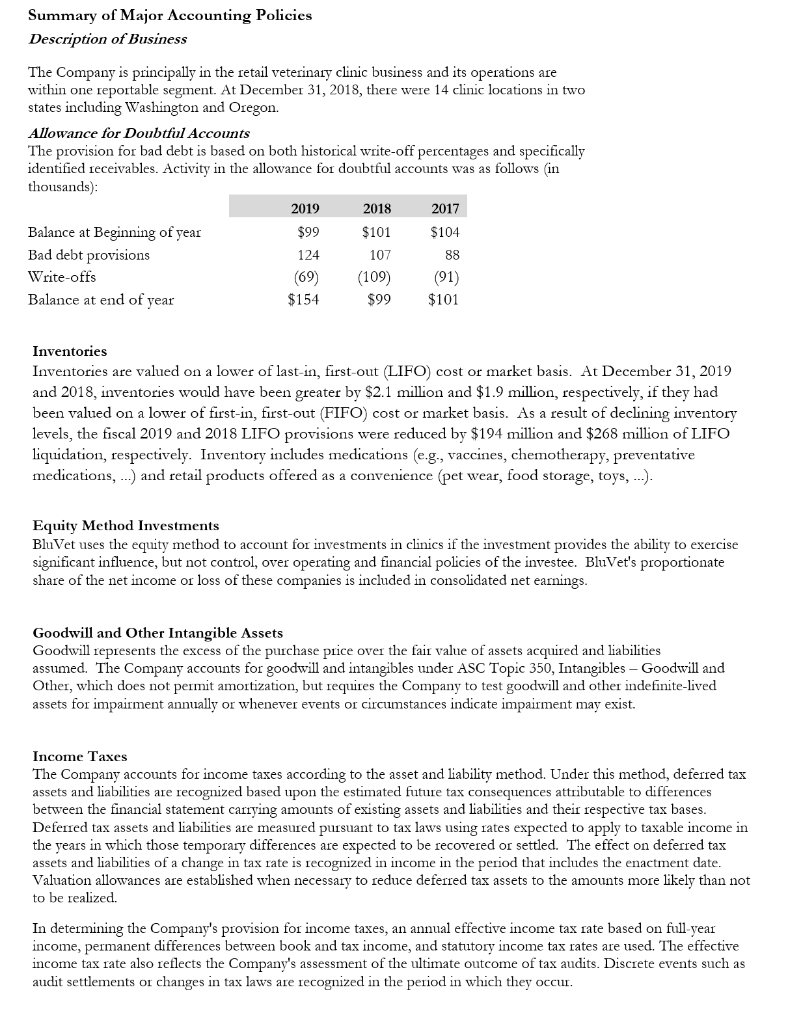

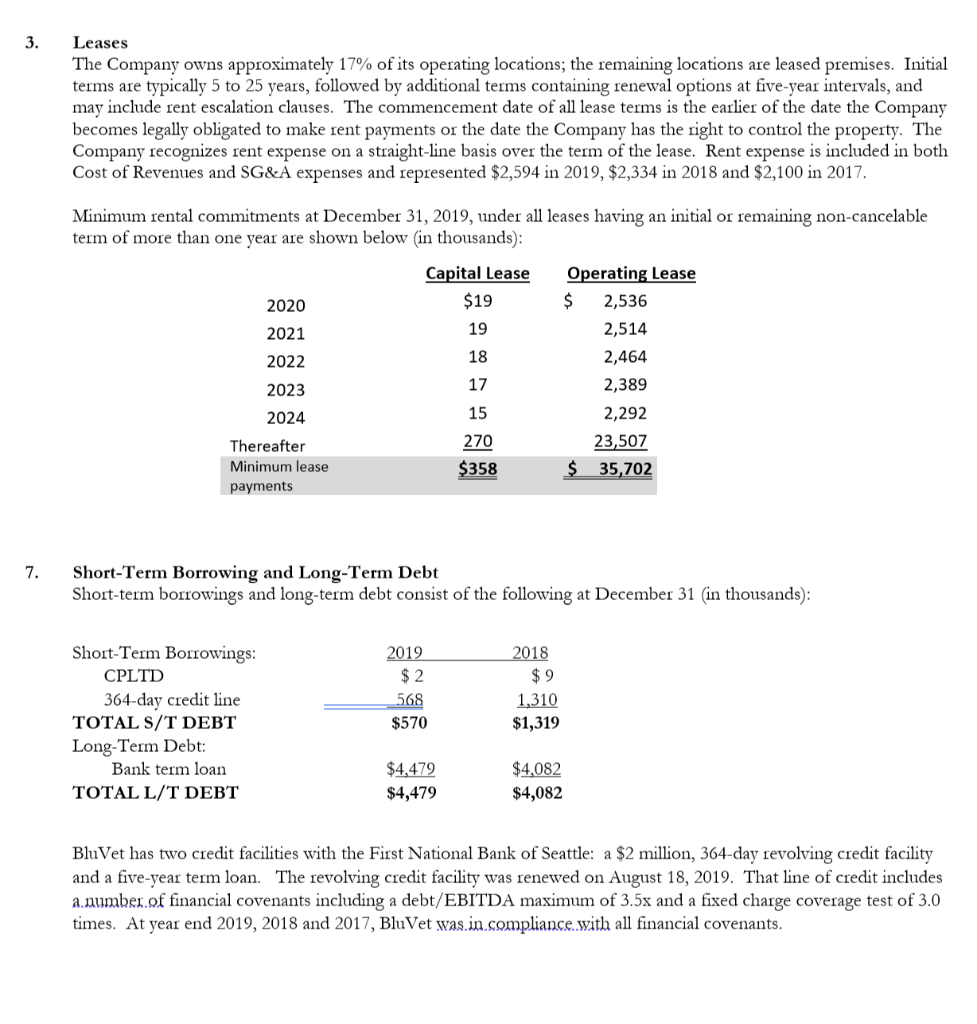

5. Explain the reference in the inventory note to the LIFO liquidation and what this means with.. regard to reported net income. 6. BluVet's accounts payable seem to be similar in size to debt. Does this suggest they have a high level of accounts payable? What tests can you perform to see if BluVet's accounts payable are reasonable or if they are stretching their pharmaceutical and other suppliers? Please do the math. 7. What is your specific view of BluVet's leverage given the stated operating strategy? 8. Provide descriptions of your ratio analysis in #1 above including liquidity, profitability, leverage, efficiency and returns. Using all of your findings in this case, provide your thoughts regarding both balance sheet strengths and weaknesses. What recommendations, if any, do you recommend to Dr. George? BluVet, Inc. Income Statement 12 Months Ended (In 000's, except Per Share data) Revenues Cost of Revenues Gross Profit 12/31/2019 $72,217 51,098 21,119 12/31/2018 $71,633 51,291 20,342 12/31/2017 $72,184 51,692 20,492 16,878 16,561 SG&A Expenses Equity earnings in Affiliates Gain on sale of business Operating Income 17,543 344 20 3,940 434 4,365 3,464 (71) Interest expense, net Other Income Earnings Before Income Tax Provision (165) 120 3,895 (88) 0 3,376 4,294 Income tax provision 1,445 1,249 1,580 Net Earnings 2,450 2,127 2,714 , . Balance Sheet For The Years Ended 12/31/2019 12/31/2018 $2,106 2,632 6,852 284 11,874 $1,297 2,167 7,036 260 10,760 12,138 6,261 3,249 1,959 23,607 35,481 12,038 6,140 3,027 1,497 22,702 33,462 (In 000's, except Per Share data) Current Assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total Current Assets Non-Current Assets Property and equipment, at cost, less accumulated depreciation and amortization Equity investment in affiliates Goodwill and other intangibles Other non-current assets Total Non-Current Assets Total Assets Current Liabilities Short-term borrowings Trade accounts payable Accrued expenses and other liabilities Income taxes payable Total Current Liabilities Non-Current Liabilities Long-term debt Deferred tax liabilities Other non-current liabilities Total Non-Current Liabilities Shareholders' Equity Common stock, $.078125 par value; authorized 3.2 million shares: issued and outstanding 1,024,000 shares in 2019 and 2018 570 4,635 3,577 101 8,883 1,319 4,384 3,019 8,722 4,477 600 2,067 7,144 4,073 545 1,886 6,504 80 Paid-in capital Employee stock loan receivable Retained earnings Accum. other comprehensive (loss)/income Total Shareholders Total Liabilities and Shareholders' Equity 80 1,074 (11) 18,409 (98) 19,454 $35,481 936 (19) 17,171 68 18,236 $33,462 BluVet, Inc. Statement of Cash Flows 12 Months Ended 12/31/2019 12/31/2018 12/31/2017 $2,450 1,283 (120) $2,127 1,166 (In 000's, except Per Share data) Cash Flows from Operating Activities Net earnings Depreciation and amortization Change in fair value of Goodwill Gains on sale of business Deferred income taxes Equity earnings in affiliates Other income adjustments $2,714 1,086 