Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. (Float Notes and Interest Rate Swaps) A float note or floating rate bond is characterized by by a face value F and a maturity

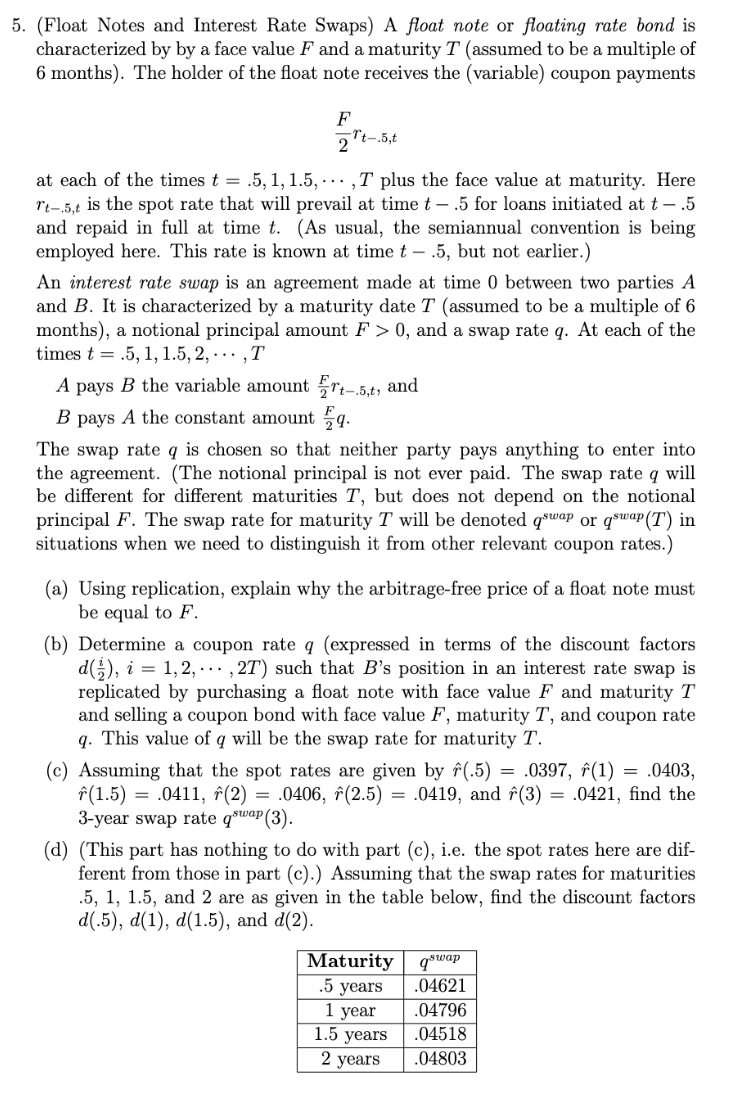

5. (Float Notes and Interest Rate Swaps) A float note or floating rate bond is characterized by by a face value F and a maturity T (assumed to be a multiple of 6 months). The holder of the float note receives the (variable) coupon payments 2Frt.5,t at each of the times t=.5,1,1.5,,T plus the face value at maturity. Here rt.5,t is the spot rate that will prevail at time t.5 for loans initiated at t.5 and repaid in full at time t. (As usual, the semiannual convention is being employed here. This rate is known at time t.5, but not earlier.) An interest rate swap is an agreement made at time 0 between two parties A and B. It is characterized by a maturity date T (assumed to be a multiple of 6 months), a notional principal amount F>0, and a swap rate q. At each of the times t=.5,1,1.5,2,,T A pays B the variable amount 2Frt.5,t, and B pays A the constant amount 2Fq. The swap rate q is chosen so that neither party pays anything to enter into the agreement. (The notional principal is not ever paid. The swap rate q will be different for different maturities T, but does not depend on the notional principal F. The swap rate for maturity T will be denoted qswap or qswap(T) in situations when we need to distinguish it from other relevant coupon rates.) (a) Using replication, explain why the arbitrage-free price of a float note must be equal to F. (b) Determine a coupon rate q (expressed in terms of the discount factors d(2i),i=1,2,,2T) such that B 's position in an interest rate swap is replicated by purchasing a float note with face value F and maturity T and selling a coupon bond with face value F, maturity T, and coupon rate q. This value of q will be the swap rate for maturity T. (c) Assuming that the spot rates are given by r^(.5)=.0397,r^(1)=.0403, r^(1.5)=.0411,r^(2)=.0406,r^(2.5)=.0419, and r^(3)=.0421, find the 3-year swap rate qswap(3). (d) (This part has nothing to do with part (c), i.e. the spot rates here are different from those in part (c).) Assuming that the swap rates for maturities .5,1,1.5, and 2 are as given in the table below, find the discount factors d(.5),d(1),d(1.5), and d(2). 5. (Float Notes and Interest Rate Swaps) A float note or floating rate bond is characterized by by a face value F and a maturity T (assumed to be a multiple of 6 months). The holder of the float note receives the (variable) coupon payments 2Frt.5,t at each of the times t=.5,1,1.5,,T plus the face value at maturity. Here rt.5,t is the spot rate that will prevail at time t.5 for loans initiated at t.5 and repaid in full at time t. (As usual, the semiannual convention is being employed here. This rate is known at time t.5, but not earlier.) An interest rate swap is an agreement made at time 0 between two parties A and B. It is characterized by a maturity date T (assumed to be a multiple of 6 months), a notional principal amount F>0, and a swap rate q. At each of the times t=.5,1,1.5,2,,T A pays B the variable amount 2Frt.5,t, and B pays A the constant amount 2Fq. The swap rate q is chosen so that neither party pays anything to enter into the agreement. (The notional principal is not ever paid. The swap rate q will be different for different maturities T, but does not depend on the notional principal F. The swap rate for maturity T will be denoted qswap or qswap(T) in situations when we need to distinguish it from other relevant coupon rates.) (a) Using replication, explain why the arbitrage-free price of a float note must be equal to F. (b) Determine a coupon rate q (expressed in terms of the discount factors d(2i),i=1,2,,2T) such that B 's position in an interest rate swap is replicated by purchasing a float note with face value F and maturity T and selling a coupon bond with face value F, maturity T, and coupon rate q. This value of q will be the swap rate for maturity T. (c) Assuming that the spot rates are given by r^(.5)=.0397,r^(1)=.0403, r^(1.5)=.0411,r^(2)=.0406,r^(2.5)=.0419, and r^(3)=.0421, find the 3-year swap rate qswap(3). (d) (This part has nothing to do with part (c), i.e. the spot rates here are different from those in part (c).) Assuming that the swap rates for maturities .5,1,1.5, and 2 are as given in the table below, find the discount factors d(.5),d(1),d(1.5), and d(2)

