Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5 FIN4801_2021_fina... x 6 / 13 144% Question 2.6 (6 marks) Wilikens Ltd manufactures and sells bespoke shoes in their own retail outlets. The company

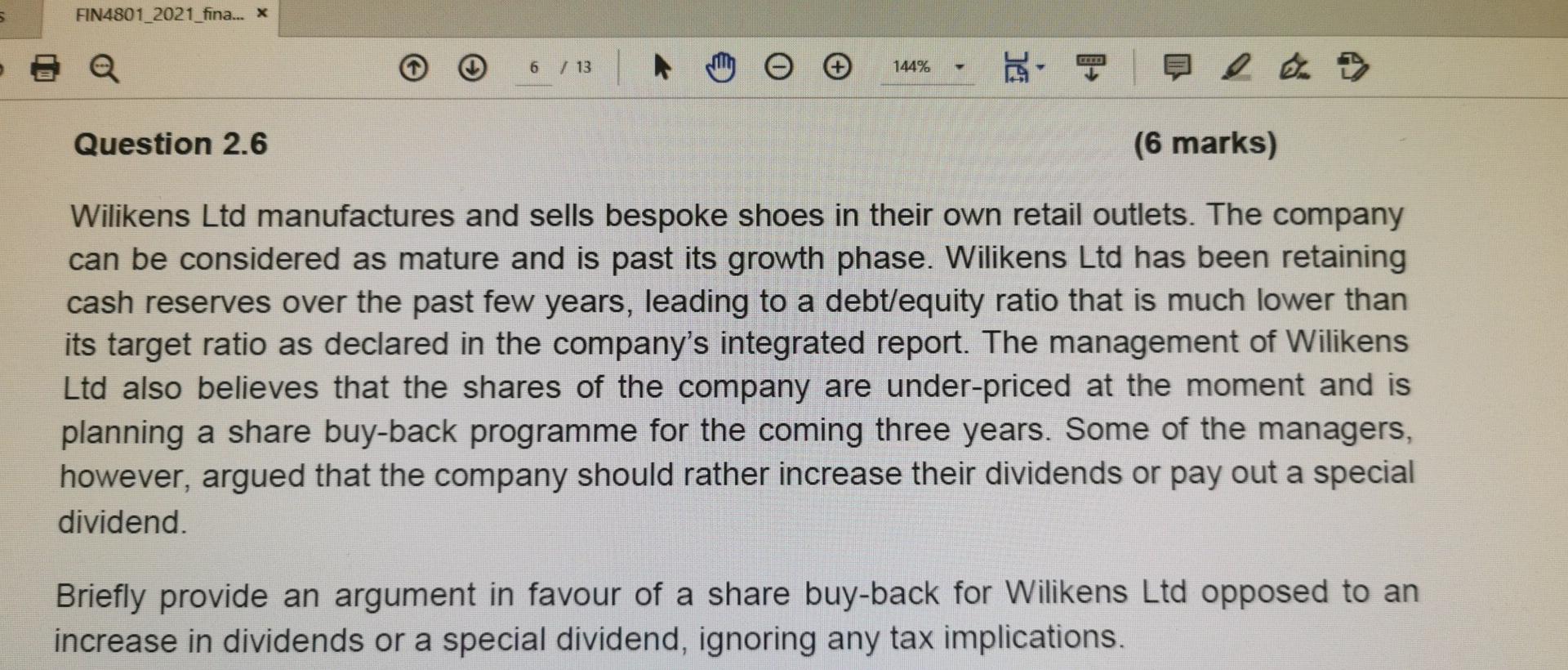

5 FIN4801_2021_fina... x 6 / 13 144% Question 2.6 (6 marks) Wilikens Ltd manufactures and sells bespoke shoes in their own retail outlets. The company can be considered as mature and is past its growth phase. Wilikens Ltd has been retaining cash reserves over the past few years, leading to a debt/equity ratio that is much lower than its target ratio as declared in the company's integrated report. The management of Wilikens Ltd also believes that the shares of the company are under-priced at the moment and is planning a share buy-back programme for the coming three years. Some of the managers, however, argued that the company should rather increase their dividends or pay out a special dividend. Briefly provide an argument in favour of a share buy-back for Wilikens Ltd opposed to an increase in dividends or a special dividend, ignoring any tax implications

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started