0 (434) 132 265 148 (344) 0 217 142 188 (449) (243) (592) 321 18 (24) 182 Accounts receivable, net Inventories Other current assets Trade accounts payable Accrued expenses and other liabilities Income taxes payable Other non-current assets and liabilities Net cash provided by operating activities 394 1,083 (4) (439) (184) (228) 109 384 218 424 103 102 68 112 4,301 4,431 3,643 (1,212) (1,213) (191) Cash Flows from Investing Activities Additions to property and equipment Return of investment in) restricted cash Proceeds from sale of assets Business and intangible asset acquisitions Short-term securities held to maturity Proceeds from sale of business Investment in affiliates and call contracts Other Net cash used for investing activities (1,550 191 123 (491) 79 (630) 0 145 (630) (50) 20 (224) (45) (1,996) (45) (4,025) (63) (5,860) 442 0 (12) (1,525) 3,000 0 (17) Cash Flows from Financing Activities Proceeds from issuance of long-term debt Payments of long-term debt Stock purchases - key executive Proceeds related to stock purchase plans Cash dividends paid Other miscellaneous Net cash provided by financing activities Net increase in cash and cash equivalents Cash and cash equivalents: beginning of year Cash and cash equivalents: end of year 4,000 (4,300) (615) 486 (1,040) (27) (1,191) 165 (787) (17) (2,028) 235 (647) 15 (1,496) 809 1,297 $2,106 1,170 (259) 1,556 $1,297 (2,442) (324) 1,880 $1,556 Summary of Major Accounting Policies Description of Business The Company is principally in the retail veterinary clinic business and its operations are within one reportable segment. At December 31, 2018, there were 14 clinic locations in two states including Washington and Oregon. Allowance for Doubtful Accounts The provision for bad debt is based on both historical write-off percentages and specifically identified receivables. Activity in the allowance for doubtful accounts was as follows (in thousands): 2019 2018 2017 Balance at Beginning of year $99 $101 $104 Bad debt provisions 124 107 88 Write-offs (69) (109) (91) Balance at end of year $154 $99 $101 Inventories Inventories are valued on a lower of last-in, first-out (LIFO) cost or market basis. At December 31, 2019 and 2018, inventories would have been greater by $2.1 million and $1.9 million, respectively, if they had been valued on a lower of first-in, first-out (FIFO) cost or market basis. As a result of declining inventory levels, the fiscal 2019 and 2018 LIFO provisions were reduced by $194 million and $268 million of LIFO liquidation, respectively. Inventory includes medications (e.g., vaccines, chemotherapy, preventative medications, ...) and retail products offered as a convenience (pet wear, food storage, toys, ...). Equity Method Investments BluVet uses the equity method to account for investments in clinics if the investment provides the ability to exercise significant influence, but not control, over operating and financial policies of the investee. BluVet's proportionate share of the net income or loss of these companies is included in consolidated net earnings. Goodwill and Other Intangible Assets Goodwill