Answered step by step

Verified Expert Solution

Question

1 Approved Answer

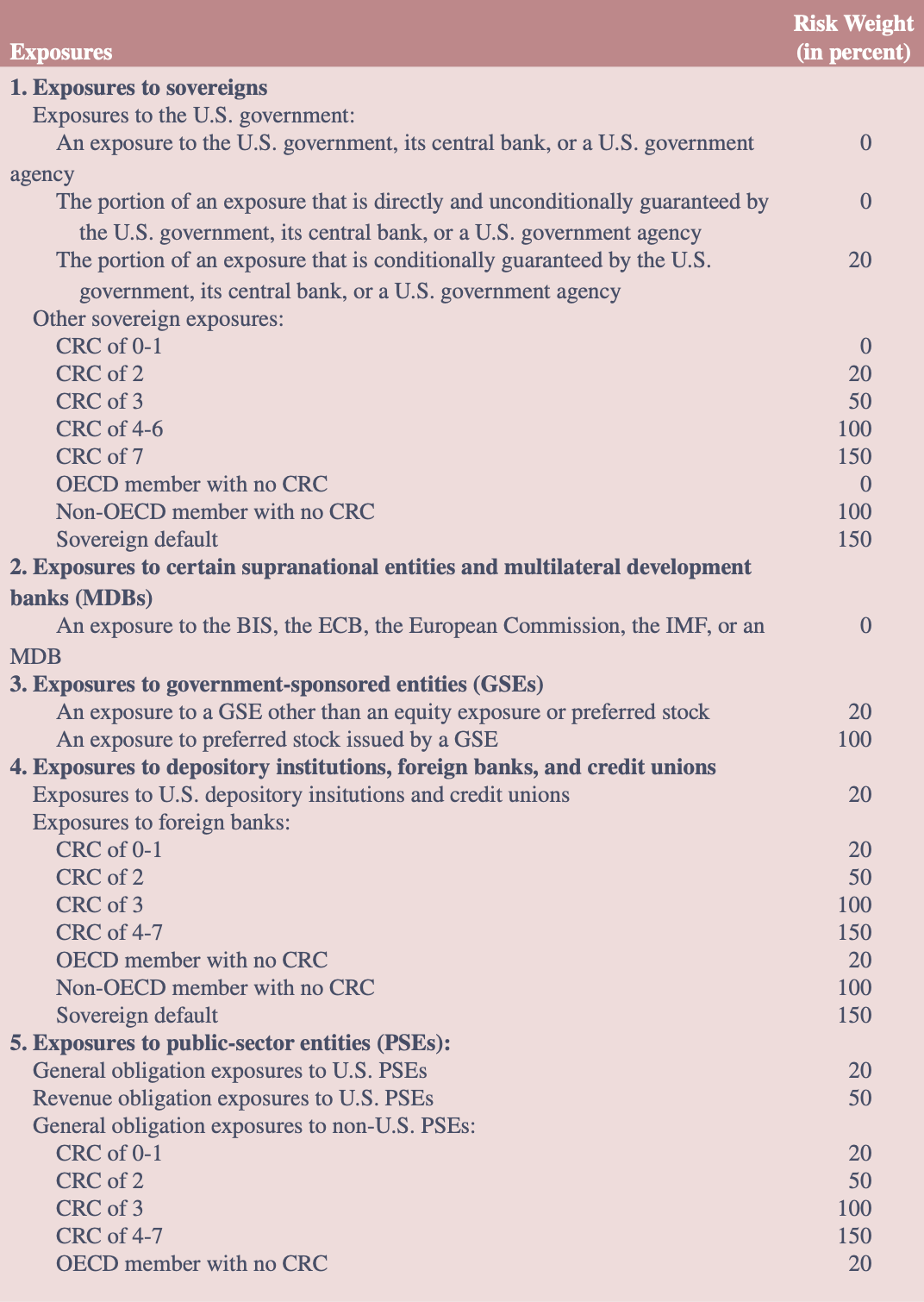

5. Exposures to public-sector entities (PSEs): General obligation exposures to U.S. PSEs Revenue obligation exposures to U.S. PSEs General obligation exposures to non-U.S. PSEs: CRC

