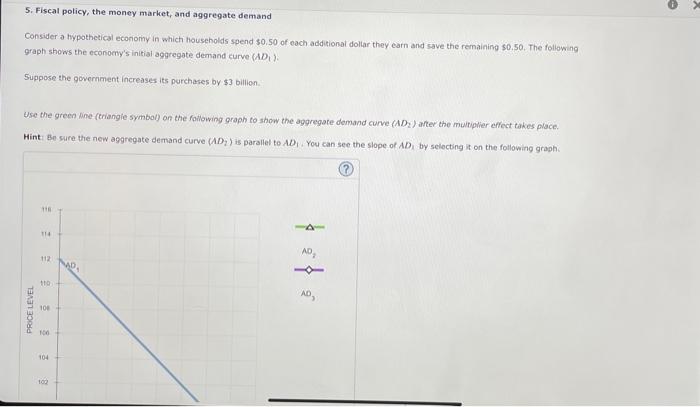

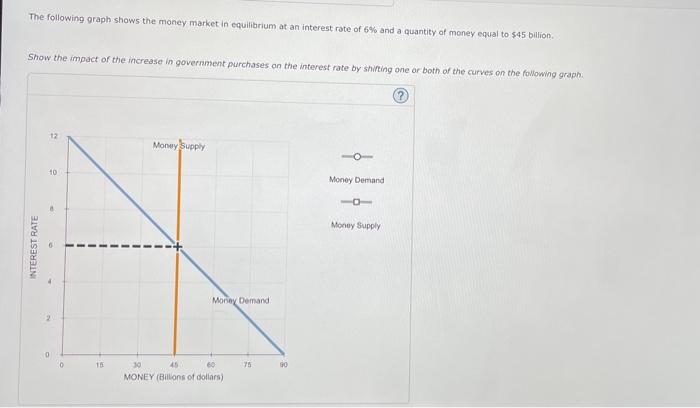

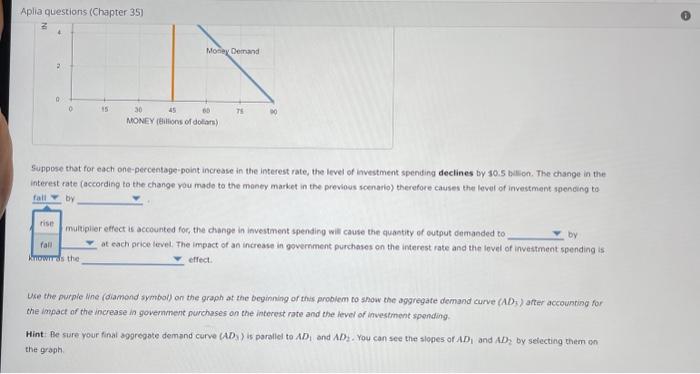

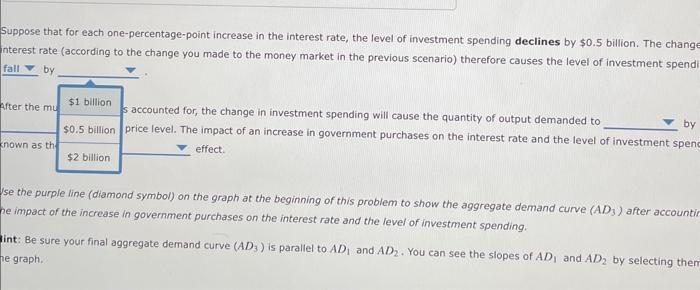

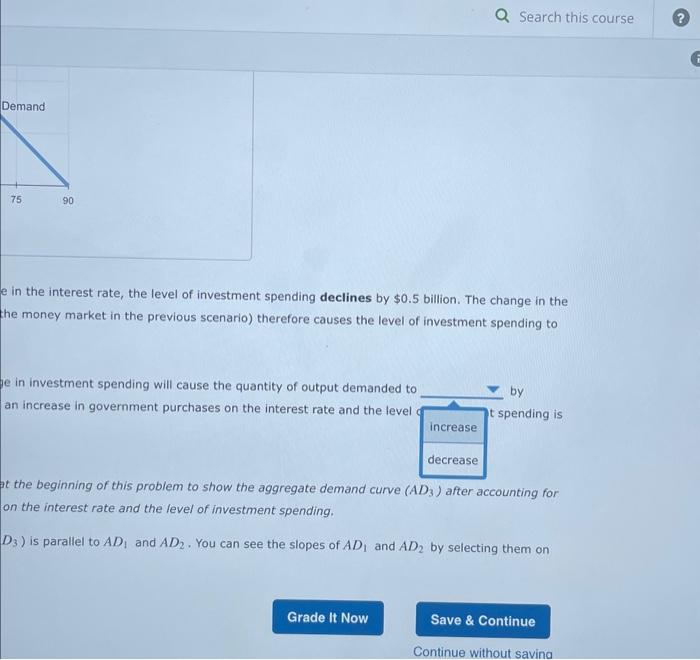

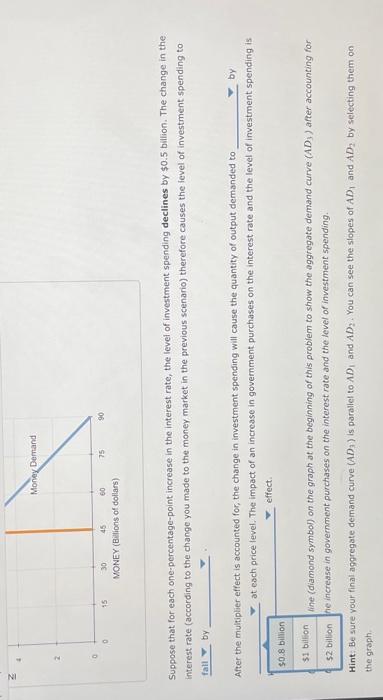

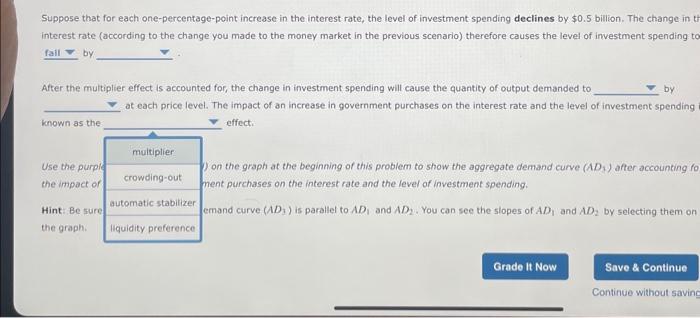

5. Fiscal policy, the money market, and aggregate demand Consider a bypothetical econoriy in which houscholds spend 50.50 of each additional doliar they earn and save the remaining 50.50 . The following graph shows the economy's initiai aggregate demand curve (AD1). Suppose the government increases its purchases by $3 billion. Use the green line (eriangle symbol) an the fanowing graph to show the aggregate demand curve (AD.) anker the muitipier effect takes place. Hint Be sure the new aggregate demand curve (AD2) is parallel to AD1. You can see the slope of AD, by selocting it on the following graphi The following graph shows the money market in equilibrium at an interest rate of 6% and a quantity af meney equal to $45 billion. Show the impact of the increase in govermment purchases on the interest rate by shilting one ar both of the curves on the following oraph. Aplia questions (Chapter 35) Suppose that for each one-percentage-point increase in the interest rate, the ievel of investment spending declines by 30.5 billon. The change in the interest rate (according to the change you made to the maney market in the prevous scenario) therefore causes the level of investment spencing to by mulipier effect is accounted for, the change in investment spendirg will cause the quantity of output demanded to by at each price level. The impact of an increave in government purchases on the interest rate and the level of investment spending is the effec. Use the purpic ine (diamond symbol) on the graph at the beginning of this probiem to show the aggregate demand curve (AD), atter accountiog for the impact of the increase in govermment purchases on the interest rate and the level of investment sponding. Hint Be sure your final apgregote demand curve (AD3) is pardilel to AD1 and AD2. You can see the slopes of AD1 and AD2 by setecting them on the graph. fuppose that for each one-percentage-point increase in the interest rate, the level of investment spending declines by $0.5 billion. The chang iterest rate (according to the change you made to the money market in the previous scenario) therefore causes the level of investment spend by fter the mt accounted for, the change in investment spending will cause the quantity of output demanded to price level. The impact of an increase in government purchases on the interest rate and the level of investment spen effect. se the purple