represents the excess of the purchase price over the fair value of assets acquired and liabilities assumed. The Company accounts for goodwill and intangibles under ASC Topic 350, Intangibles - Goodwill and Other, which does not permit amortization, but requires the Company to test goodwill and other indefinite-lived assets for impairment annually or whenever events or circumstances indicate impairment may exist. Income Taxes The Company accounts for income taxes according to the asset and liability method. Under this method, deferred tax assets and liabilities are recognized based upon the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured pursuant to tax laws using rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rate is recognized in income in the period that includes the enactment date. Valuation allowances are established when necessary to reduce deferred tax assets to the amounts more likely than not to be realized. In determining the Company's provision for income taxes, an annual effective income tax rate based on full-year income, permanent differences between book and tax income, and statutory income tax rates are used. The effective income tax rate also reflects the Company's assessment of the ultimate outcome of tax audits. Discrete events such as audit settlements or changes in tax laws are recognized in the period in which they occur. 3. Leases The Company owns approximately 17% of its operating locations; the remaining locations are leased premises. Initial terms are typically 5 to 25 years, followed by additional terms containing renewal options at five-year intervals, and may include rent escalation clauses. The commencement date of all lease terms is the earlier of the date the Company becomes legally obligated to make rent payments or the date the Company has the right to control the property. The Company recognizes rent expense on a straight-line basis over the term of the lease. Rent expense is included in both Cost of Revenues and SG&A expenses and represented $2,594 in 2019, $2,334 in 2018 and $2,100 in 2017. Minimum rental commitments at December 31, 2019, under all leases having an initial or remaining non-cancelable term of more than one year are shown below in thousands): Capital Lease $19 2020 2021 2022 2023 2024 Thereafter Minimum lease payments Operating Lease $ 2,536 2,514 2,464 2,389 2,292 23,507 $ 35,702 270 $358 Short-Term Borrowing and Long-Term Debt Short-term borrowings and long-term debt consist of the following at December 31 (in thousands): 2019 2018 $ 2 568 Short-Term Borrowings: CPLTD 364-day credit line TOTAL S/T DEBT Long-Term Debt: Bank term loan TOTAL L/T DEBT $ 9 1,310 $1,319 $570 $4,479 $4,479 $4,082 $4,082 BluVet has two credit facilities with the First National Bank of Seattle: a $2 million, 364-day revolving credit facility and a five-year term loan. The revolving credit facility was renewed on August 18, 2019. That line of credit includes a number of financial covenants including a debt/EBITDA maximum of 3.5x and a fixed charge coverage test of 3.0 times. At year end 2019, 2018 and 2017, BluVet was in compliance with all financial covenants. 