5. (Float Notes and Interest Rate Swaps) A float note or floating rate bond is characterized by by a face value F and a maturity T (assumed to be a multiple of 6 months). The holder of the float note receives the (variable) coupon payments 2Frt.5,t at each of the times t=.5,1,1.5,,T plus the face value at maturity. Here rt.5,t is the spot rate that will prevail at time t.5 for loans initiated at t.5 and repaid in full at time t. (As usual, the semiannual convention is being employed here. This rate is known at time t.5, but not earlier.) An interest rate swap is an agreement made at time 0 between two parties A and B. It is characterized by a maturity date T (assumed to be a multiple of 6 months), a notional principal amount F>0, and a swap rate q. At each of the times t=.5,1,1.5,2,,T A pays B the variable amount 2Frt.5,t, and B pays A the constant amount 2Fq. The swap rate q is chosen so that neither party pays anything to enter into the agreement. (The notional principal is not ever paid. The swap rate q will be different for different maturities T, but does not depend on the notional principal F. The swap rate for maturity T will be denoted qswap or qswap(T) in situations when we need to distinguish it from other relevant coupon rates.) (a) Using replication, explain why the arbitrage-free price of a float note must be equal to F. (b) Determine a coupon rate q (expressed in terms of the discount factors d(2i),i=1,2,,2T) such that B 's position in an interest rate swap is replicated by purchasing a float note with face value F and maturity T and selling a coupon bond with face value F, maturity T, and coupon rate q. This value of q will be the swap rate for maturity T. (c) Assuming that the spot rates are given by r^(.5)=.0397,r^(1)=.0403, r^(1.5)=.0411,r^(2)=.0406,r^(2.5)=.0419, and r^(3)=.0421, find the 3-year swap rate qswap(3). (d) (This part has nothing to do with part (c), i.e. the spot rates here are different from those in part (c).) Assuming that the swap rates for maturities .5,1,1.5, and 2 are as given in the table below, find the discount factors d(.5),d(1),d(1.5), and d(2). 5. (Float Notes and Interest Rate Swaps) A float note or floating rate bond is characterized by by a face value F and a maturity T (assumed to be a multiple of 6 months). The holder of the float note receives the (variable) coupon payments 2Frt.5,t at each of the times t=.5,1,1.5,,T plus the face value at maturity. Here rt.5,t is the spot rate that will prevail at time t.5 for loans initiated at t.5 and repaid in full at time t. (As usual, the semiannual convention is being employed here. This rate is known at time t.5, but not earlier.) An interest rate swap is an agreement made at time 0 between two parties A and B. It is characterized by a maturity date T (assumed to be a multiple of 6 months), a notional principal amount F>0, and a swap rate q. At each of the times t=.5,1,1.5,2,,T A pays B the variable amount 2Frt.5,t, and B pays A the constant amount 2Fq. The swap rate q is chosen so that neither party pays anything to enter into the agreement. (The notional principal is not ever paid. The swap rate q will be different for different maturities T, but does not depend on the notional principal F. The swap rate for maturity T will be denoted qswap or qswap(T) in situations when we need to distinguish it from other relevant coupon rates.) (a) Using replication, explain why the arbitrage-free price of a float note must be equal to F. (b) Determine a coupon rate q (expressed in terms of the discount factors d(2i),i=1,2,,2T) such that B 's position in an interest rate swap is replicated by purchasing a float note with face value F and maturity T and selling a coupon bond with face value F, maturity T, and coupon rate q. This value of q will be the swap rate for maturity T. (c) Assuming that the spot rates are given by r^(.5)=.0397,r^(1)=.0403, r^(1.5)=.0411,r^(2)=.0406,r^(2.5)=.0419, and r^(3)=.0421, find the 3-year swap rate qswap(3). (d) (This part has nothing to do with part (c), i.e. the spot rates here are different from those in part (c).) Assuming that the swap rates for maturities .5,1,1.5, and 2 are as given in the table below, find the discount factors d(.5),d(1),d(1.5), and d(2) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started