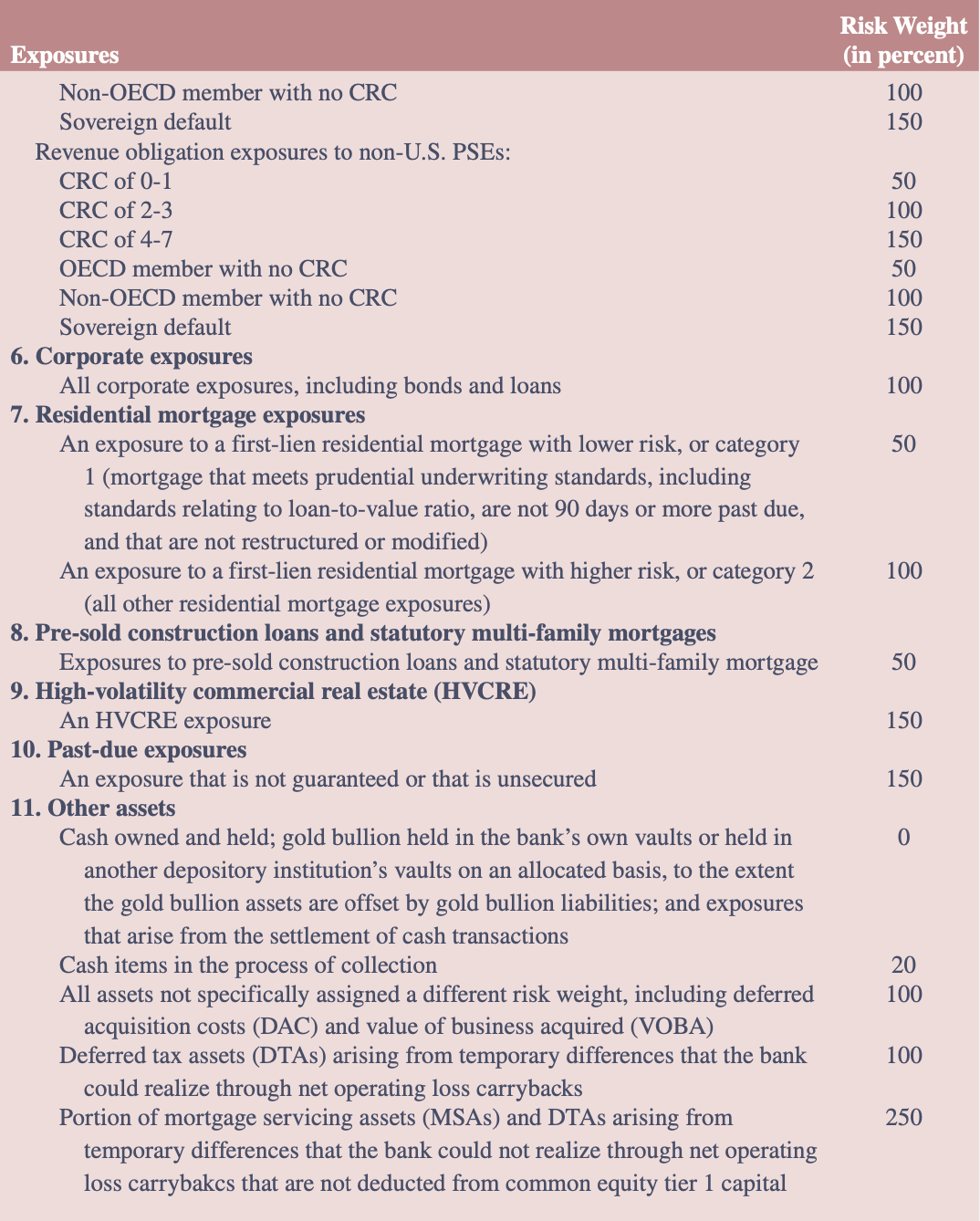

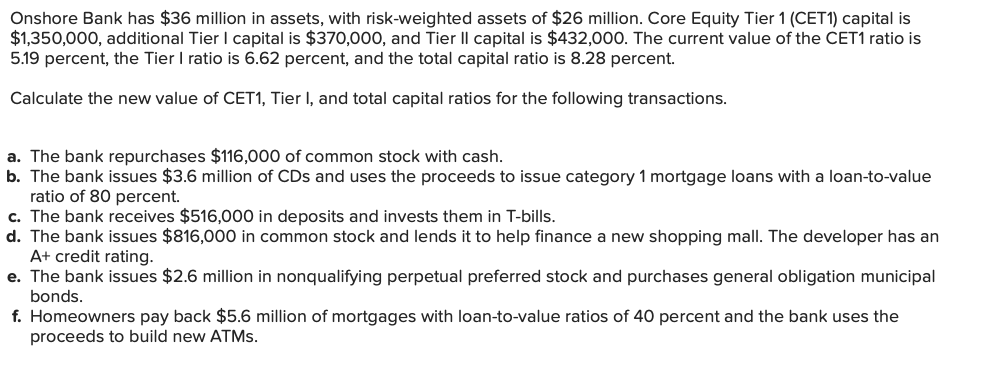

5. Exposures to public-sector entities (PSEs): General obligation exposures to U.S. PSEs Revenue obligation exposures to U.S. PSEs General obligation exposures to non-U.S. PSEs: CRC of 0-1 CRC of 2 CRC of 3 CRC of 4-7 OECD member with no CRC Risk Weight Exposures (in percent) Non-OECD member with no CRC 100 Sovereign default Revenue obligation exposures to non-U.S. PSEs: CRC of 01 CRC of 23 CRC of 4-7 OECD member with no CRC Non-OECD member with no CRC Sovereign default 6. Corporate exposures All corporate exposures, including bonds and loans 100 7. Residential mortgage exposures An exposure to a first-lien residential mortgage with lower risk, or category 50 1 (mortgage that meets prudential underwriting standards, including standards relating to loan-to-value ratio, are not 90 days or more past due, and that are not restructured or modified) An exposure to a first-lien residential mortgage with higher risk, or category 2100 (all other residential mortgage exposures) 8. Pre-sold construction loans and statutory multi-family mortgages Exposures to pre-sold construction loans and statutory multi-family mortgage 50 9. High-volatility commercial real estate (HVCRE) An HVCRE exposure 150 10. Past-due exposures An exposure that is not guaranteed or that is unsecured 150 11. Other assets Cash owned and held; gold bullion held in the bank's own vaults or held in 0 another depository institution's vaults on an allocated basis, to the extent the gold bullion assets are offset by gold bullion liabilities; and exposures that arise from the settlement of cash transactions Cash items in the process of collection All assets not specifically assigned a different risk weight, including deferred 100 acquisition costs (DAC) and value of business acquired (VOBA) Deferred tax assets (DTAs) arising from temporary differences that the bank 100 could realize through net operating loss carrybacks Portion of mortgage servicing assets (MSAs) and DTAs arising from 250 temporary differences that the bank could not realize through net operating loss carrybakcs that are not deducted from common equity tier 1 capital Onshore Bank has $36 million in assets, with risk-weighted assets of $26 million. Core Equity Tier 1 (CET1) capital is $1,350,000, additional Tier I capital is $370,000, and Tier II capital is $432,000. The current value of the CET1 ratio is 5.19 percent, the Tier I ratio is 6.62 percent, and the total capital ratio is 8.28 percent. Calculate the new value of CET1, Tier I, and total capital ratios for the following transactions. a. The bank repurchases $116,000 of common stock with cash. b. The bank issues $3.6 million of CDs and uses the proceeds to issue category 1 mortgage loans with a loan-to-value ratio of 80 percent. c. The bank receives $516,000 in deposits and invests them in T-bills. d. The bank issues $816,000 in common stock and lends it to help finance a new shopping mall. The developer has an A+ credit rating. e. The bank issues $2.6 million in nonqualifying perpetual preferred stock and purchases general obligation municipal bonds. f. Homeowners pay back $5.6 million of mortgages with loan-to-value ratios of 40 percent and the bank uses the proceeds to build new ATMs