5. Explain the reference in the inventory note to the LIFO liquidation and what this means with.. regard to reported net income. 6. BluVet's accounts payable seem to be similar in size to debt. Does this suggest they have a high level of accounts payable? What tests can you perform to see if BluVet's accounts payable are reasonable or if they are stretching their pharmaceutical and other suppliers? Please do the math. 7. What is your specific view of BluVet's leverage given the stated operating strategy? 8. Provide descriptions of your ratio analysis in #1 above including liquidity, profitability, leverage, efficiency and returns. Using all of your findings in this case, provide your thoughts regarding both balance sheet strengths and weaknesses. What recommendations, if any, do you recommend to Dr. George? BluVet, Inc. Income Statement 12 Months Ended (In 000's, except Per Share data) Revenues Cost of Revenues Gross Profit 12/31/2019 $72,217 51,098 21,119 12/31/2018 $71,633 51,291 20,342 12/31/2017 $72,184 51,692 20,492 16,878 16,561 SG&A Expenses Equity earnings in Affiliates Gain on sale of business Operating Income 17,543 344 20 3,940 434 4,365 3,464 (71) Interest expense, net Other Income Earnings Before Income Tax Provision (165) 120 3,895 (88) 0 3,376 4,294 Income tax provision 1,445 1,249 1,580 Net Earnings 2,450 2,127 2,714 , . Balance Sheet For The Years Ended 12/31/2019 12/31/2018 $2,106 2,632 6,852 284 11,874 $1,297 2,167 7,036 260 10,760 12,138 6,261 3,249 1,959 23,607 35,481 12,038 6,140 3,027 1,497 22,702 33,462 (In 000's, except Per Share data) Current Assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total Current Assets Non-Current Assets Property and equipment, at cost, less accumulated depreciation and amortization Equity investment in affiliates Goodwill and other intangibles Other non-current assets Total Non-Current Assets Total Assets Current Liabilities Short-term borrowings Trade accounts payable Accrued expenses and other liabilities Income taxes payable Total Current Liabilities Non-Current Liabilities Long-term debt Deferred tax liabilities Other non-current liabilities Total Non-Current Liabilities Shareholders' Equity Common stock, $.078125 par value; authorized 3.2 million shares: issued and outstanding 1,024,000 shares in 2019 and 2018 570 4,635 3,577 101 8,883 1,319 4,384 3,019 8,722 4,477 600 2,067 7,144 4,073 545 1,886 6,504 80 Paid-in capital Employee stock loan receivable Retained earnings Accum. other comprehensive (loss)/income Total Shareholders Total Liabilities and Shareholders' Equity 80 1,074 (11) 18,409 (98) 19,454 $35,481 936 (19) 17,171 68 18,236 $33,462 BluVet, Inc. Statement of Cash Flows 12 Months Ended 12/31/2019 12/31/2018 12/31/2017 $2,450 1,283 (120) $2,127 1,166 (In 000's, except Per Share data) Cash Flows from Operating Activities Net earnings Depreciation and amortization Change in fair value of Goodwill Gains on sale of business Deferred income taxes Equity earnings in affiliates Other income adjustments $2,714 1,086 0 (434) 132 265 148 (344) 0 217 142 188 (449) (243) (592) 321 18 (24) 182 Accounts receivable, net Inventories Other current assets Trade accounts payable Accrued expenses and other liabilities Income taxes payable Other non-current assets and liabilities Net cash provided by operating activities 394 1,083 (4) (439) (184) (228) 109 384 218 424 103 102 68 112 4,301 4,431 3,643 (1,212) (1,213) (191) Cash Flows from Investing Activities Additions to property and equipment Return of investment in) restricted cash Proceeds from sale of assets Business and intangible asset acquisitions Short-term securities held to maturity Proceeds from sale of business Investment in affiliates and call contracts Other Net cash used for investing activities (1,550 191 123 (491) 79 (630) 0 145 (630) (50) 20 (224) (45) (1,996) (45) (4,025) (63) (5,860) 442 0 (12) (1,525) 3,000 0 (17) Cash Flows from Financing Activities Proceeds from issuance of long-term debt Payments of long-term debt Stock purchases - key executive Proceeds related to stock purchase plans Cash dividends paid Other miscellaneous Net cash provided by financing activities Net increase in cash and cash equivalents Cash and cash equivalents: beginning of year Cash and cash equivalents: end of year 4,000 (4,300) (615) 486 (1,040) (27) (1,191) 165 (787) (17) (2,028) 235 (647) 15 (1,496) 809 1,297 $2,106 1,170 (259) 1,556 $1,297 (2,442) (324) 1,880 $1,556 Summary of Major Accounting Policies Description of Business The Company is principally in the retail veterinary clinic business and its operations are within one reportable segment. At December 31, 2018, there were 14 clinic locations in two states including Washington and Oregon. Allowance for Doubtful Accounts The provision for bad debt is based on both historical write-off percentages and specifically identified receivables. Activity in the allowance for doubtful accounts was as follows (in thousands): 2019 2018 2017 Balance at Beginning of year $99 $101 $104 Bad debt provisions 124 107 88 Write-offs (69) (109) (91) Balance at end of year $154 $99 $101 Inventories Inventories are valued on a lower of last-in, first-out (LIFO) cost or market basis. At December 31, 2019 and 2018, inventories would have been greater by $2.1 million and $1.9 million, respectively, if they had been valued on a lower of first-in, first-out (FIFO) cost or market basis. As a result of declining inventory levels, the fiscal 2019 and 2018 LIFO provisions were reduced by $194 million and $268 million of LIFO liquidation, respectively. Inventory includes medications (e.g., vaccines, chemotherapy, preventative medications, ...) and retail products offered as a convenience (pet wear, food storage, toys, ...). Equity Method Investments BluVet uses the equity method to account for investments in clinics if the investment provides the ability to exercise significant influence, but not control, over operating and financial policies of the investee. BluVet's proportionate share of the net income or loss of these companies is included in consolidated net earnings. Goodwill and Other Intangible Assets Goodwill represents the excess of the purchase