line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (AD 3 ) after accounti e impact of the increase in government purchases on the interest rate and the level of investment spending. Be sure your final aggregate demand curve (AD3) is parallel to AD1 and AD2. You can see the slopes of AD1 and AD2 by selecting then e graph. e in the interest rate, the level of investment spending declines by $0.5 billion. The change in the the money market in the previous scenario) therefore causes the level of investment spending to in investment spending will cause the quantity of output demanded to an increase in government purchases on the interest rate and the level by t spending is the beginning of this problem to show the aggregate demand curve (AD3) after accounting for on the interest rate and the level of investment spending. D3 ) is parallel to AD1 and AD2. You can see the slopes of AD1 and AD2 by selecting them on Suppose that for each one-percentage-point increase in the interest rate, the level of investment spending declines by $0.5 billion. The change in the interest rate (according to the chango you made to the money market in the previous scenario) therefore causes the level of investment spending to fall F by After the multiplier effect is accounted for, the change in investment spending will cause the quantity of output demanded to by at cach price level. The impact of an increase in government purchases on the interest rate and the level of investment spending is effect. line (diamond symbol) on the graph at the beginning of this problem to show the aggregate demand curve (ADy) after accounting for Hint Be sure vour final aggregate demand curve (AD3) is parallel to AD1 and AD2. You can see the slopes of AD1 and AD2 by selecting them on the oraph. Suppose that for each one-percentage-point increase in the interest rate, the level of investment spending declines by $0.5 bilion. The change in ti interest rate (according to the change you made to the money market in the previous scenario) therefore causes the level of investment spending to by After the multiplier effect is accounted for, the change in investment spending will cause the quantity of output demanded to at each price level. The impact of an increase in government purchases on the interest rate and the level of investment spending known as the effecti. Use the purpi on the graph at the beginning of this problem to show the aggregate demand curve (AD b 3 after accounting fo the impact of rent purchases on the interest rate and the level of investment spending. Hint: Be sur imand curve (AD3) is parallel to AD1 and AD2. You can see the slopes of AD1 and AD2 by selecting them on the graph