5. Exposures to public-sector entities (PSEs): General obligation exposures to U.S. PSEs Revenue obligation exposures to U.S. PSEs General obligation exposures to non-U.S. PSEs: CRC of 0-1 CRC of 2 CRC of 3 CRC of 4-7 OECD member with no CRC Risk Weight Exposures (in percent) Non-OECD member with no CRC 100 Sovereign default Revenue obligation exposures to non-U.S. PSEs: CRC of 01 CRC of 23 CRC of 4-7 OECD member with no CRC Non-OECD member with no CRC Sovereign default 6. Corporate exposures All corporate exposures, including bonds and loans 100 7. Residential mortgage exposures An exposure to a first-lien residential mortgage with lower risk, or category 50 1 (mortgage that meets prudential underwriting standards, including standards relating to loan-to-value ratio, are not 90 days or more past due, and that are not restructured or modified) An exposure to a first-lien residential mortgage with higher risk, or category 2100 (all other residential mortgage exposures) 8. Pre-sold construction loans and statutory multi-family mortgages Exposures to pre-sold construction loans and statutory multi-family mortgage 50 9. High-volatility commercial real estate (HVCRE) An HVCRE exposure 150 10. Past-due exposures An exposure that is not guaranteed or that is unsecured 150 11. Other assets Cash owned and held; gold bullion held in the bank's own vaults or held in 0 another depository institution's vaults on an allocated basis, to the extent the gold bullion assets are offset by gold bullion liabilities; and exposures that arise from the settlement of cash transactions Cash items in the process of collection All assets not specifically assigned a different risk weight, including deferred 100 acquisition costs (DAC) and value of business acquired (VOBA) Deferred tax assets (DTAs) arising from temporary differences that the bank 100 could realize through net operating loss carrybacks Portion of mortgage servicing assets (MSAs) and DTAs arising from 250 temporary differences that the bank could not realize through net operating loss carrybakcs that are not deducted from common equity tier 1 capital Onshore Bank has $36 million in assets, with risk-weighted assets of $26 million. Core Equity Tier 1 (CET1) capital is $1,350,000, additional Tier I capital is $370,000, and Tier II capital is $432,000. The current value of the CET1 ratio is 5.19 percent, the Tier I ratio is 6.62 percent, and the total capital ratio is 8.28 percent. Calculate the new value of CET1, Tier I, and total capital ratios for the following transactions. a. The bank repurchases $116,000 of common stock with cash. b. The bank issues $3.6 million of CDs and uses the proceeds to issue category 1 mortgage loans with a loan-to-value ratio of 80 percent. c. The bank receives $516,000 in deposits and invests them in T-bills. d. The bank issues $816,000 in common stock and lends it to help finance a new shopping mall. The developer has an A+ credit rating. e. The bank issues $2.6 million in nonqualifying perpetual preferred stock and purchases general obligation municipal bonds. f. Homeowners pay back $5.6 million of mortgages with loan-to-value ratios of 40 percent and the bank uses the proceeds to build new ATMs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started