price over the fair value of assets acquired and liabilities assumed. The Company accounts for goodwill and intangibles under ASC Topic 350, Intangibles - Goodwill and Other, which does not permit amortization, but requires the Company to test goodwill and other indefinite-lived assets for impairment annually or whenever events or circumstances indicate impairment may exist. Income Taxes The Company accounts for income taxes according to the asset and liability method. Under this method, deferred tax assets and liabilities are recognized based upon the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured pursuant to tax laws using rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rate is recognized in income in the period that includes the enactment date. Valuation allowances are established when necessary to reduce deferred tax assets to the amounts more likely than not to be realized. In determining the Company's provision for income taxes, an annual effective income tax rate based on full-year income, permanent differences between book and tax income, and statutory income tax rates are used. The effective income tax rate also reflects the Company's assessment of the ultimate outcome of tax audits. Discrete events such as audit settlements or changes in tax laws are recognized in the period in which they occur. 3. Leases The Company owns approximately 17% of its operating locations; the remaining locations are leased premises. Initial terms are typically 5 to 25 years, followed by additional terms containing renewal options at five-year intervals, and may include rent escalation clauses. The commencement date of all lease terms is the earlier of the date the Company becomes legally obligated to make rent payments or the date the Company has the right to control the property. The Company recognizes rent expense on a straight-line basis over the term of the lease. Rent expense is included in both Cost of Revenues and SG&A expenses and represented $2,594 in 2019, $2,334 in 2018 and $2,100 in 2017. Minimum rental commitments at December 31, 2019, under all leases having an initial or remaining non-cancelable term of more than one year are shown below in thousands): Capital Lease $19 2020 2021 2022 2023 2024 Thereafter Minimum lease payments Operating Lease $ 2,536 2,514 2,464 2,389 2,292 23,507 $ 35,702 270 $358 Short-Term Borrowing and Long-Term Debt Short-term borrowings and long-term debt consist of the following at December 31 (in thousands): 2019 2018 $ 2 568 Short-Term Borrowings: CPLTD 364-day credit line TOTAL S/T DEBT Long-Term Debt: Bank term loan TOTAL L/T DEBT $ 9 1,310 $1,319 $570 $4,479 $4,479 $4,082 $4,082 BluVet has two credit facilities with the First National Bank of Seattle: a $2 million, 364-day revolving credit facility and a five-year term loan. The revolving credit facility was renewed on August 18, 2019. That line of credit includes a number of financial covenants including a debt/EBITDA maximum of 3.5x and a fixed charge coverage test of 3.0 times. At year end 2019, 2018 and 2017, BluVet was in compliance with all financial covenants